Gross Pay Ytd Means

For example divide year-to-date gross. A really good return on investment for an active investor is 15 annually.

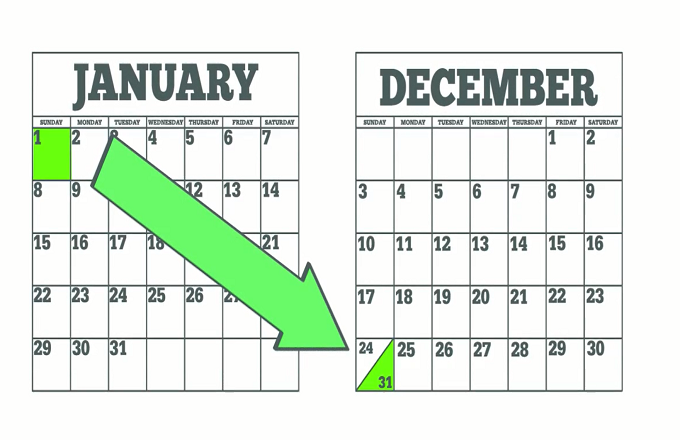

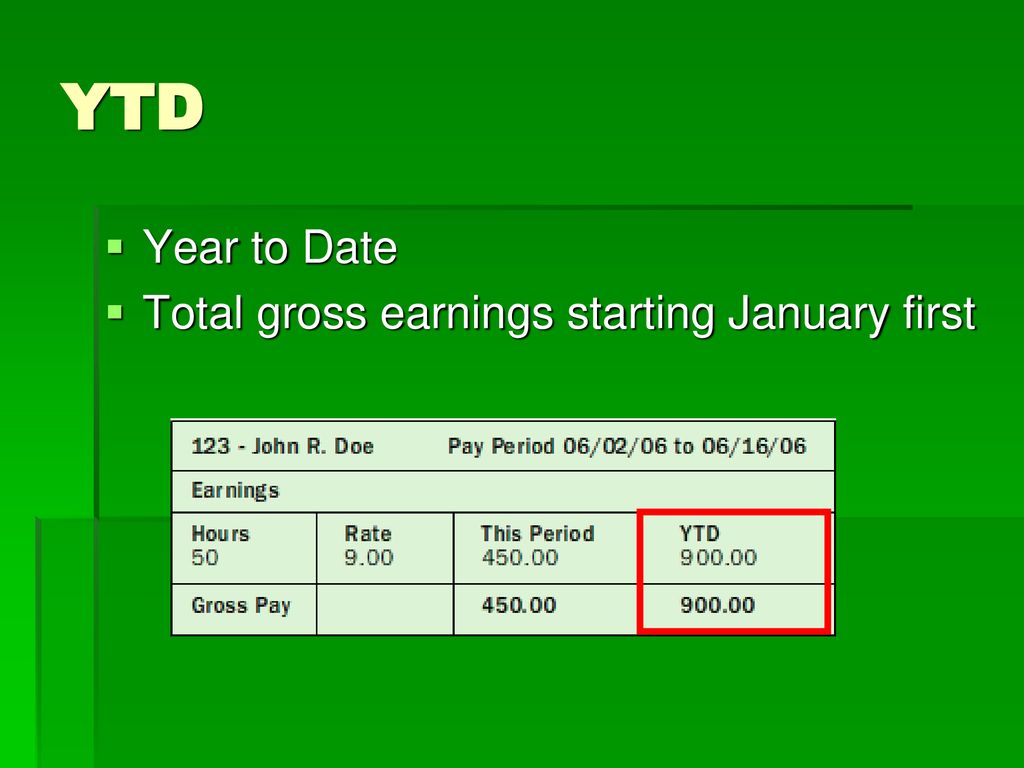

Simply stated your YTD short for Year-to-Date amount shows the sum of your earnings from the beginning of the current calendar year to the present time or the time your pay stub was issued.

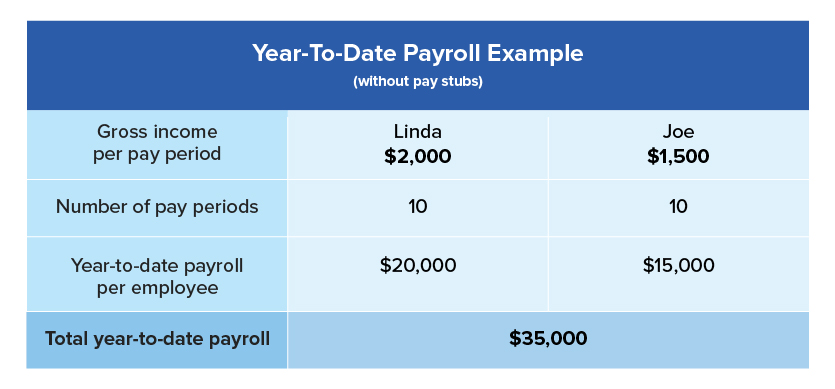

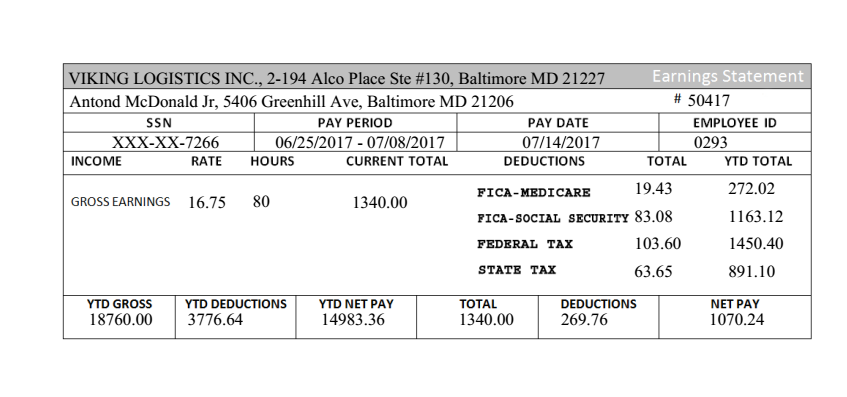

Gross pay ytd means. YTD Net Pay - this is the amount a person earned for the year after deductions. Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes. YTD Deduction and Benefits The total amount that was deducted from the employee wages.

Is YTD gross or net. YTD Gross Pay The total amount the employee earned for the year. For example if you make 2500 an hour and work 40 hours per week your gross pay is the product of 25 x 40 hours equaling 100000.

There are several practical uses for understanding your YTD amounts. What is YTD gross pay. This is the year-to-date amount of the deductions taken from employees YTD Gross Pay for federal income.

The Totals section near the bottom of your pay statement shows your total pay and deductions for both the current pay period and the year to date YTD. Notice I didnt say it was the total amount paid to each employee. Most banks and lenders will use a Year to Date calculator to work out the income figure to use on your home loan application and in a lot of cases the banks will use the lower figure of your YTD income and your group certificate.

Your total gross pay from the Hours and Earnings section of your pay statement. Year to date column shows total Gross Salary total deductions total tax deucted and net income based on a calendar year. Your final paycheck of the year will have almost the same information as on your T4 slip.

Here are some of the most common ways and what they all mean. What does taxable gross YTD mean. YTD Deductions - this is the amount that was deducted from a persons YTD Gross.

YTD is calculated based on your employees gross incomes. Gross income is the amount an employee earns before taxes and deductions are taken out. In other words Year to Date YTD income represents what you should earn over the course of 12 months.

This is the total amount an employee has earned from the start of their work to date before taking out. Heres what the different YTDs mean. Its aggressive but its achievable if you put in time.

YTD Gross - this is the amount a person earned for the year before deductions. Year to date. Gross pay is a term that describes the amount of pay you receive before they take any deductions out.

What Is Gross YTD. Gross income is the starting point from which the Internal Revenue Service IRS calculates an individuals tax liability. What is a good YTD rate of return.

How do you calculate monthly income from YTD. Year-to-date earnings are the gross earnings for an employee for the period from the beginning of the year through the date of the report or payroll record. Taxable fringe benefits are.

To calculate YTD you must consider your employees gross incomes which. YTD stands for year to date again from the beginning of the current year up to but not including today. Its all your income from all sources before allowable.

Once again make sure you know whether your company goes by the calendar year or the fiscal year as the latter may not begin on January 1st. Gross pay often called gross wages is the total compensation earned by each employee. YTD Net Pay - this is the amount a person earned for the year after deductions.

YTD stands for Year to Date. YTD can also include the money paid to your independent contractors. YTD Gross - this is the amount a person earned for the year before deductions.

It may include earnings for overtime bonuses shift work and holiday pay etc. It includes only payments actually made to or on behalf of the employee. Divide the gross year to date income by number of months the figure represents.

Independent contractors are not your employeesthey are self-employed people hired for a specific job. Create your paystub now httpsbitly2vUL93Z Create a paystub instantly online - No software neededSubscribe for more tutorials and helpful videos http. Your companys year-to-date payroll YTD is the amount of money your company has spent on the payroll since the beginning of the calendar or fiscal year up to the current payroll date.

Pay Terms Gross Pay - This is the total amount that you have earned before deductions have been applied.

A Note About Pay Stubs Payroll Template Payroll Checks Templates

Hrpaych Yeartodate Payroll Services Washington State University

Monthly Financial Statement Template Blank Personal Financial Statement Sba Monthly Financia Income Statement Personal Financial Statement Statement Template

Solved Ytd As Of Last Completed Month Microsoft Power Bi Community

9 How To Make Payroll Check Stubs Simple Salary Slip Payroll Checks Check Stubs Payroll

Payroll Software Singapore One Stop Accounting Payroll Software Payroll Payslip Template

Creating Ytd And Mtd Calculations Tableau Software Data Visualization Software Visualisation

29 Free Payroll Templates Payroll Template Payroll Checks Free Checking

Frugal Finance What Is Gross Ytd Here S What Everything On Your Paycheck Means

Ytd Calculator And What Is Year To Date Income Calculator

What Is Year To Date Ytd Payroll And Why Should You Care Knit People Small Business Blog

Ytd Calculator And What Is Year To Date Income Calculator

Post a Comment for "Gross Pay Ytd Means"