President Salary Taxability

Also Salary received from MP or MLA is taxable as Income from Other Sources not as Income from Salaries. Lincoln Johnson and Grant.

France Revised Phase Down Of Corporate Income Tax Rate Kpmg United States

It will be considered as Profits from Business or Profession.

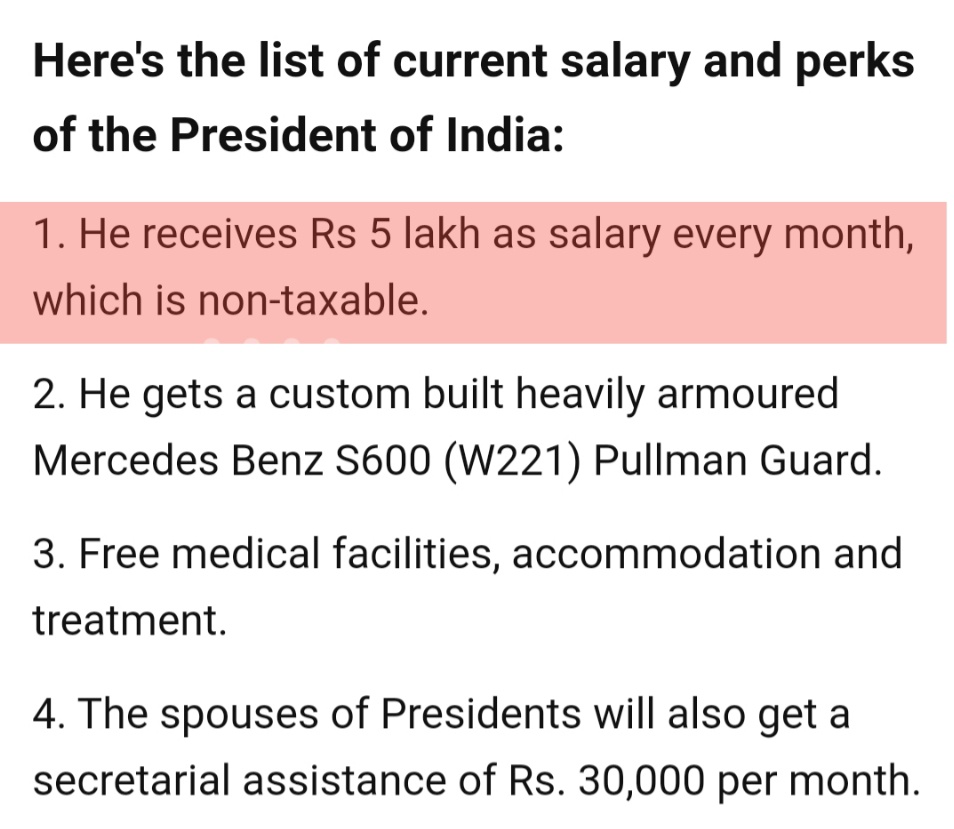

President salary taxability. The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951. This act has been amended from time to time to review the salary. The existence of employer-employee relationship is the sine-quanon for taxing a.

BofAs senior associates are now up to 135K salaries up from 120k last year. ACN salary trends based on salaries posted anonymously by ACN employees. A free inside look at Groupe Gabriel-Prestige-Président salary trends based on 11 salaries wages for 11 jobs at Groupe Gabriel-Prestige-Président.

Assassinat du président dHaïti. This video shall be useful for the students of CA CS CMA BBA BCom M. 2 Points to consider.

Contribution by employer to pension fund established us 80CCD. In such a case he is qualified for a reasonable salarycompensation for his professional work because his work is saving the Trust from paying another CAs fee. Salaries posted anonymously by Groupe Gabriel-Prestige-Président employees.

It is also used to fix the pension and other benefits of retired President. Lincoln paid income taxes throughout his presidency. An amount received by a partner from a partnership firm for carrying out business and profession will not be treated as salary and treated under the head Salaries.

Taxability of Employers contribution to provident fund in excess of 12 of salary. It is needless to say that the income of the president is Tax free. Logic for an exemption is it would.

C Income from salary taxable during the year shall consists of following. To argue from this executive gesture that the judiciary could and should act in like manner is to assume that in the matter of compensation and power and need of security the judiciary is on a par with the Executive. The actual receipt of salary in the previous year is not material as far as its taxability is concerned.

A Salary income is chargeable to tax on due basis or receipt basis whichever is earlier. Salary is the remuneration received by or accruing to an individual periodically for service rendered as a result of an express or implied contract. Average salaries for ACN Président Directeur Général.

Both banks now pay considerably higher. Any contribution by employer to a pension fund established u 80 CCD of the. Taxability of and source of Salary of PM.

Such assumption certainly ignores the. The Revenue Act of 1862 provided for a special 3 tax on the salaries of every person in the civil military. Any amount contributed by an employer to a recognized provident fund in excess of 12 of salary is taxable under the head salary.

However there is an exception if a person receives a salary as Minister of State or Central Government it will treat as salary. 5 minutes pour comprendre une crise politique et sécuritaire Lassassinat du président haïtien Jovenel Moïse dans la nuit de mardi à mercredi survient. Though it was clearly mentioned in Section 15 of Income-tax Act 1961 that any income earned where relation of Employer-Employee is established is taxable under the head salaries.

In this video we will understand the salary taxability according to the pay scale. Arkesden says that London vice presidents at the bank are now paid a flat 165k 229k base salary for three years up from 150k base salary last year. In hiking base salaries to a flat rate for all three years of being a vice president BofA has followed Morgan Stanley.

B Existence of relationship of employer and employee is must between the payer and payee to tax the income under this head. Salary earned by PM though taxable under head Salaries but there are some exemptions which allowed him to exempt the Salary to some extent. Without the voluntary act of the President his salary would not be taxable because of constitutional protection against diminution.

Case law-According to the case PNR Society for Relief Rehabilitation of the Disabled Trust Vs.

25 Percent Corporate Income Tax Rate Details Analysis

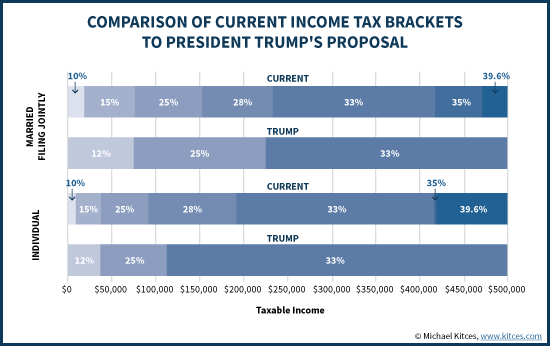

Understanding Trump S 2017 Income Tax Reform Proposals

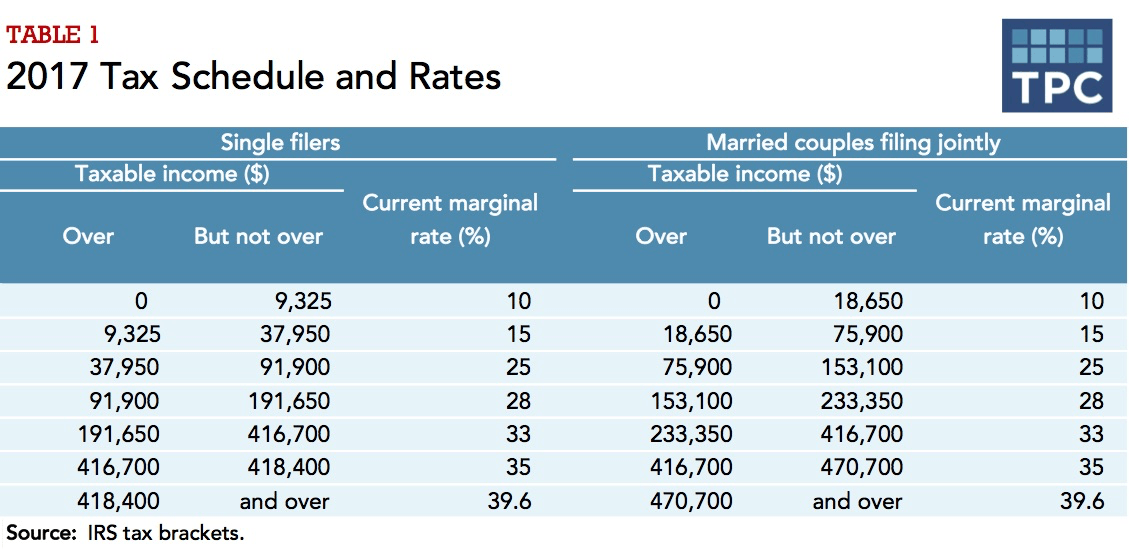

How Federal Income Tax Rates Work Full Report Tax Policy Center

Whether Salary Of The President Of India Is Taxable Law Trend

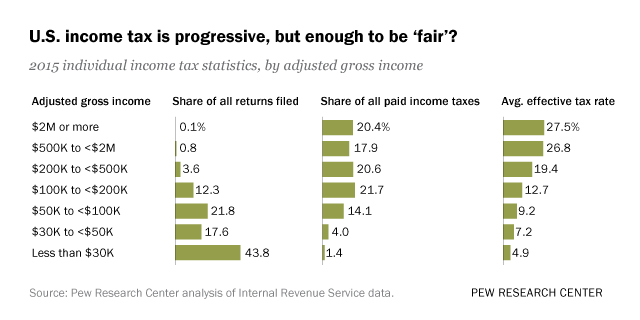

Who Pays U S Income Tax And How Much Pew Research Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

No The President Of India Is Not Exempted From Income Tax

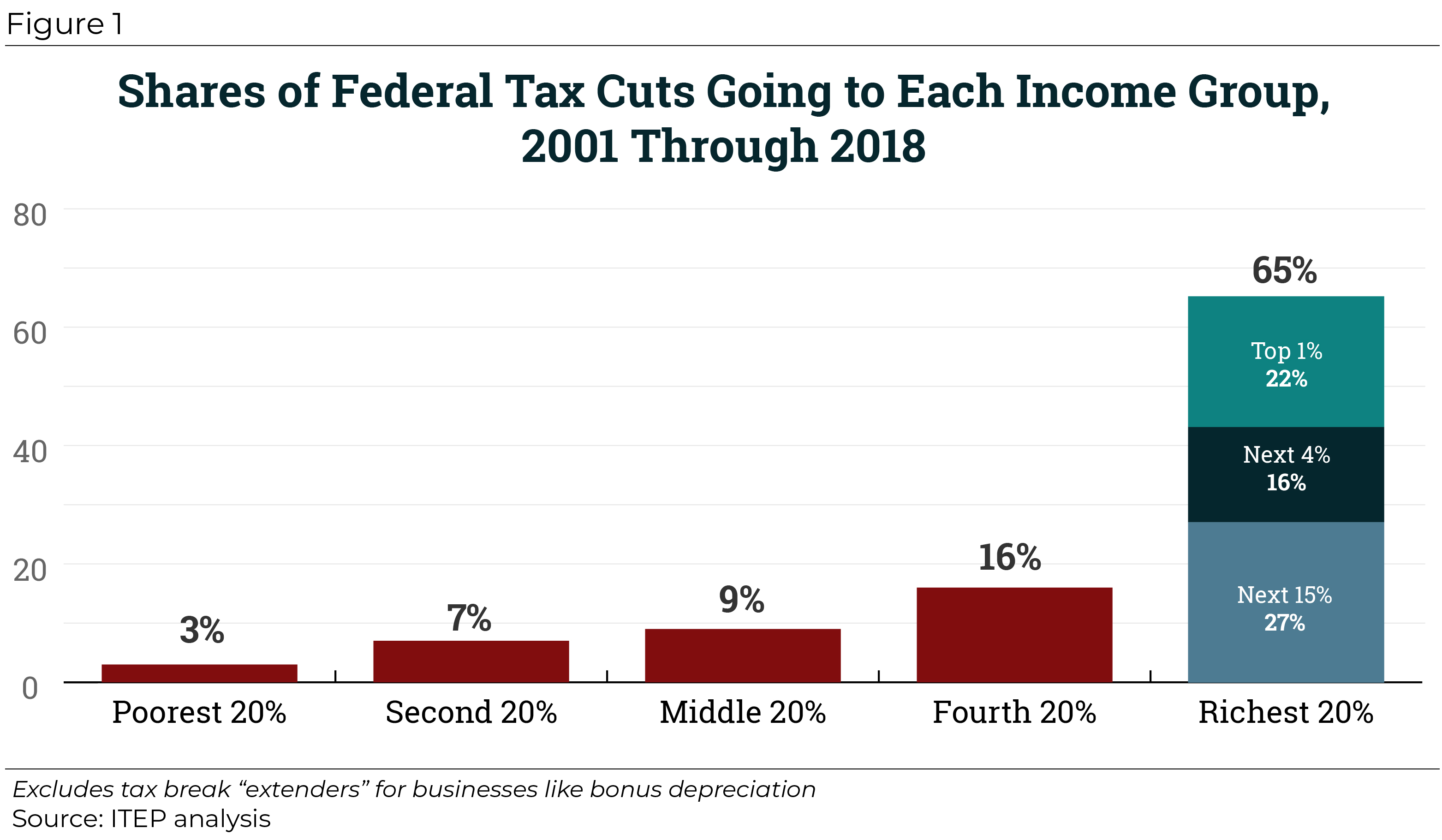

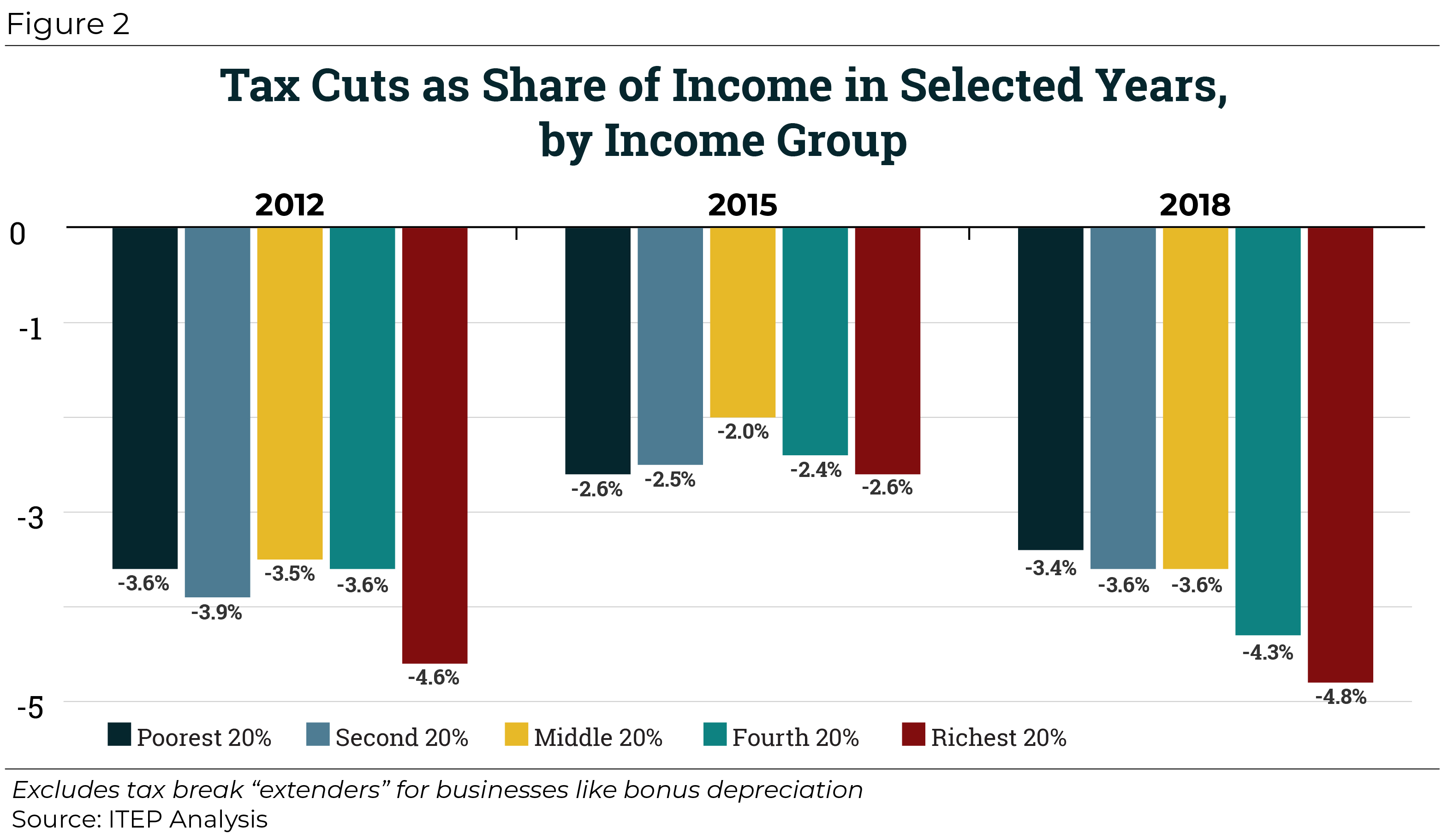

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Who Pays U S Income Tax And How Much Pew Research Center

Federal Tax Cuts In The Bush Obama And Trump Years Itep

President Of India Salary Controversy How Much Does President Of India Earn Is It Taxable Youtube

Donald Trump Did Not Pay Income Tax In 10 Of Last 15 Years Deccan Herald

Biden S Tax Plan Calculator See How Your Taxes Might Change Forbes Advisor

Siddharth Setia On Twitter But President S Salary Is Tax Free Why Is He Lying

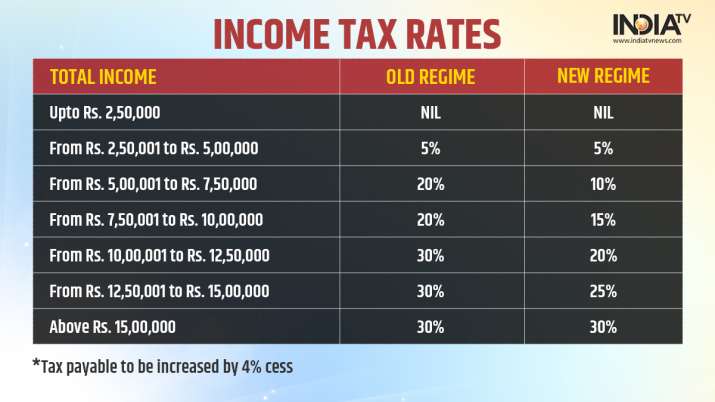

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And New Regime Income News India Tv

Does The President Of India Ram Nath Kovind Pay Income Tax

Do You Know The Salary Of The President Of India Education Today News

Post a Comment for "President Salary Taxability"