President Salary Exempt

Through an amendment to the Finance Bill in 2018 the Presidents salary was last revised to Rs. Chief of Staff FY 10194080 Perry Michael C.

How Much Do Big Education Nonprofits Pay Their Bosses Quite A Bit It Turns Out The Washington Post

In California exempt employees must meet certain salary and duties tests and must be paid at least twice the state minimum hourly wage based on a 40-hour week.

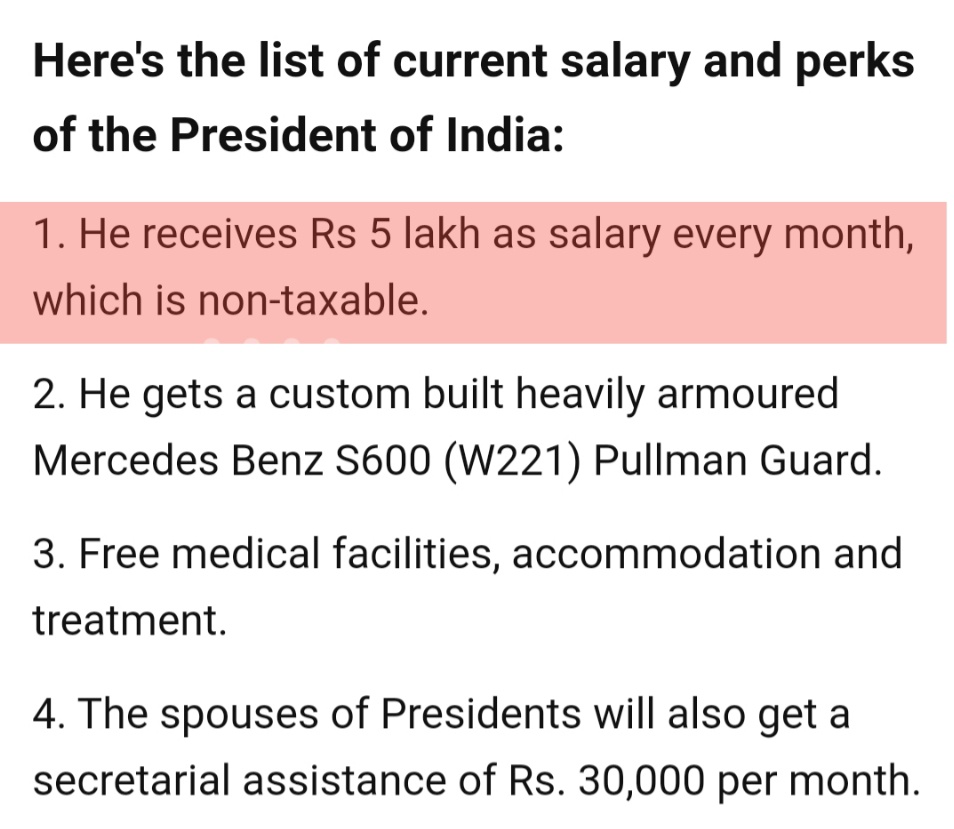

President salary exempt. Can we file RTI for getting information regarding file of IT returns. 5 lakh rupees per month. Presidents Salary Exempt From Sequestration.

Notably the compromise did not just eliminate the increase to the salary thresholdit repealed the entire regulatory framework for defining the. The most significant change in the regulations relates to the minimum annual salary that employees must earn in order to be eligible for exemption from overtime pay. Type FY2020 Salary FY2020 FACULTY AND EXEMPT SALARIES AS OF MAY 17 2019 2010 President Presidents Area 3944 Presidents Office Green C.

As of 2017 it is. To President FY 12802400. Current rules peg the minimum annual salary at 23660 or 455 per week.

The United States Department of Labor under the direction of President Barack Obama and Labor Secretary Thomas Perez has issued new overtime pay regulations that will affect millions of American workers and their employers. Scott President FY 42000000 Helbling Brenda R. The Prime Minister is required to pay tax on his taxable income.

An Administrative Increment increase for an Exempt position may be up to an additional 12 of the employees current base salary. The proper form under a note advising the president that as you are probably aware the Income Tax Law specifically exempts your compensation Wilson acted accord-ingly. 50 on 50 Talk to Advocate T Kalaiselvan.

Therefore it appears that President does pay tax on his income. A report published last month by the Congressional Research ServiceBudget Sequestration and Selected Program Exemptions and Special Rules. His tax returns for 1914 1915 and 1916 repeated the same procedure.

The salary of the President of India is thus determined by the 1951 Presidents Emoluments and Pensions Act. Additionally do US presidents get paid for life. FY2021 FACULTY AND EXEMPT SALARIES AS OF JUN 10 2020 Name Title Rank Yr.

When President George Washington took office in the year 1789 the salary of the President was established at 25000 a year. Further the Income Tax Act and the The Presidents Emoluments and Pension Act 1951 do not exempt the Presidents salary from income tax. His completed return for 1913 omitted any mention of his presidential salary of 75000.

The states minimum wage is scheduled to increase on January 1 2021 and varies based on size of the employer. Neither the Constitution nor the Presidents Emoluments and Pensions Act 1951 exempt the Heads of State from taxation Mridhula Raghavan. Neither the Income Tax Act nor the President Emoluments and Pension Act specifically exempt the salary of the President of India from taxation.

In addition to the salary the president receives other allowances in which free medical treatment housing and other perks are provided for life. The Administrative Increment must be entered into PHR as an addition to salary and include the duties justification and the calculation of pay. Type FY2021 Salary 2010 - President Intercollegiate Athletics - 3933 Womens Track CC Cawley Cathleen A.

Asst Coach Track Jump Coach FY 3850080 Cawley Timothy Director of TrackX-Country FY 6907680 Floeck Travis Assistant Track Coach FY 4933760. Name Title Rank Yr. The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951 the salary of the president of India is TAX FREE.

Former presidents receive a pension equal to the pay that the head of an executive department Executive Level I would be paid. President Barack Obama wont have to worry about his paycheck if the spending sequestration included in the Budget Control Act that he signed into law in 2011 begins taking effect this Friday. Similarly what President made a salary of 25000 per year.

Once released the approval process is tiered requiring the department division and final UHR. For the administrative professional and executive exemptions under state law employers with 26 or more.

President Obama Issues New Overtime Pay Rules Effective December 1 Batts Morrison Wales Lee P A A Non Profit Cpa Batts Morrison Wales Lee P A A Non Profit Cpa

Do You Know The Salary Of The President Of India Education Today News

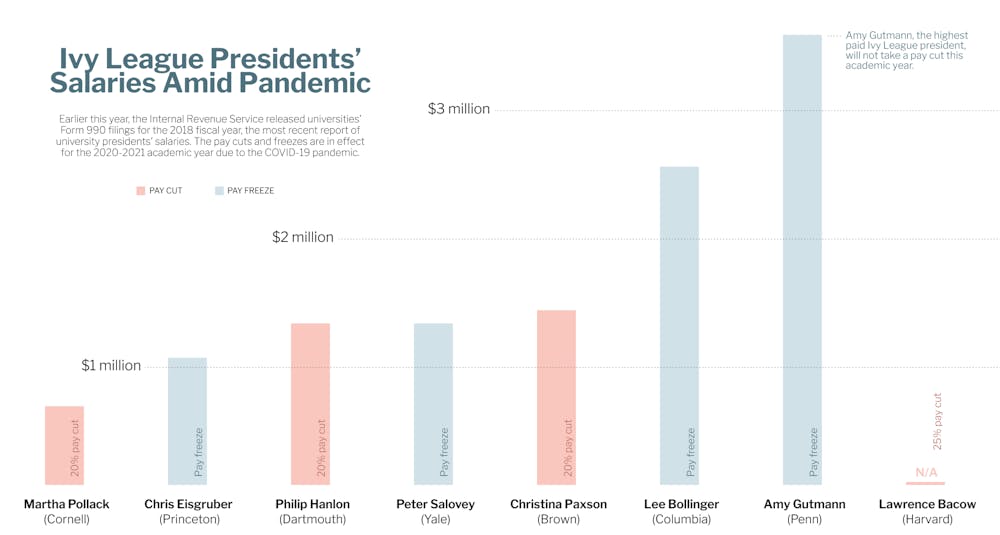

Gutmann Highest Paid Ivy League President Will Not Take Covid Induced Pay Cut Like Peers The Daily Pennsylvanian

Gutmann Highest Paid Ivy League President Will Not Take Covid Induced Pay Cut Like Peers The Daily Pennsylvanian

The Math Behind President Kovind S Tax Outgo

Whether Salary Of The President Of India Is Taxable Law Trend

Executive Compensation At Public And Private Colleges

Https Www Jstor Org Stable 40574568

Does The President Of India Ram Nath Kovind Pay Income Tax

Does Trump Avoid Taxes Many Other Presidents Did

No The President Of India Is Not Exempted From Income Tax

Siddharth Setia On Twitter But President S Salary Is Tax Free Why Is He Lying

Https Data Adb Org Node 4341 Download

What Is An Exempt Employee Requirements Qualifications And More

Https Www Ebrd Com Documents Comms And Bis Pdf Basic Documents Of Ebrd 2013 Headquarters Pdf

It Takes Two Exempt Employees Must Meet Both Salary And Duties Tests

No The President Of India Is Not Exempted From Income Tax

Leblanc Took Small Pay Cut To Become President The Gw Hatchet

Post a Comment for "President Salary Exempt"