Annual Income Calculator Singapore

If you have vacation pay for these days enter your weeks as the full 52 weeks. The economy of Singapore has been ranked as one of the most open and competitive economies in the world making it a business-friendly regulatory environment for.

Know Your Worth 7 Salary Calculators Tools To Compute Your Earnings

Calculate public holiday pay Find out your pay for working on a public holiday.

Annual income calculator singapore. Your working time will include days per week hours per day and weeks per year. On average the number of weeks worked per year is around 50 weeks. A minimum base salary for Software Developers DevOps QA and other tech professionals in Singapore starts at S 43000.

Find tech jobs in Singapore. TAX PAYABLE S Your Tax Payable is 550 on first 40000 7 on next 40000. Individuals without in-camp training over the past year.

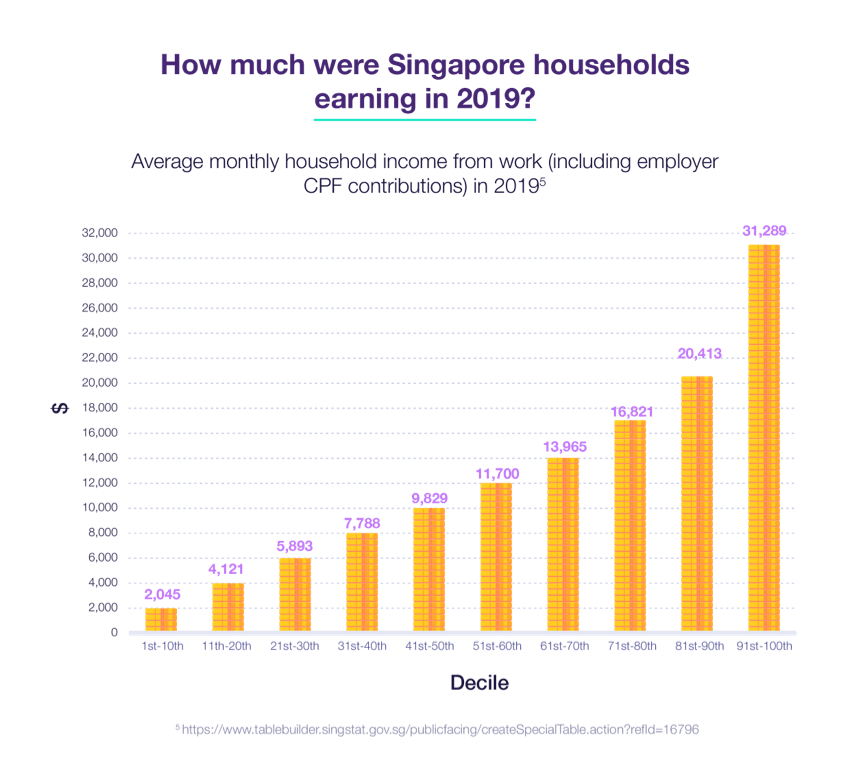

The average monthly net salary in Singapore SG is around 6 005 SGD with a minimum income of 2 500 SGD per month. Second the estimated median Singaporean income excluding employers contribution based on the figures approximated is around 3800-4200. Calculate pro-rated annual leave.

How to calculate annual income from hourly. The adjusted annual salary can be calculated as. How to find annual income - examples.

YA 2021 XLS 170KB New. For self-employed persons gross monthly income. First determine your hourly pay rate and working time.

YA 2020 XLS 122KB YA 2019 XLSX 42KB YA 2018 XLS 114KB YA 2017 XLS 114KB Compute income tax liability for tax resident individuals locals and foreigners who are in Singapore for 183 days or more 2. The median household income was 5600 in 2010 which indicates a. Rikvins detailed Free Online Singapore Personal Income Tax Calculator helps you to estimate your annual tax payable.

This number is derived by adding up the total of all incomes being earned in Singapore and dividing it by the number of households nationwide. For incomplete month salary calculator singapore it should base on daily rate of pay. Calculate overtime pay for a monthly-rated employee Find out your pay for working overtime.

The Singapore Income Tax Calculator is designed for Tax Resident Individuals who wish to calculate their salary and income tax deductions for the 2021 Assessment year The year ending 31 December 2020. One is the reported median Singaporean income which is 4534. Next determine any additional.

The annual net income calculator will display the result in the last field. KETs verification tool Check if work arrangements comply with the Employment Act and to calculate the daily and hourly rate of pay. Singapore Personal Income Tax Calculator Estimate your annual individual income tax by using our free Personal Income Tax Calculator.

15 40 52 31200. The Singapore Annual Income Tax Calculator is designed to provide you with a salary illustration with calculations to show how much income tax you will pay in 202122 and your net pay the amount of money you take home after deductions. The other 2 weeks are vacation.

If youre still curious about how our yearly salary calculator works here are two examples showing it in practice. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. It comprises basic wages overtime pay commissions tips other allowances and one-twelfth of annual bonuses.

All bi-weekly semi-monthly monthly and quarterly figures. For individuals who attended in-camp training over the past year. For employees it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax.

Residents refer to Singapore Citizens and Permanent Residents. For households with at least one working person the median household income for Singaporeans is 7744. You can also select future and historical tax years for additional income tax calculations where figures are held if you would like to calculate your income tax for a year which is not shown.

30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. If your son s or your husband is a NSman key in 750. Enter your gross employment income for the previous year including any bonuses fixed allowances and any benefits in kind.

S 2253 1644 1475. Salary for an incomplete month of work is calculated as follows. Income tax calculator for tax resident individuals.

The median household income from work per household member is at 2463. This includes the employers contribution. Annual Income Renewal Commission.

Singapores average monthly household income from work including employer CPF contributions was 12386 in 2019. Supply the required details in order to compute your tax payable. Retirement Analysis - Income Payout Needed In Singapore the rate of inflation is generally calculate at the range of 25 pa to 35 pa depending on individual lifestyle needs and expenditures.

To determine her annual income multiply all the values. Gross monthly income from work refers to income earned from employment. Lets go with 4000.

Taking an inflation rate of in account you will need a monthly retirement income of.

Singapore Personal Income Tax Taxation Guide

How To Calculate Wage For Salary Calculator Singapore

Are You Earning Enough Singapore S Average Household Income Revealed Standard Chartered Singapore

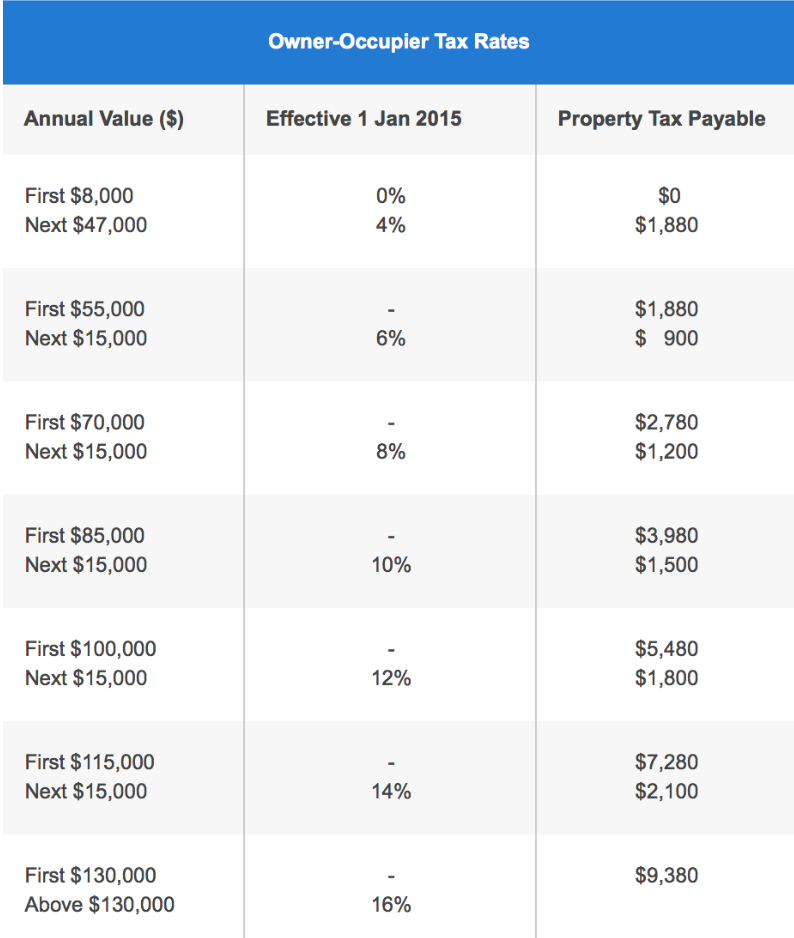

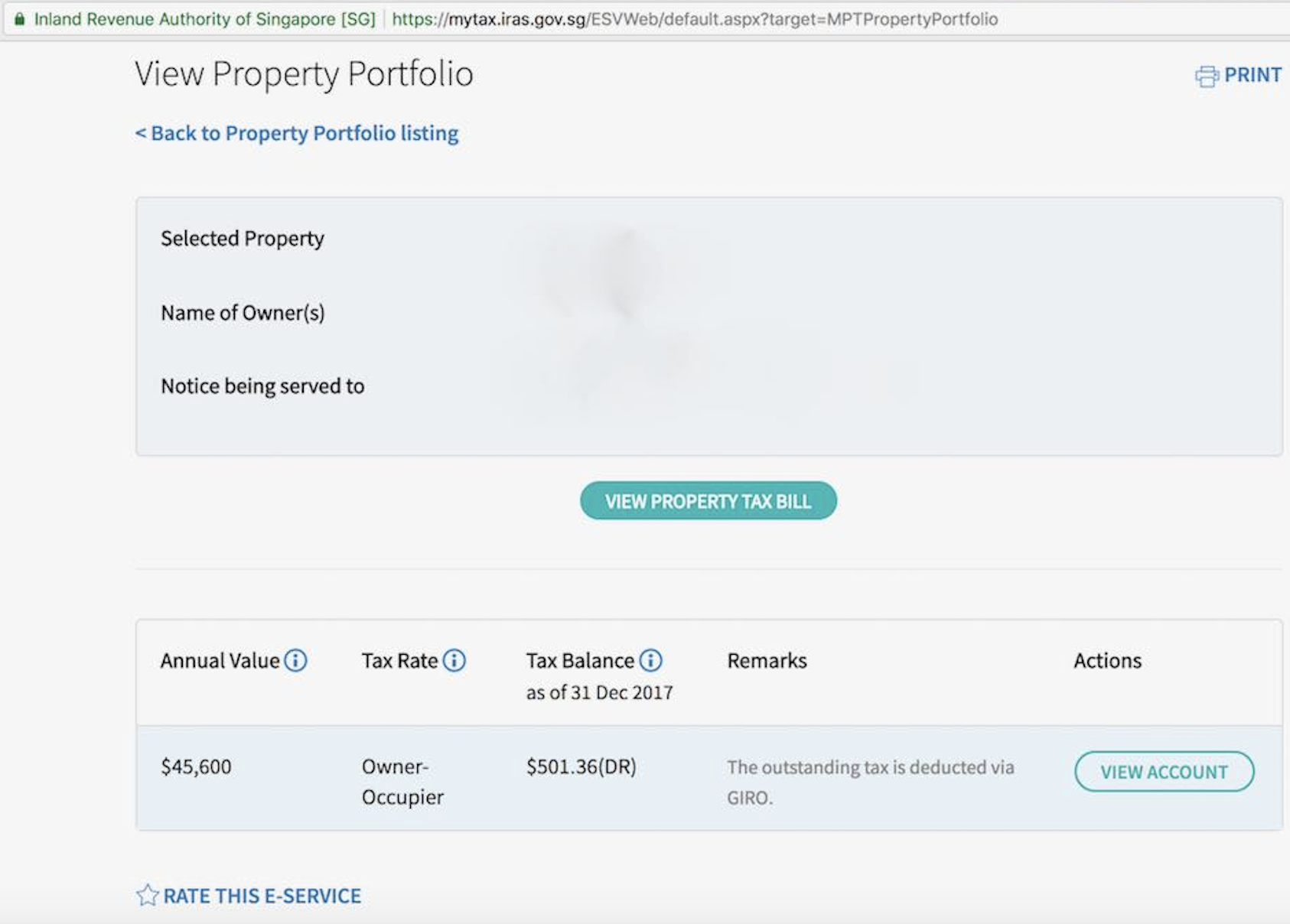

Property Tax For Homeowners How Much To Pay Rebates Deadline 2021 Update

How 16 Years Old Calculates Income Tax

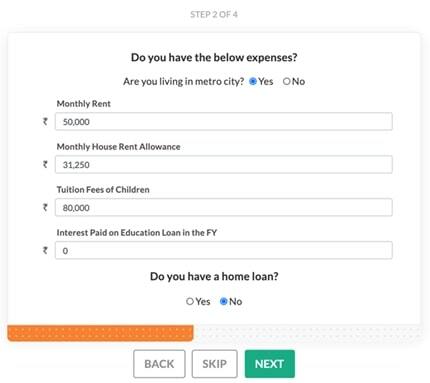

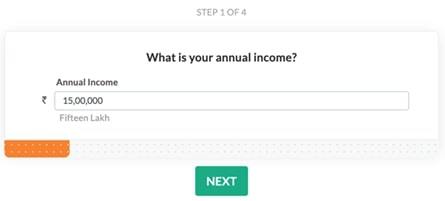

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Singapore Corporate Tax How To Pay Tax Rate Exemptions Singaporelegaladvice Com

Singapore Influencers Here S How To Calculate Your Income Tax Singaporelegaladvice Com

Donation Tax Calculator Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

How To Calculate Wage For Salary Calculator Singapore

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

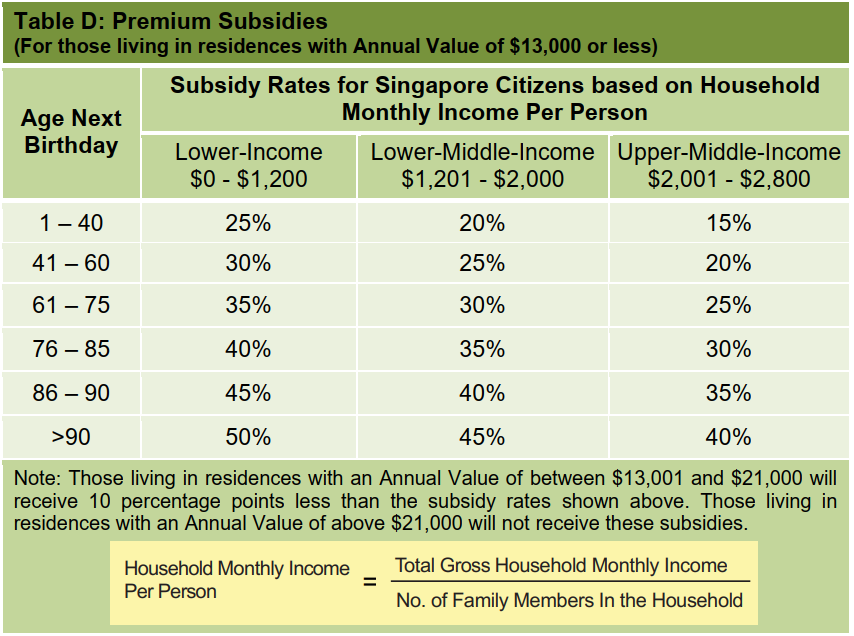

Household Monthly Income Per Person Calculator

How To Calculate Wage For Salary Calculator Singapore

Iras Filing Of Income Tax Computations In Functional Currencies Other Than Singapore Dollars

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Property Tax Singapore Calculate Annual Value And How Much To Pay I Compare You Save

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

Post a Comment for "Annual Income Calculator Singapore"