Self Employed Annual Income Calculator

If you have not completed your tax return you can provide an estimate of your profits. Your tax code age and other options might also affect your calculations.

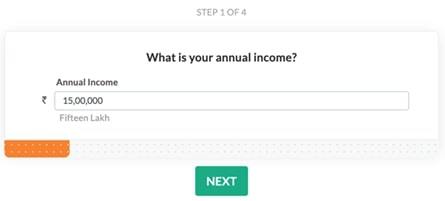

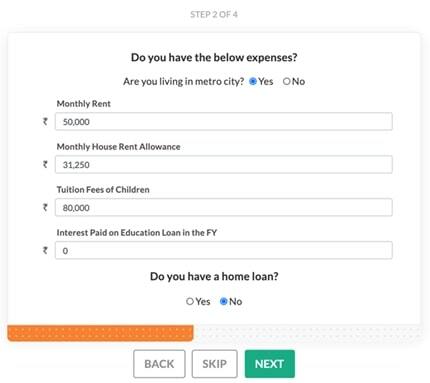

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

If youre a freelancer consultant or small business owner like yours truly selling products or services then this calculator shows your major tax expense.

Self employed annual income calculator. At Hnry we decided to create our own tax calculator specifically for self-employed freelancers contractors and sole traders. Understanding how these taxes work can earn you substantial financial savings as an entrepreneur. That way you can plan your finances with more confidence.

This is the figure used on your tax return to work out how much tax you have to pay. In this article youll learn how we calculated the. To estimate and analyze a borrowers cash flow situation enter the required data into the cash flow analysis calculator according to the calculations that appear on the borrowers tax returns.

Line item losses are entered with parenthesis. Line by line explanations are displayed by hovering the cursor over the help buttons at the beginning of each line. To estimate how much WIS you may receive please key in your period worked date of birth net trade income and select the contribution group.

Then enter your annual income and outgoings from self-employment. You will also have to pay 63 9 on 702 of your self-employment income. All you need to do is enter the amount you get paid and what you spend on business costs.

Our calculator uses standard Tax and NI calculations. There is no tax free threshold in New Zealand and therefore any income you earn as a contractor or freelancer will be taxed. Well then work out your Tax and NI figures for you.

If your income varies use an average over a few months for the best results. It also will not include any tax youve already paid through your salary or wages or. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Key Taxes for the Self-Employed. Alternatively please input in Basic SalaryIncome the total annual income of the applicant made up of their share of net profit drawings salary dividend etc average over 3 years. If you are self employed use this simplified Self Employed Tax Calculator to work out your tax and National Insurance liability.

Self Employment consists of two taxes for Social Security and Medicare. Yes that means that instead of receiving a maximum of 2083333 you can get a maximum of 4166666. However you may be eligible for a tax refund when.

If you did not yet get any PPP see our guide and eligibility calculator. When youre self-employed you have to pay your income tax and national insurance contributions yourself in your annual Self Assessment. More information about the calculations performed is available on the details page.

Can be used by salary earners self-employed or independent contractors. You already made tax payments for the year but your annual income ended up less than planned. Our employed and self-employed calculator gives you an estimated income and national insurance tax bill based on your annual gross salary self-employment income self-employment expenses and pension contributions.

IRD calculate your income. Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. Enter your gross annual income into the calculator.

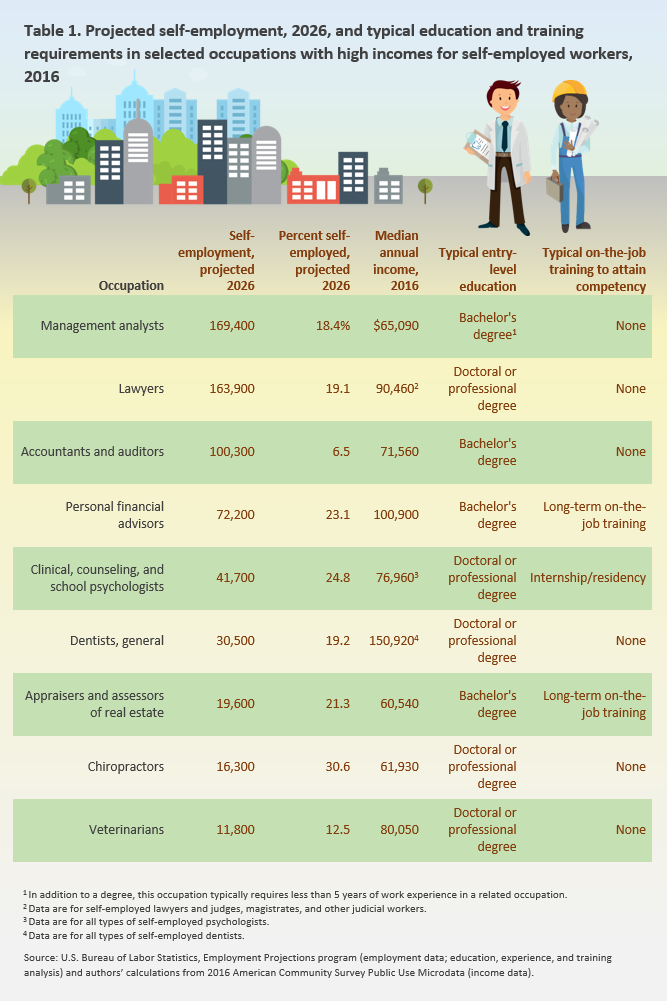

This means that the Tax Credits Office will usually use your self-assessment tax return to work out how much tax credits you should get. Our self-employed and sole trader income calculator is easy to use. Intuits and Gallups Gig Economy and Self-Employment Report shows that the median income of workers who are primarily self-employed is 34751 compared to a median income of 40800 for those who.

A self-employed mortgage calculator uses the information you put in to calculate what your mortgage repayments might be based on your income. Use the self-employment Income Tax calculator to work out your take-home pay after business expenses National Insurance contributions and Income Tax. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more.

You will need to pay Class 2 NI worth 159. Our calculator helps you quickly assess how much you owe. For a self employed applicant please input in Basic SalaryIncome the average of the applicants Total Income Received over the last 3 years taken from their SA302s.

Estimate your Income Tax for the current year. Income Tax - Any self-employed income you earn will need to have Income Tax paid on it. For Working Tax Credit your earnings are the taxable profits you made from self employment in a year.

It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. The calculator uses tax information from the tax year 2021 2022 to show you take-home pay. When you use a self-employed mortgage calculator youll usually be asked to put how much you get paid your pension contribution and the business expenses to work out your affordability and what your repayments are likely to be.

Please click to see the WIS criteria. Any data from the respective forms and schedules. The calculator needs some information from you before working out your tax and National Insurance.

Food and accommodation businesses get up to 50000. You must meet the eligibility criteria to qualify for WIS. Self-employed and 1099 workers may be eligible for two rounds of PPP.

It will calculate out how much tax youll need to pay across the main tax types. Firstly you need to enter the annual salary that you receive from your employment and if applicable any overtime or pension details. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022.

You pay 2054 20 on your self-employment income between 0 and 10270. You pay 7092 40 on your self-employment income between 10270 and 28000.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Net Income 12 Steps With Pictures Wikihow

Schedule C Income Mortgagemark Com

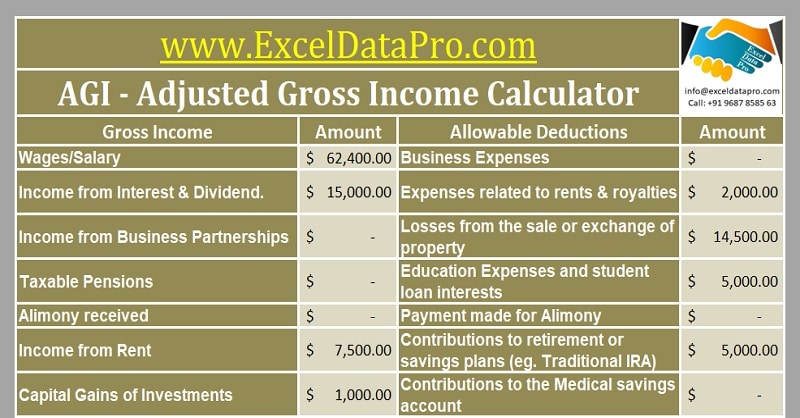

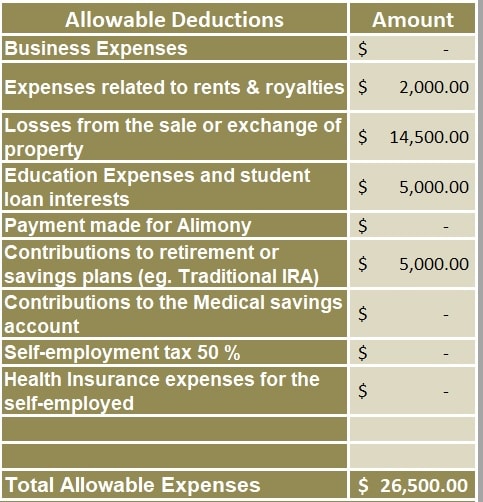

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Quarterly Tax Calculator Calculate Estimated Taxes

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

4 Ways To Calculate Annual Salary Wikihow

Estimated Quarterly Tax Payments Seattle Business Apothecary Resource Center For Self Employed Women

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Doordash Tax Calculator 2021 What Will I Owe How Bad Will It Hurt

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How Much Should I Set Aside For Taxes 1099

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Employed And Self Employed Tax Calculator Taxscouts

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Post a Comment for "Self Employed Annual Income Calculator"