Hourly To Salary Ontario After Tax

The default salary input is an annual salary you can change this to hourly monthly weekly etc. This is required information only if you selected the hourly salary option.

37 000 After Tax 2021 Income Tax Uk

Yearly Monthly 4 Weekly 2 Weekly Weekly Daily Hourly 1.

Hourly to salary ontario after tax. In the Weekly hours field enter the number of hours you do each week excluding any overtime. 22 lignes Hourly pay to annual salary Hourly pay Weekly pay 40 hrs Monthly pay avg Annual. Formula for calculating net salary.

If the employee has a very clear work week of 40 hours and a contract with no wiggle room for the employer to require more their hourly rate will be their salary divided by 40. A list of support Ontario personal income tax rates and thresholds is provided below the salary calculator. That means that your net pay will be 40568 per year or 3381 per month.

If you make 60000 a year your hourly salary is approximately 30 an hour. Gross annual income Taxes Surtax CPP EI Net annual salary. 75000 a year is about 3750 an hour.

Enter the number of hours worked a week. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary Net annual salary Weeks of work year Net weekly income. The Ontario Hourly Salary Calculator is updated with the latest Ontario personal income tax rates for 2021 and is a good calculator for working out your income tax and salary after tax in Ontario based on Hourly income.

Net annual salary Weeks of work year Net weekly income. Alberta 6800000 Salary after Tax Calculations. Now you can go back to the Dues or Strike Calculator you were working on and enter the.

Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. Your average tax rate is 220 and your marginal tax rate is 353. Visit PayScale to research tax preparer hourly pay by city experience skill employer and more.

Please note that 2021 is the default tax year used in the Ontario salary calculator you can select a different tax year in the advanced features of the salary calculator. The calculator is updated with the tax rates of all Canadian provinces and territories. Global salary benchmark and benefit data.

Formula for calculating net salary The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. The Ontario salary comparison calculator is designed to be used online with mobile desktop and tablet devices. If the employee is salaried as opposed to hourly the overtime rate is calculated by dividing their weekly salary by 44 to arrive at their hourly rate of pay.

Before Tax After Tax. Annual salary without commas average weekly hours Take one of the two calculated amounts from the boxes on the right. You can calculate your Hourly take home pay based of your Hourly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Hourly Pay Rate. Yearly Monthly 4 Weekly 2 Weekly Weekly Daily Hourly 1.

Alberta 6200000 Salary after Tax Calculations. Annual Salary Paid Employees Only whether paid bi-weekly semi-monthly or other Enter annual salary. If you make an hourly wage and youd like a more exact number for your annual salary you first need to figure out how many.

Use the simple hourly Canada tax calculator or switch to the advanced Canada hourly tax calculator to review NIS payments and income tax deductions for 2021. Enter your pay rate. The average hourly pay for a Tax Preparer in Canada is C1655.

The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD. This means that high-income residents pay a higher percentage than low-income residents. You can use the Ontario Hourly Salary Calculator to compare.

Enter the number of pay periods. The Canada Hourly Tax Calculator is updated for the 202122 tax year. Make sure you are locally compliant with Papaya Global help.

The latest budget information from April 2021 is used to show you exactly what you need to know. As required in the advanced area of the Ontario Salary. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

Annonce Payroll Employment Law for 140 Countries. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Minimum wage rates list in Ontario for 2021 For 2021 until september 30 2021 the province of Ontario as decided to make an increase in the minimum wage of 025 over 2020 from 14 to 1425 per hour. Calculating an Annual Salary from an Hourly Wage. Before taxes or any other deductions Gross Monthly Pay.

The category of fishing and hunting guides is not considered in this calculator as it is very specific. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. The amount can be hourly daily weekly monthly or even annual earnings.

After Tax Income Overview How To Calculate Example

Paycheck Calculator Take Home Pay Calculator

Tax Relief For Low Income And Minimum Wage Workers Ontario Ca

Annual Wages Salaries And Commissions Of T1 Tax Filers 2017

How To Calculate Marginal Tax Rate On Income

Tax Advisor Average Salary In Canada 2021 The Complete Guide

Payslip Templates 28 Free Printable Excel Word Formats Payslip Template Templates Business Template

If You Earned Cad 2000 Month In Canada What Would Your Salary Be After Taxation Quora

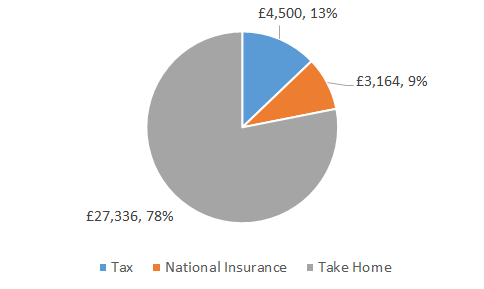

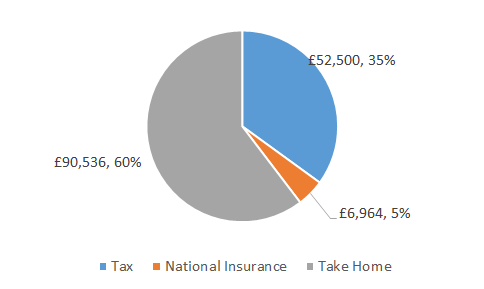

Taking Dividends Vs Salary What S Better Starling Bank

Tax Advisor Average Salary In Canada 2021 The Complete Guide

Tax Advisor Average Salary In Canada 2021 The Complete Guide

Top 10 Best And Worst Paying Job In Canada For 2019 Moving To Canada Canadian Things Paying Jobs

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Mana Net Income Debt Relief Programs Credit Card Debt Relief

How Much Would The Government Tax On A Canadian 300k Salary Quora

Annual Wages Salaries And Commissions Of T1 Tax Filers 2017

Excel Formula Income Tax Bracket Calculation Exceljet

Post a Comment for "Hourly To Salary Ontario After Tax"