Annual Income Calculator Ph

Sweldong Pinoy is for personal use. It can be used for the 2013 14 to 2019 20.

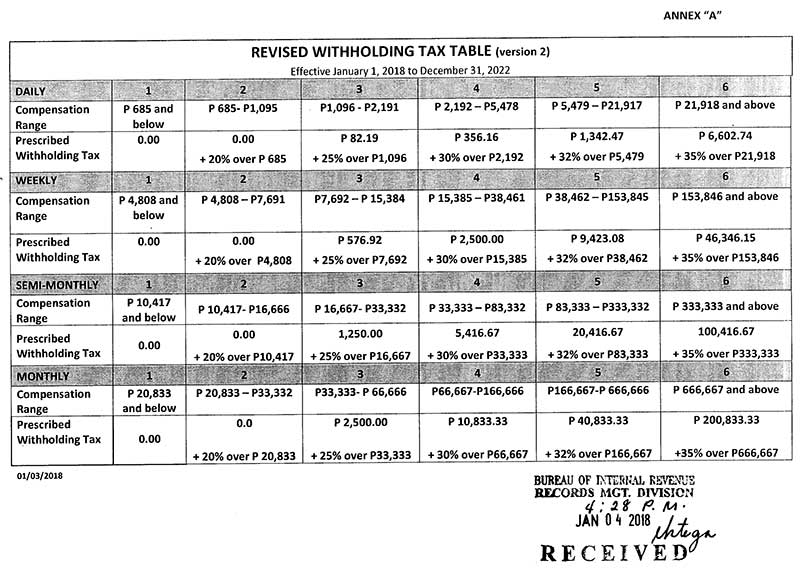

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

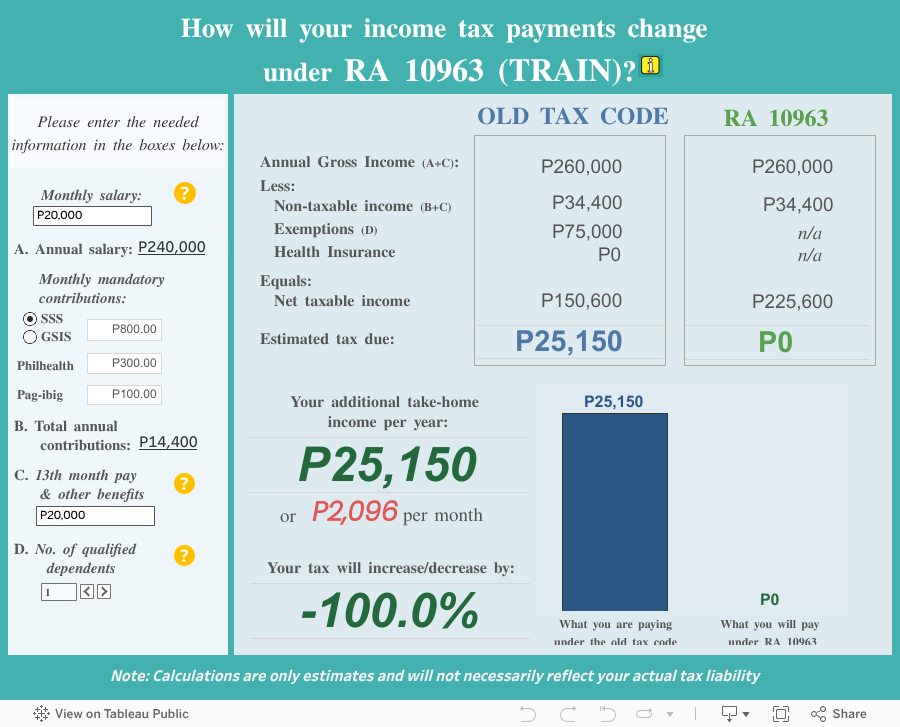

A quick and efficient way to calculate Philippines income tax amounts and compare salaries in Philippines review income tax deductions for income in Philippines and estimate your tax returns for your Salary in Philippines.

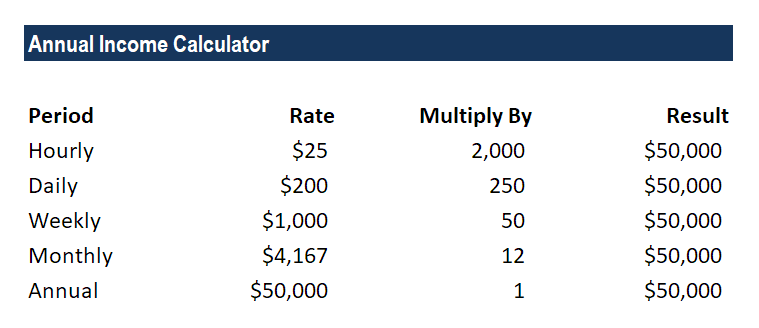

Annual income calculator ph. How to Calculate Annual Salary. Hourly to salary calculator to calculate your income in hourly weekly bi-weekly semi-monthly monthly quarterly and annually. Based on this the average salaried person works 2080 40 x 52 hours a year.

We created this to allow individuals to have an idea on how much their net pay would be. If you work 375 hours a week divide your annual salary by 1950 375 x 52. Multiply your daily salary Step.

For this example we would like our annual income to be 12000000. On average its found that the freelancer in this problem works 30 hours per workweek. Calculate your take home pay in Philippines thats your salary after tax with the Philippines Salary Calculator.

Need help finding the right home loan. 15 40 52 31200. To enter your time card times for a payroll related calculation use this time card calculator.

The other 2 weeks are vacation. Gross vs net income. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

However the results may not necessarily coincide with tax payable up to the last peso and should not be used in filing for income taxes. The annual net income calculator will display the result in the last field. Next determine the number of weeks worked per year.

To determine her annual income multiply all the values. In our example your daily salary would be 136 17 per hour times 8 hours per day. The unadjusted results ignore the holidays.

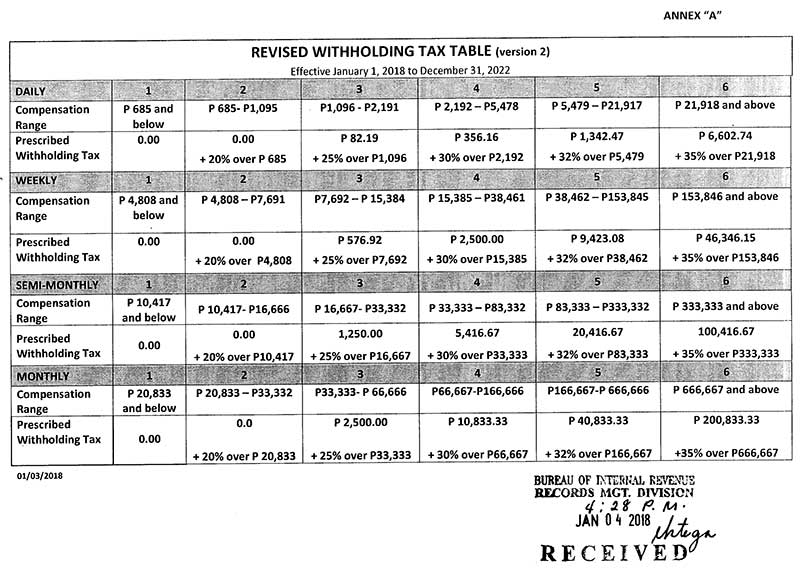

Next determine any additional. To determine your hourly wage divide your annual salary by 2080. With the new tax reform middle and low income earners will be exempted from income tax.

At 75000 you hourly wage is 750001950 or. We are continuously working with Certified Public Accountants when making changes to this app. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year.

Generally its the amount of income thats taxable unless exempted by law. Highlights of the FIRB Accomplishment Report CY 2014. One of a suite of free online calculators provided by.

How to calculate annual income from hourly. Button and the table on the right will display the information you requested from the tax calculator. Phone us on 1300 130 987Our team are happy to help put you in touch with a broker local to your areaOnline enquiryComplete our online enquiry form and well give you a call to connect you with one of our brokers.

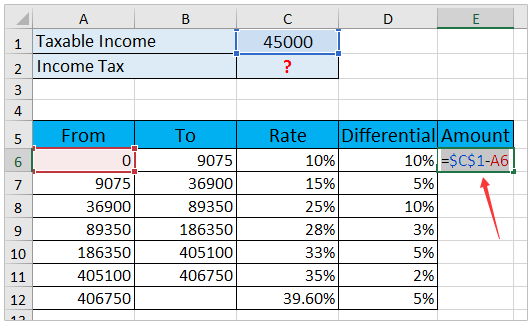

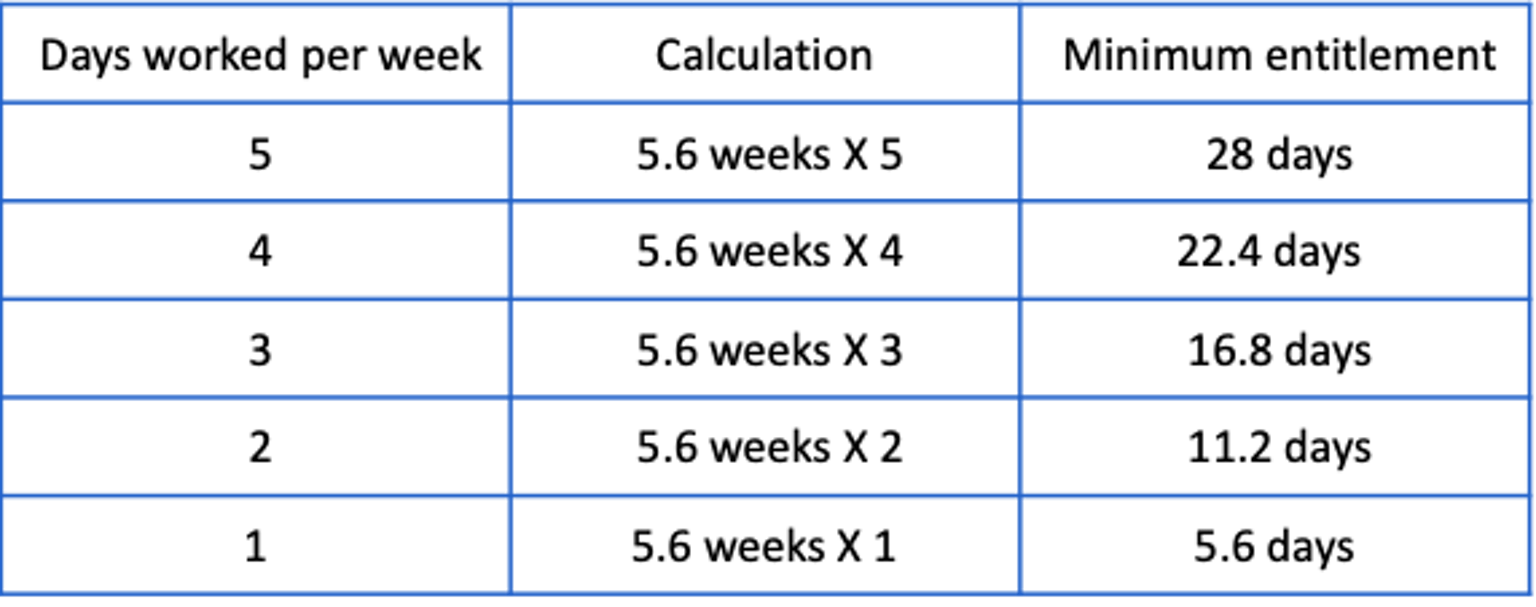

Taxable income is your total annual income minus all the deductions and tax reliefs you are entitled for. Back to calculators Income annualisation calculator Work out your annual income from the money youve received so far this year. On average the number of weeks worked per year is around 50 weeks.

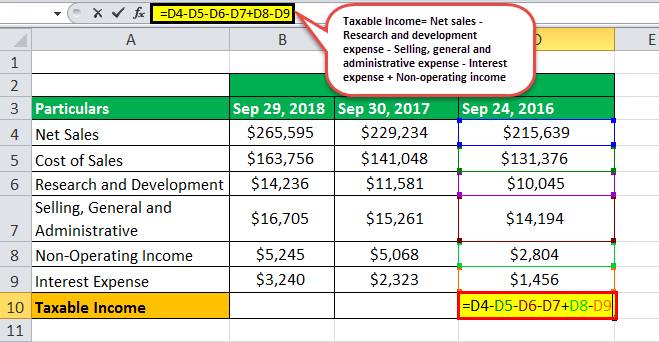

Magnitude of Tax Subsidy Grant and Utilization By Recipient 2006-2015. Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400 Base on our sample computation if you are earning 25000month your taxable income would be 23400. How to calculate freelance rate.

First determine your hourly pay rate and working time. If you have vacation pay for these days enter your weeks as the full 52 weeks. Procedures for Availment of Tax Subsidy of GOCCs.

A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Please do not use the app as a replacement. If youre still curious about how our yearly salary calculator works here are two examples showing it in practice.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. First determine the yearly desired salary. To convert weekly income to annual income multiply your weekly salary by how many weeks.

Next determine the number of hours worked per week. This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for. How Much do I Make a Year Calculator to convert hourly wage to annual salary.

This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Multiply your monthly salary by how many hours you work in a year. Annual Salary Hourly Wage Hours per workweek 52 weeks Quarterly Salary Annual Salary 4 Monthly Salary Annual Salary.

If you work 2000 hours a year and make 25 per hour then you would add 4 zeros from the annual salary multiply the result by 2 to get 50000 per year. Your working time will include days per week hours per day and weeks per year. Calculate your take home pay from hourly wage or salary.

Multiply your hourly wage by the number of work hours per day. Figures are computed based on actual and proposed first to third year income tax schedules. The formula of calculating annual salary and hourly wage is as follow.

If you make 75000 a year your hourly wage is 750002080 or 3606. This is based on Income Tax National Insurance and Student Loan information from April 2021. Gross annual income calculator.

Look into the income tax table and determine your salary column. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga. How to find annual income - examples.

Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. Find out how much do I make annually now by entering your hourly wage. Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example.

Tax Calculator Philippines 2021

How To Calculate Income Tax In Excel

Taxable Income Formula Calculator Examples With Excel Template

Annual Income Learn How To Calculate Total Annual Income

How To Calculate Foreigner S Income Tax In China China Admissions

What You Need To Know About Income Tax Calculation In Malaysia

Excel Formula Income Tax Bracket Calculation Exceljet

How To Create An Income Tax Calculator In Excel Youtube

Tax Calculator Compute Your New Income Tax

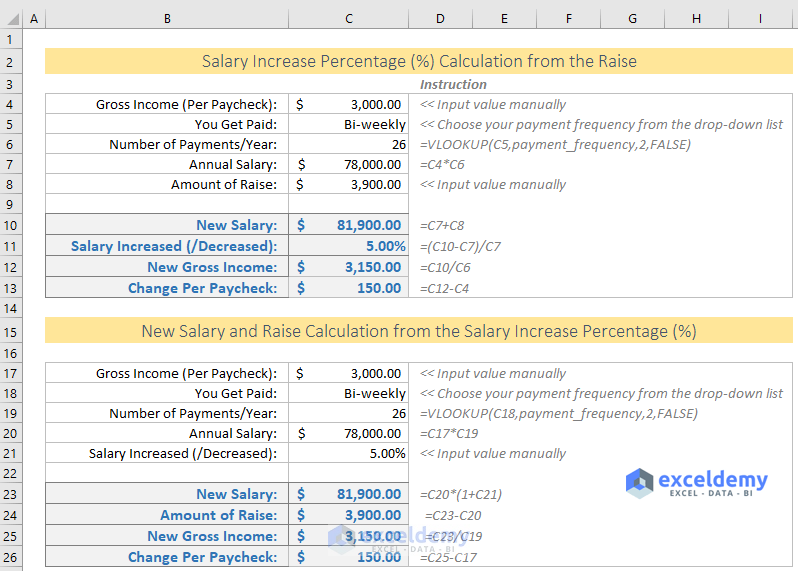

How To Calculate Salary Increase Percentage In Excel Free Template

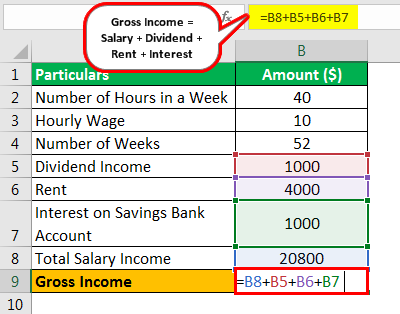

Gross Income Formula Step By Step Calculations

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

4 Ways To Calculate Annual Salary Wikihow

Taxable Income Formula Examples How To Calculate Taxable Income

Know Your Worth 7 Salary Calculators Tools To Compute Your Earnings

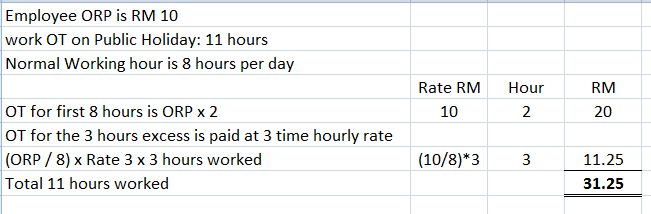

Salary Calculation Dna Hr Capital Sdn Bhd

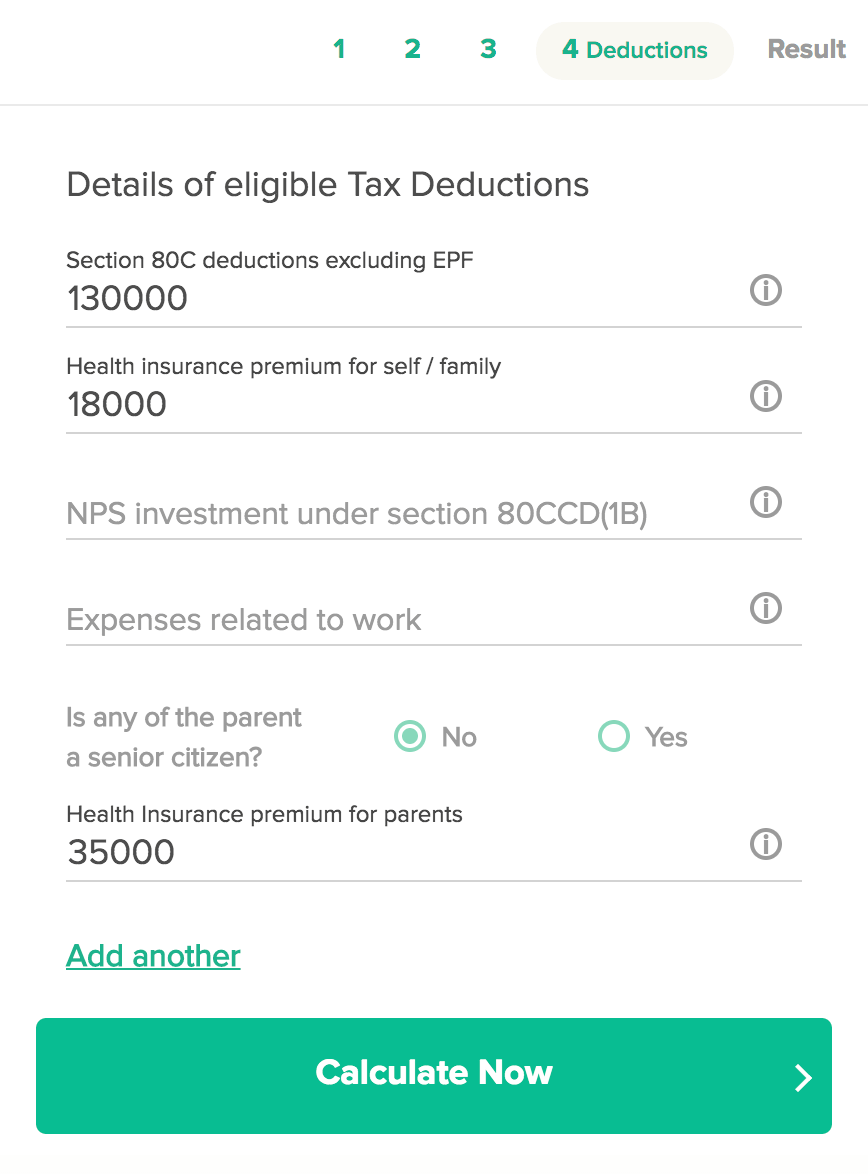

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Post a Comment for "Annual Income Calculator Ph"