Pa Salary After Taxes

The UKs income tax and National Insurance rates for the current year are set out in the tables below. Agencies get 111 million in stimulus funds but have created only 55 jobs Controller Wendy Greuel who audited the Public Works and Transportation departments says the city needs to move more quickly to spend the federal money.

These charts show the average base salary core compensation as well as the average total cash compensation for the job of Physician Assistant in the United States.

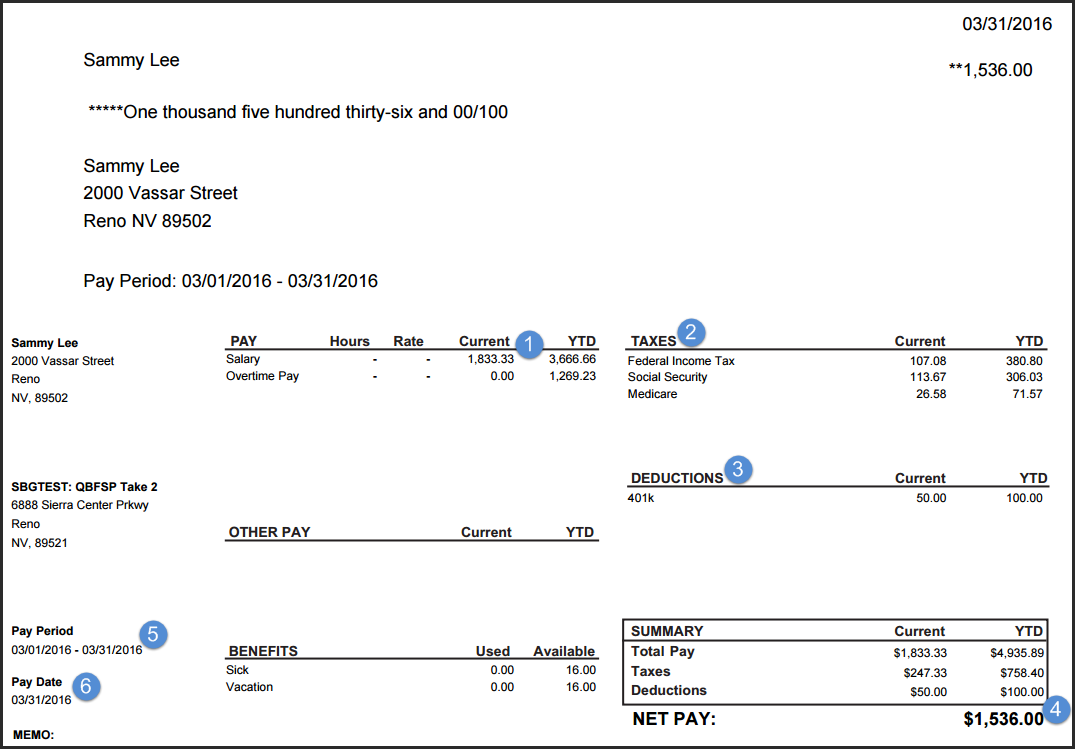

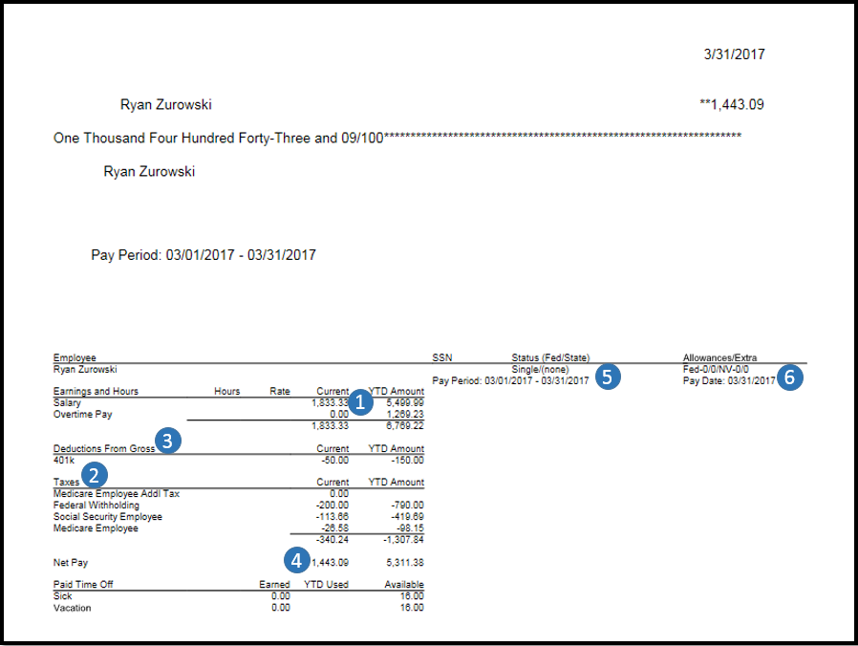

Pa salary after taxes. Make sure you are locally compliant with Papaya Global help. This allows you to review how Federal Tax is calculated and Pennsylvania State tax is calculated and how those income taxes affect the salary after tax calculation on a 15000000. Your average tax rate is 200 and your marginal tax rate is 328.

Global salary benchmark and benefit data. An Independent Earner Tax Credit IETC of has been applied. Salary after Tax is an easy-to-use online calculator for computing your monthly or yearly net take-home salary based on the fiscal regulations for 2021.

Salary After Tax the money you take home after all taxes and contributions have been deducted. With an average PA salary of 104000. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Your average tax rate is 222 and your marginal tax rate is 361. Salary After Tax the money you take home after all taxes and contributions have been deducted. Pennsylvania is one of just eight states that has a flat income tax rate and of those states it has the lowest rate.

Universal Social Charge USC Pay Related Social Insurance PRSI Total Tax Due. Annonce Payroll Employment Law for 140 Countries. Also known as Net Income.

Global salary benchmark and benefit data. This reduces the amount of PAYE you pay. After subtracting normal expenses out of your pay check such as taxes retirement health insurance youd have approximately 4564 take home pay per month or 54775 per year.

Salary After Tax the money you take home after all taxes and contributions have been deducted. This marginal tax rate means that your immediate additional income will be taxed at this rate. Also known as Net Income.

For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. - Pennsylvania State Tax. These include income tax as well as National Insurance payments.

Pennsylvania also levies local income taxes in more than 2500 municipalities. QPIP CPPQPP EI premiums. Pennsylvania levies a flat state income tax rate of 307.

Our simple salary calculator gives an estimate of your take-home pay after your employer has made deductions from your gross salary. Therefore your income level and filing status will not affect the income tax rate you pay at the state level. Well at least I feel good knowing that 111000000 of my tax dollars helped keep 55 jobs in Los Angeles Two LA.

Salary Before Tax your total earnings before any taxes have been deducted. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. If you dont qualify for this tax.

Your Income Tax Breakdown. Total Tax Due the sum of all taxes and contributions that will be deducted from your gross salary. De très nombreux exemples de phrases traduites contenant salary after tax Dictionnaire français-anglais et moteur de recherche de traductions françaises.

Youll then get a breakdown of your total tax liability and take-home pay. Social Security and Medicare. Make sure you are locally compliant with Papaya Global help.

The total cash compensation which includes base and annual incentives can vary anywhere from 101932 to. Also known as Gross Income. You can alter the salary example to illustrate a different filing status or show an alternate tax year.

Annonce Payroll Employment Law for 140 Countries. This 15000000 Salary Example for Pennsylvania is based on a single filer with an annual salary of 15000000 filing their 2021 tax return in Pennsylvania in 2021. Filing 6500000 of earnings will result in 199550 of your earnings being taxed as state tax calculation based on 2021 Pennsylvania State Tax Tables.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. That means that your net pay will be 43984 per year or 3665 per month. How to Calculate Salary After Tax in Pennsylvania in 2021 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status.

Your Income Tax Breakdown. Total Tax Due the sum of all taxes and contributions that will be deducted from your gross salary. This results in roughly 14256 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on.

Also known as Net Income. If you make 55000 a year living in the region of Pennsylvania USA you will be taxed 11017. The deductions used in the calculator.

Taxes in the UK. It also changes your tax code. Just like federal income taxes your employer will withhold money to cover this state income tax.

The filing status affects the Federal and State tax tables used to produce your salary after. The base salary for Physician Assistant ranges from 90592 to 118260 with the average base salary of 102576.

I Have A Ctc Of Around 10 Lacs How Much Will I Get In Hand Salary Per Month How Do I Save Tax Quora

Ssc Chsl Salary 2021 Salary Job Profile Promotions

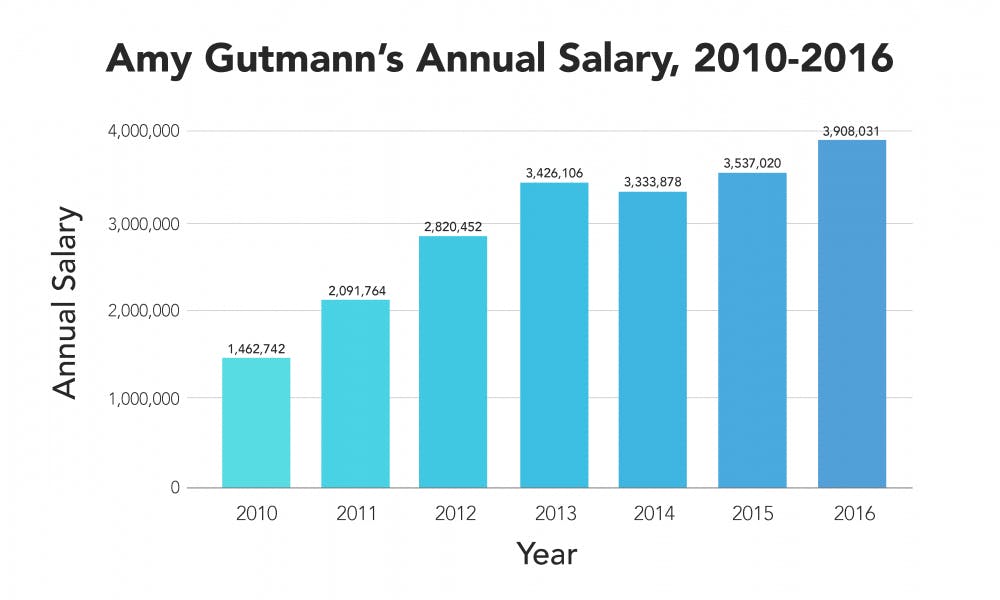

Penn President Amy Gutmann S Salary Climbs To 3 9 Million The Daily Pennsylvanian

Average Salary In Pennsylvania 2021 The Complete Guide

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

What Is The New Salary After 7th Cpc Of A Postal Assistant That Is Going To Be Recruited Through This Year S Ssc Chsl Quora

Pennsylvania Salary Paycheck Calculator Paycheckcity

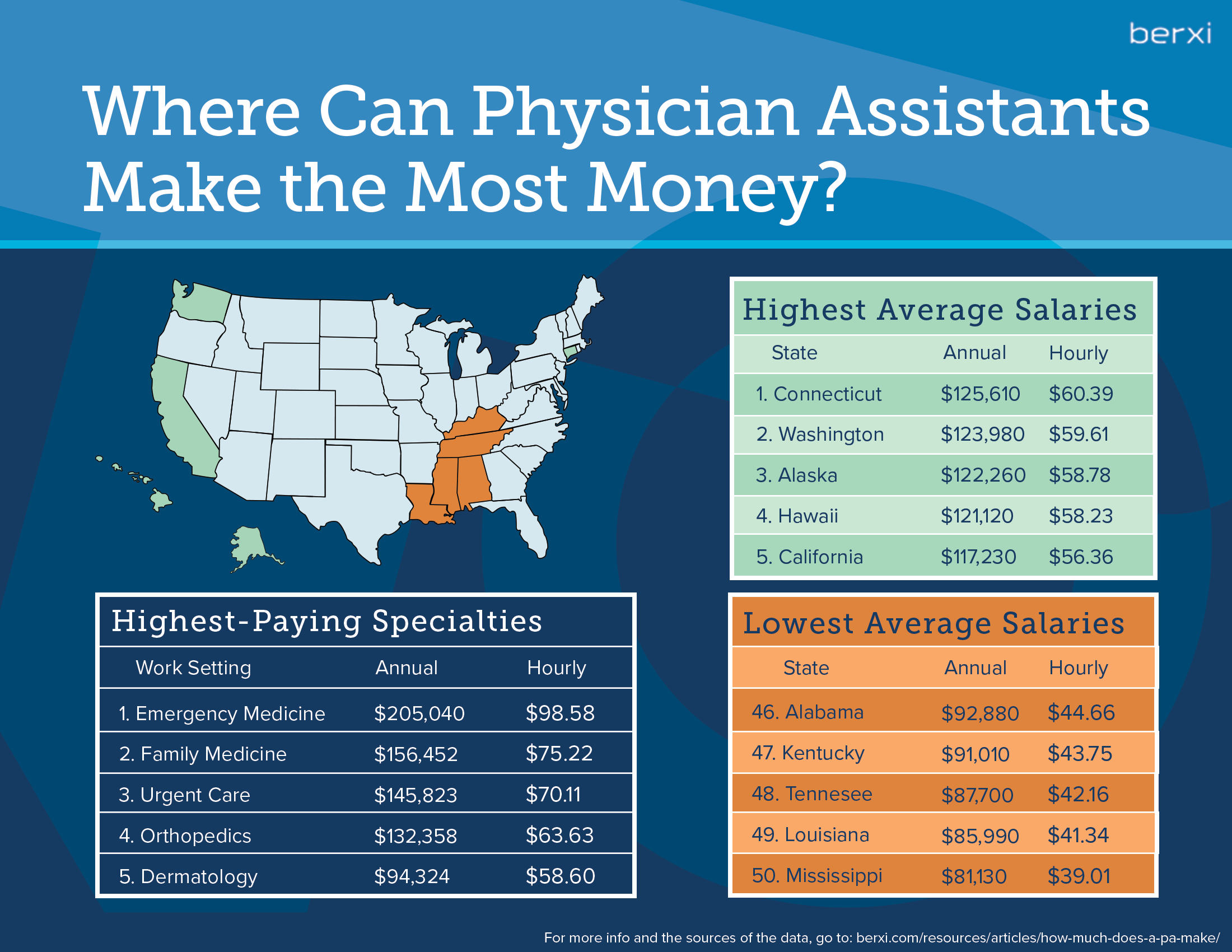

Here S How Much Physician Assistants Can Make Berxi

Https Www Uc Pa Gov Unemployment Benefits File Documents Part Time 20pua 20weekly 20benefit 20filing 20guide 205 6 20 20final Pdf

Salary Certificate Sample Is Prepared By Human Resource Department Of An Organizations In Certificate Format Salary Certificate Format Business Letter Template

The Truth About Being A Production Assistant How Much Money Will I Make

Pennsylvania Paycheck Calculator Smartasset

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Guide To Local Wage Tax Withholding For Pennsylvania Employers

Post a Comment for "Pa Salary After Taxes"