Gross Pay Journal Entry

Making this as simple as possible as you have only one employee. The example demonstrates how to calculate gross and net pay make journal entries and determine the impact on the income statement and balance sheet.

Payroll Principlesofaccounting Com

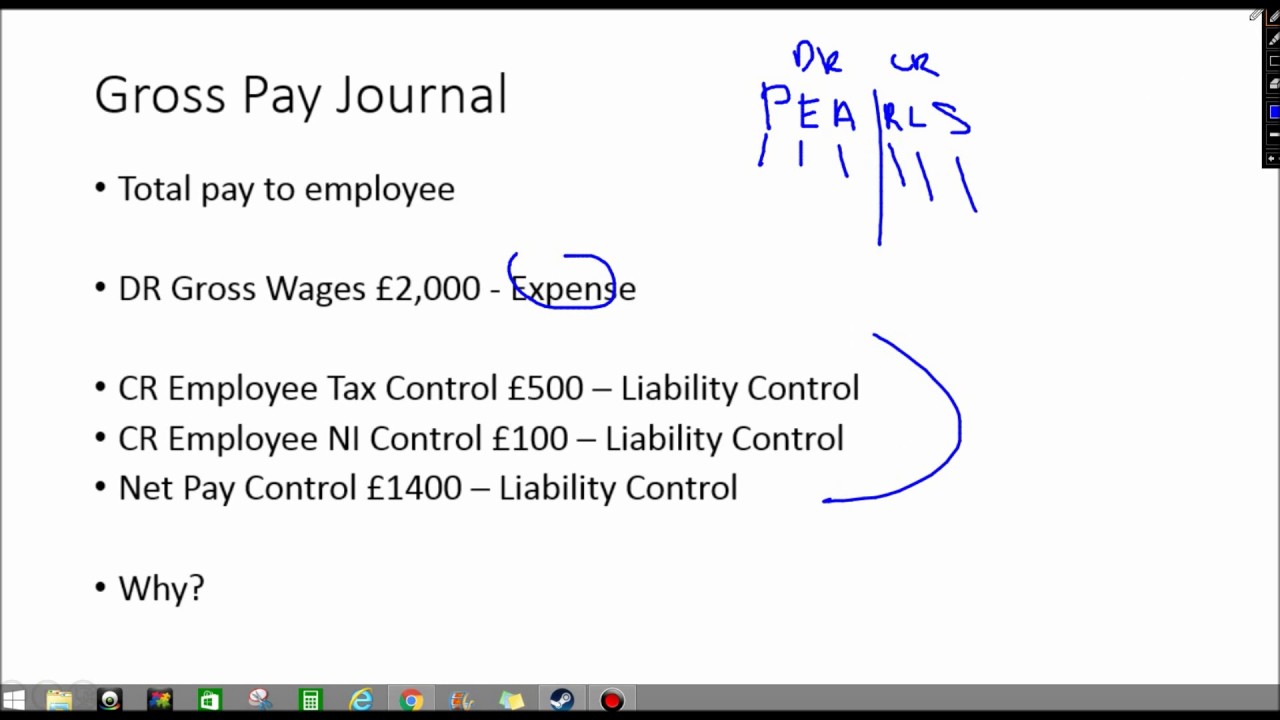

In terms of Debit and Credit think about that key word Expense any expense is a debit entry in the general ledger and therefore the wages expense must be a debit entry in the journal.

Gross pay journal entry. What is a Journal Entry Journal entries are used in bookkeeping to reflect the costs and liabilities of a business. This ensures that the financial statements reflect all the expenses incurred during that period. In accordance with accrual accounting and the matching principle the date used to record the hourly payroll is the last day of the work period.

Debit CPP employer expense. For these entries record the gross wages your employees earn and all withholdings. Your liability is then cleared when you record bank payment to pay your employees and HMRC.

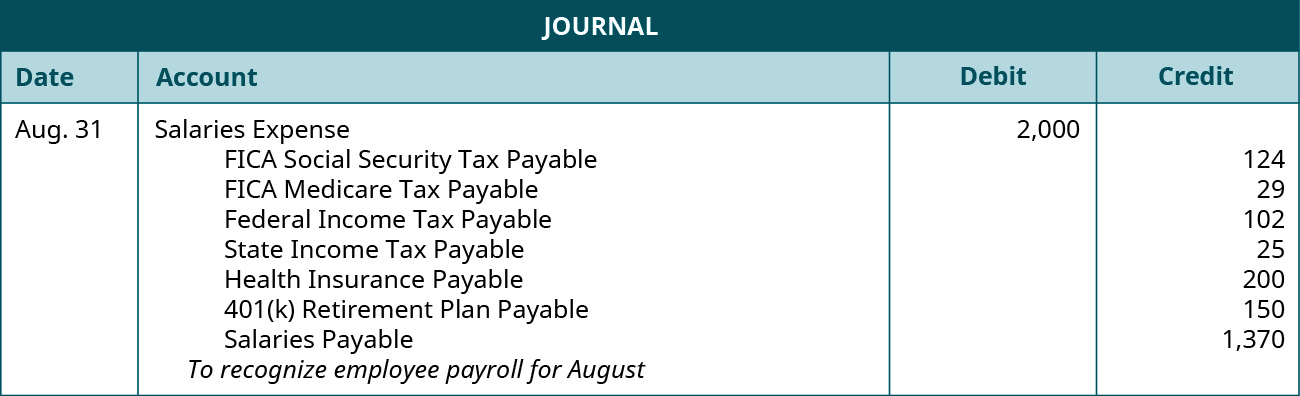

Here is the payroll journal entry to record the payment of the paycheck. Initial recordings also known as the originating entry are the primary entries for payroll accounting. This bank payment should then be entered using the same code as.

Journal 1 shows the employees gross wages 1200 for the week. These are all entered as a Debit value. Net payroll is what you pay your employees AFTER deductions.

Debit EI Employer expense. This is probably the one journal entry which students slip up on consistently. The gross wage is the expense charged to the income statement.

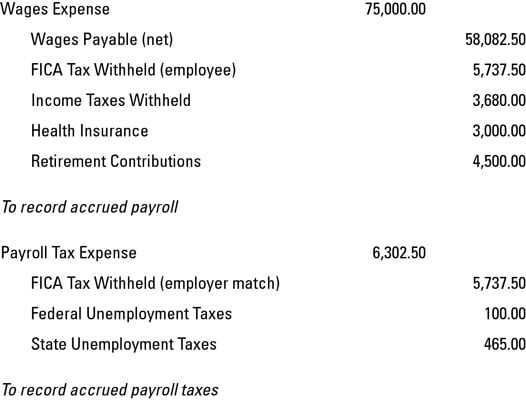

This includes payroll journal entries which show gross wages paid record the entries as debits and payroll liabilities offset them as credits for the recording time frame. From Adjustments choose Journals then New Journal. The other half of the payroll journal records the costs to your business and is reported on profit and loss.

All payroll entries at this stage will involve the Wages Control Account so a good approach would be to do this entry first in the journal. Gross payroll is the total amount you pay your employees BEFORE deductions. The primary payroll journal entry is for the initial recordation of a payroll.

Enter the pay date for the relevant pay period. Also include employment taxes you owe to the government. The payroll advance is in effect a short term interest free loan to the employee to be.

For this organization the next biweekly pay period would be from October 26 through November 8 2020. Its the first entry you record to show a transaction. Credit CPP Payable for both the employer and employee amounts.

Gross Wages 2092508 Including gross SMP 67830 Net Wages 2065303 Including net SMP 67638 NIC Compensation 2035. The journal entry to record the hourly payrolls wages and withholdings for the work period of December 1824 is illustrated in Hourly Payroll Entry 1. This can be a mixture of payroll expenses and liabilities such as taxes health benefits 401 k contributions etc.

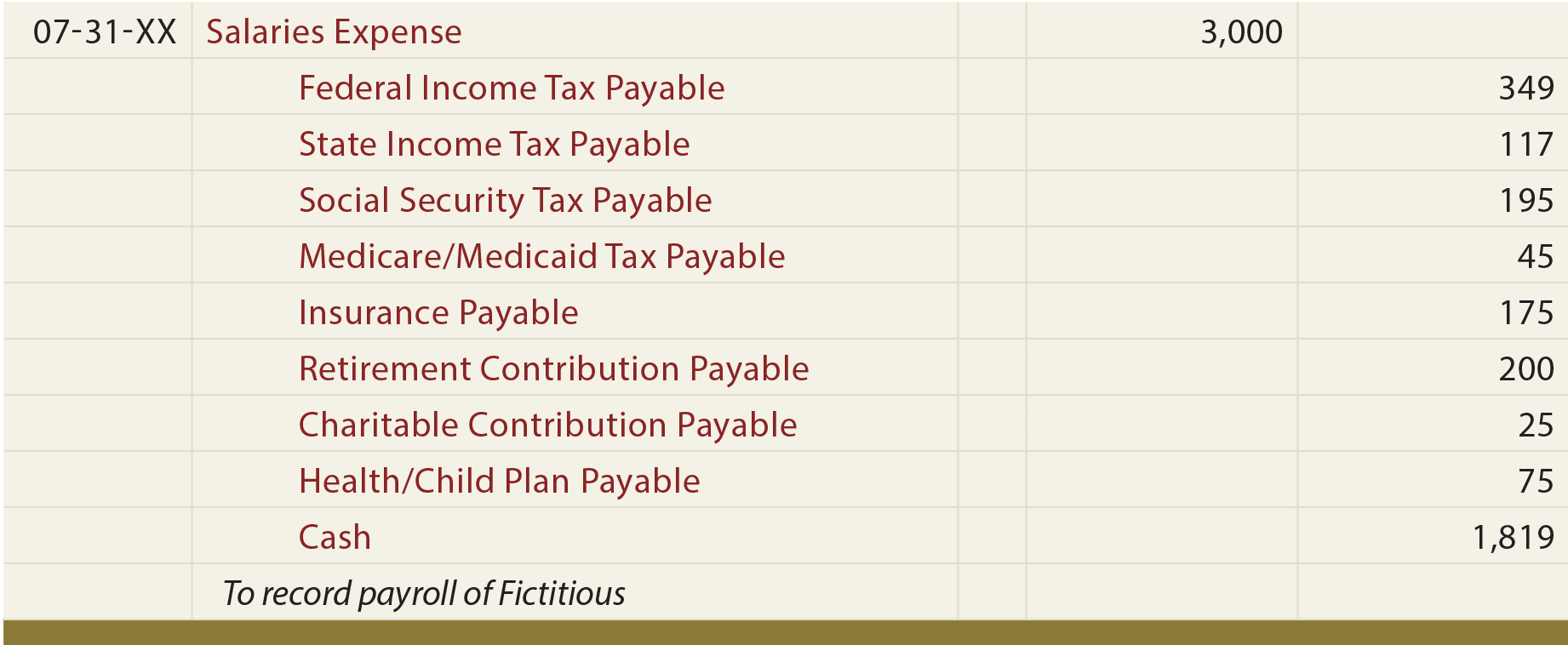

Some costs can be recorded straight from the. Payroll Journal Entry Example 1. After subtracting some of the most common payroll taxes the employees wages payable or take-home pay is 925.

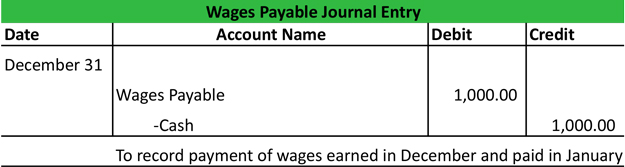

The last kind of journal entry you may need to make is to accrue payroll when the end of a pay period and the end of an accounting period dont coincide. Total SMP NIC Compensation 69865 67830 2035 I will appreciate if anyone can help with journal entry with sage nominal code. For the October month-end close the following.

Debit WagesSalary for the gross amount of the pay. As an example of payroll accounting if gross pay is 2000 employee tax is 500 and other deductions are 100 then the net pay due do the employee is 1400. A payroll advance journal entry is used when a business wants to give an employee a cash advance of their wages.

The payroll accounting journal entries would be as follows. Wages and Salaries At the end of each payroll period make debit entries under the salary expense account for all gross wages and salaries paid to your employees. This amount will be recorded as various liabilities.

2 Payroll Journal Entry For Salary Payable In addition to the gross pay and withholding in the previous payroll journal entries ABC Company has incurred additional payroll liability expenses that must be recorded. If you are a small employer eligible to reclaim any Sick Pay Maternity Pay or Adoption Pay in the month this can be posted to the PAYENI account to reduce the payment being made to HMRC. The difference between the gross pay and the net pay is the taxes that were withheld from the employees pay.

This entry records the gross wages earned by employees as well as all withholdings from their pay and any additional taxes owed to the government by the company. Payroll Advance to an Employee Journal Entry. When you actually pay your staff and see the payments on the bank statement you should record your wages and HMRC payments.

How To Record Accrued Payroll And Taxes Dummies

Allowance For Doubtful Accounts Double Entry Bookkeeping

Payroll Journal Entry For Quickbooks Online Asap Help Center

Recording Payroll And Payroll Liabilities Accounting In Focus

Recording Payroll And Payroll Liabilities Accounting In Focus

Payroll Journal Entries For Wages Accountingcoach

What Is Payroll Accounting Payroll Journal Entry Guide 2021

Payroll Accounting Process Double Entry Bookkeeping

Payroll Journal Entries Financial Statements Balance Sheets Study Com

What Is Wages Payable Definition Meaning Example

Payroll Journal Entries For Wages Accountingcoach

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Developed By Lisa Swallow Cpa Cma Ms Ppt Video Online Download

What Is Payroll Accounting Payroll Journal Entry Guide 2021

Accounts Payable Explanation Journal Entries Examples Accounting For Management

Wages Journal Basics How To Payroll Accounting Youtube

Payroll Journal Entry For Quickbooks Online Asap Help Center

Chapter 6 Analyzing And Journalizing Payroll Transactions Ppt Video Online Download

Payroll Journal Entries For Wages Accountingcoach

Post a Comment for "Gross Pay Journal Entry"