Wages Meaning For Pf

A regular payment usually on an hourly daily or weekly basis made by an employer to an employee especially for manual or unskilled work. The government is likely to increase the monthly wage ceiling of mandatory EPF soon.

Wage definition is - a payment usually of money for labor or services usually according to contract and on an hourly daily or piecework basis often used in plural.

Wages meaning for pf. Post matriculation education of sondaughter. Example for each employee getting wages above 15000 amount will be 75- 3. Wages or Salaries are emoluments earned by an employee.

The report suggests that it will be hiked from Rs 15000 to RS 21000. Wages Definition Wages means all remuneration earnings allowances tips and service charges however designated or calculated payable to an employee in respect of work done or work to be done. Under the PF rules contribution towards PF is to be calculated on basic wages dearness allowance retaining allowance and cash value of any food concession.

However as per new PF enhancement now PF. Effected by cut of electricity. Basic wage definition as per EPF act 1952 Basic wages means all emoluments which are earned by an employee while on duty or on leave or on holidays with wages in either case in accordance with the terms of the contract of employment and which are paid or payable in cash to him but does not include-.

The wage structure and the components of salary have been examined on facts both by the authority and the appellate authority under the Act who have arrived at a factual conclusion that the allowances in question were essentially a part of the basic wage camouflaged as part of an allowance so as to avoid deduction and contribution accordingly to the provident fund account of the. As per our current practice we were deducting PF on the max. You will also find details such as the name of the employee date of birth date of joining the organisation and so on.

Non receipts on wages for-2 months. Basic wages have been defined to mean. Allowances including travelling allowances attendance allowances commission and overtime pay are within the definition of wages.

How to use wage in a sentence. EDLI contribution to be paid even if member has crossed 58 years age and pension contribution is not payable. Wage synonyms wage pronunciation wage translation English dictionary definition of wage.

It is paid either as a consolidated wage or bifurcated into various Allowances. As per PF law Basic wages means all emoluments which are earned by an employee while on duty or on leave or on holidays with wages in either case in accordance with the terms of the contract of employment and which are paid or payable in cash to but does not include. Every setup with more than 20 employees or more has to offer PF to its employees.

EPF Wages. Through a provident fund PF you contribute a part of your salary each month towards the pension fund. Definition Of Basic Salary For The Purpose Of Pf - PDF Download.

For example if the PF Gross is Rs 2000 per month and the minimum wages is Rs 3000 the PF department may not accept the PF calculation and ask the organization to calculate PF on at least the minimum wages. Illness of memberfamily member. I would like to seek your expert view on the issue that we are currently dealing.

Employees Provident Fund EPF wage ceiling. The first thing to check on your PF statement is your PF number. The PF statement carries the name and address of the establishment along with the establishment ID.

The amount accumulates over a period of time and you get it as a lump sum upon retirement or at the end of the employment. The PF department by way of a circular has stated that the salary for the purpose of PF calculation should not be less than the minimum wages specified by the Minimum Wages Act. If an organization is in full compliance with the Minimum Wages.

For an un-exempted organisation the PF number is an alphanumeric representing the state regional office establishment and the PF member code. Each contribution is to be rounded to nearest rupee. According to the provisions of the Employees Provident Fund and Miscellaneous Provisions Act 1952 called the PF Act the statute which governs Provident Fund PF contribution the PF contribution should be calculated as 12 of the basic wages plus DA plus cash value of food concession plus retaining allowance if any subject to a maximum of Rs6500- per month.

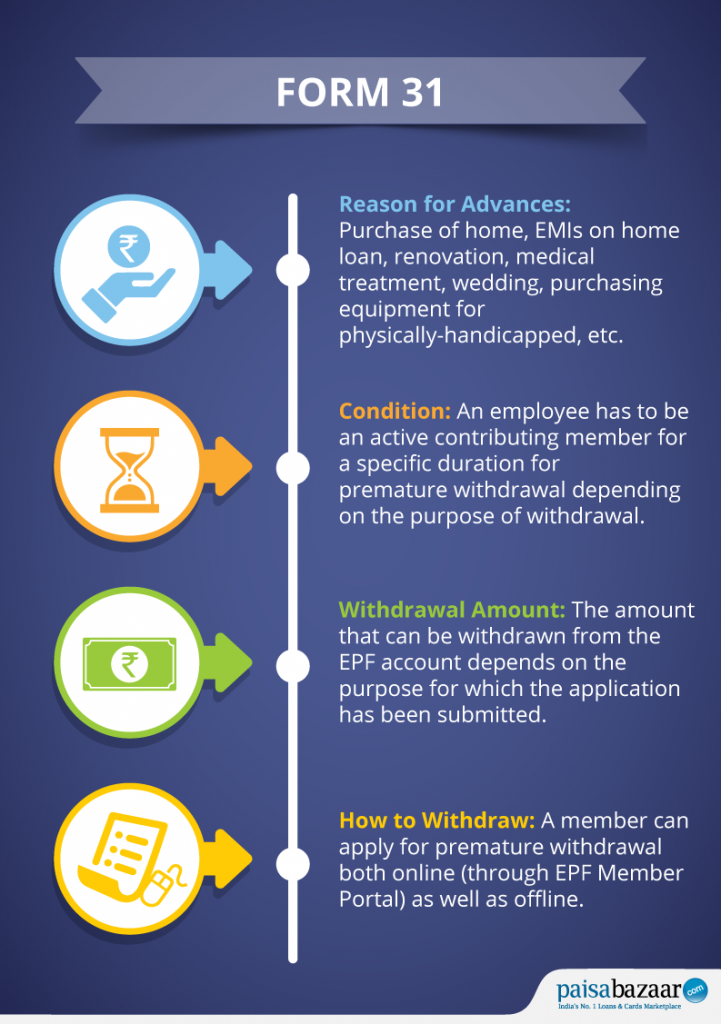

Damage to the property due to natural calamityfloodriotearth quake. The confusion in definition of wages and hence the issue of splitting of wages primarily arises from the expression commission or any other similar allowance payable to the employee in Section 2b ii of the Act as commission and any other similar allowance are read as two separate expressions and hence any other allowance is read as an omnibus exclusion thereby encouraging. An EPFO subscriber can take advance from EPF deposits for purposes such as purchaseconstruction of house repayment of loan non-receipt of wage for 2 months for marriage of selfdaughterson.

However it does not include. Get more Personal Finance News and Business News on Zee Business. Wages on which the employer is supposed to remit the dues-Number No decimals allowed-EPF wages cannot be more than the Gross wages-The Exempted Establishments under EPF Scheme should also fill in the EPF Wages-0 zero wages can be allowed only in case the employee did not earn any wage during the month.

Contribution to be paid on up to maximum wage ceiling of 15000- even if PF is paid on higher wages. Discharge or dismissal or retrenchment challanged by the member the case is pending in the court.

Is Employee Attrition Costing You Thousands Of Dollars Or Is It Good For Business Learn What S Causing Attr Employee Engagement Employee Employee Development

Epf Form 31 Instructions Filing Procedure How To Download

New Wage Code How Your Salary Structure Will Change Businesstoday

Epingle Par Nadia Juarez Sur Interior Design Decor Coussin Pouf Ikea Deco Balcon

What Is Meaning Of Private Limited Company Private Limited Company Limited Company Company

Employee Compensation Salary Wages Incentives Commissions Entrepreneur S Toolkit

Epf Interest Rate 2020 21 How To Calculate Interest On Epf

Ee Balance Er Balance Meaning In Pf

Latest Provident Fund Rule Epf Contribution Must For Special Allowances Part Of Your Basic Salary Zee Business

Impact Of The Definition Of Wages On Statutory Benefits

Housing For Crpf New Accommodations For Central Reserve Police Forces State Ut Wise Details In 2021 Police Force Wise Police

Banksy Posts Video Of 1m Painting Shredding Stunt At Sotheby S Balloon Painting Banksy Girl With Balloon Banksy Paintings

What Is Pf Know Pf Meaning Benefits Rate Of Interest Karvy Corporate

Payroll Or Wages Sheet Meaning Documents Necessary For Preparation Of Payroll

Pf Account Number Format Details Establishment Id Extension

The Spiritual Meaning Of The Food On Your Rosh Hashanah Table Happyroshhashanah Happy Rosh Hashanah Happyroshhashanah The Spiritual Meaning Of The Food On Yo

Employee Provident Fund Epf Changed Rules From 1st Sept 2014 Sap Blogs

Defaulting Pay Components And Values Based On Total Ctc In Employee Central Sap Blogs

Post a Comment for "Wages Meaning For Pf"