Annual Income Calculator Tennessee

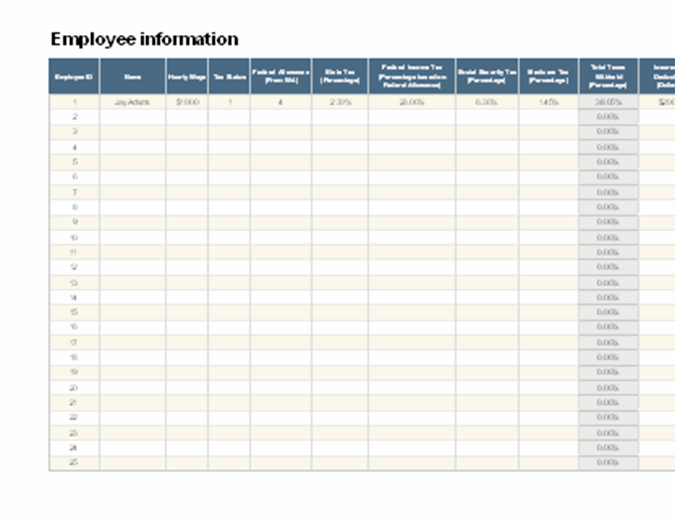

The annual net income calculator will display the result in the last field. Confirm Number of Dependants.

Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inTennessee the net effect for those individuals is a higher state income tax bill in Tennessee and a higher Federal tax bill.

Annual income calculator tennessee. Taxable Income in Tennessee is calculated by subtracting your tax deductions from your gross income. Social Security - 3410. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

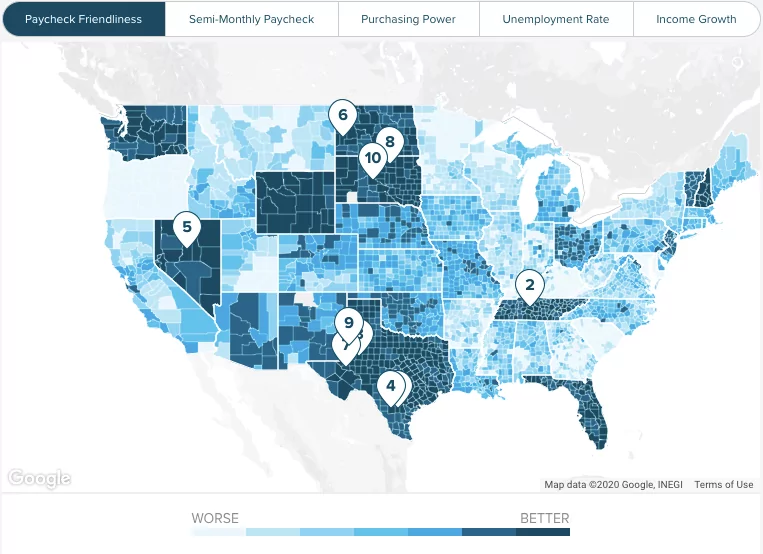

Adults 52 lived in middle-income households in 2018 according to a new Pew Research Center analysis of government data. Average salary in Tennessee is 74183 USD per year. Tennessee Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This goes to the IRS where it is counted toward your annual income taxes and funds a range of expenses. The Income Tax calculation for Tennessee includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Tennessee State Tax Tables in 2021 Federal Tax Calculation for 1500000 Salary 1500000 Federal Tax Calculation The table below details how Federal Income Tax is calculated in 2021. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Tennessee residents only.

15 40 52 31200. FLI Family Leave Insurance. Living Wage Calculation for.

23 lignes Living Wage calculator. Income Tax Calculator USA Find out how much your salary is after tax. Men receive an average salary of 87197 USDWomen receive a salary of 62811 USD.

Medicare - 798. Enter your gross income. This form is how employers know.

First determine your hourly pay rate and working time. Use this free tool to calculate 2020 Tennessee Poverty Levels including monthly totals annual income amounts and percentages of Tennessee Poverty Levels like 133 135 138 150 200 and more. Press Calculate to see your State tax and take home breakdown including Federal Tax deductions.

Use this poverty level calculator to get 2021 annual and monthly federal poverty income levels and percentages for your household size in Tennessee. If you have vacation pay for these days enter your weeks as the full 52 weeks. Enter your Tennessee State income.

Salaries are different between men and women. On average the number of weeks worked per year is around 50 weeks. SDI State Disability Insurance - 3120.

It works for either individual income or household income or alternatively only to compare salary wage income. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. All bi-weekly semi-monthly monthly and quarterly figures.

The state does levy the Hall Income Tax though named after the Tennessee state senator who sponsored the legislation in 1929. Federal Income Tax - 5088. As mentioned above Tennessee employers withhold federal income tax from your paycheck each pay period.

If youre still curious about how our yearly salary calculator works here are two examples showing it in practice. Where do you work. About half of US.

Confirm Number of Children you claim Tax Credits for. For example if you are a filing your taxes as single have no children are below the age of 65 and you are not blind with the consideration of the standard tax deduction your calculation would look like this. Tennessee has no state income tax on salaries wages bonuses or any other type of work income.

How to use the advanced tax calculator. On this page is a 2020 income percentile by state calculator for the United States. The other 2 weeks are vacation.

Your working time will include days per week hours per day and weeks per year. Select other relevant tax factors Age related tax allowances. For tax year 2020 it is a 1 tax that only applies to earnings from interest and investment dividends.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. To determine her annual income multiply all the values. Tennessee Salary Paycheck Calculator.

Calculate your Tennessee net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Tennessee paycheck calculator. ZenPayroll Inc dba Gusto Gusto does not. Next determine any additional.

Check the box - Advanced Federal Tax Calculator. Enter pre-tax income earned between January and December 2019 and select a state and income type to compare an income percentile. The most paid careers are Agriculture Fishing with average income 150000 USD and Aviation Shipping with income.

When you start a new job youll fill out a W-4 form detailing your filing status income level and more. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. It is not a substitute for the advice of an accountant or other tax professional.

Beginning with tax year 2021 the Hall Income Tax is repealed. How to find annual income - examples. The most typical earning is 42000 USDAll data are based on 315 salary surveys.

Roughly three-in-ten 29 were in lower-income households and 19 were in upper-income households. Our calculator below updated with 2018 data lets you find out which group you are in first compared with other adults in your. After a few seconds you will be provided with a full breakdown of the tax you are paying.

The adjusted annual salary can be calculated as. How to calculate annual income from hourly. State Income Tax - 2606.

You can also choose comparison states and show the income. Enter your annual income. The calculator takes your gross income along with the other information you provided it with and uses it to calculate the final amount that you take home.

To use our Tennessee Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

How Fair Market Values Are Used To Determine Payment Standards Market Value Marketing Being Used

How To Calculate Net Income Howstuffworks

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

The Automatic Nonprofit Salary Calculator Blue Avocado Salary Calculator Salary Non Profit

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

Estimate Grain Hauling Costs Calculator Online Calculator Grains Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

Pin On Nomisma Solution The Finest Software For Income Tax Computation

Health Insurance Marketplace Calculator Kff

Tennessee Paycheck Calculator Smartasset

Metaphor For The Payment Of Taxes In 2021 Real Estate Investing Investing Real Estate Investor

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2021

7 Free Salary Payslip Template Download Simple Salary Slip Payslip Template Online Training Business Salary Slip

Tennessee Paycheck Calculator Smartasset

Post a Comment for "Annual Income Calculator Tennessee"