Gross Pay Report Quickbooks

Here is how you run gross sales report in QuickBooks Desktop. Choisissez loutil le plus simple et abordable du marché pour TPEPME.

How To Run Payroll Reports In Quickbooks In 3 Quick Steps

Start QuickBooks and open.

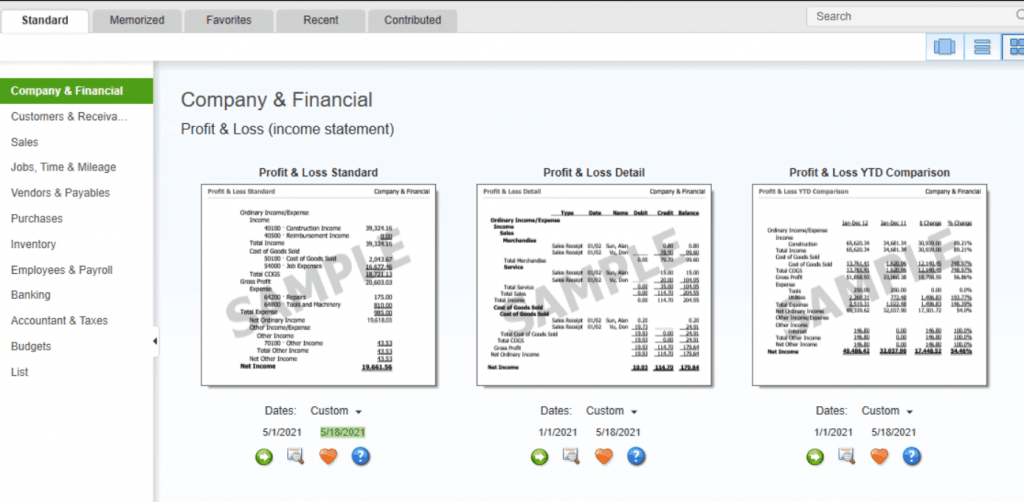

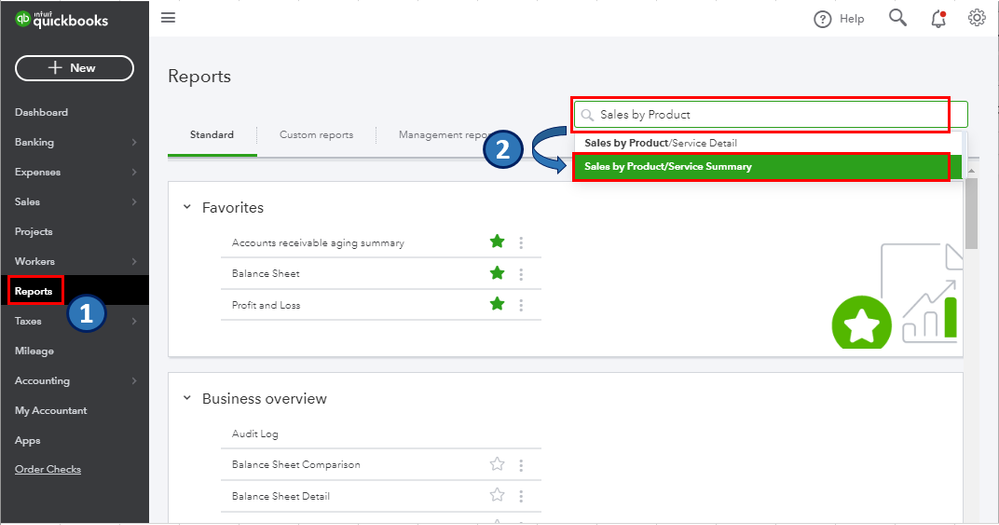

Gross pay report quickbooks. Gross receipt does not consider the price adjustments or discounts. Annonce Dites au revoir aux CRM et ERP complexes et trop chers. Select Reports then choose Standard then select Payroll.

QuickBooks offers a number of their tax liability. Lastly select Run Report. IBAN TL TR94 0011 1000 0000 0070 3125 64 click on the Employees tab at www.

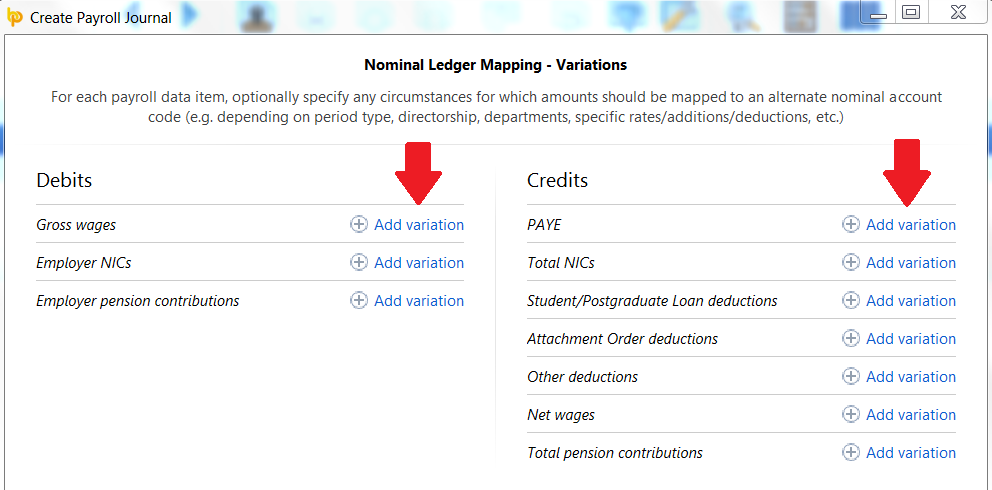

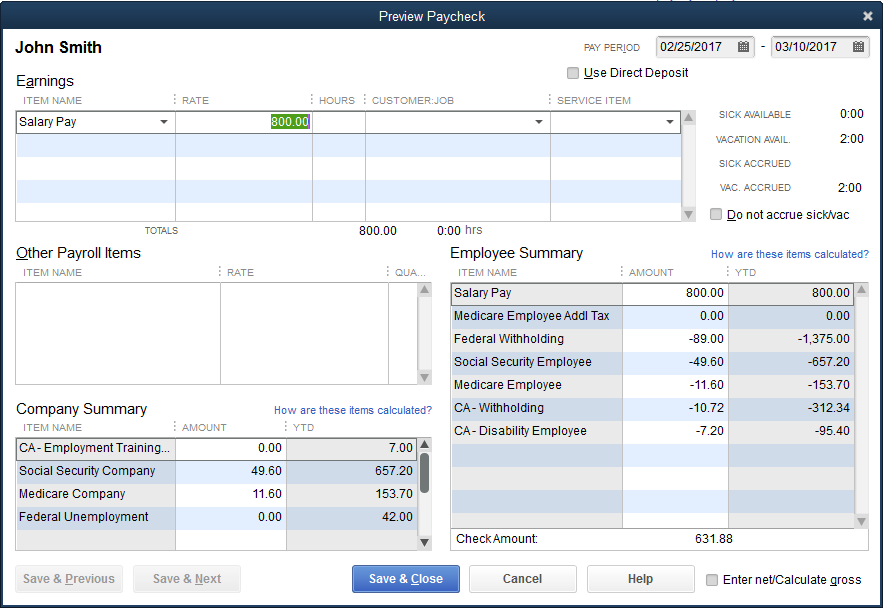

This report can drill down to information on individual paychecks including compensation history and deductions. Select either gross pay or net pay depending on where you want this item reported on the Payroll Summary report. December 10 2018 0947 PM.

Go to the Reports tab. Etsi töitä jotka liittyvät hakusanaan Quickbooks employee gross pay report tai palkkaa maailman suurimmalta makkinapaikalta jossa on yli 20 miljoonaa työtä. W-2 and 1099 forms are typically posted in order with a payroll company a business provides the gross pay for insurance premiums or to fund - in the US.

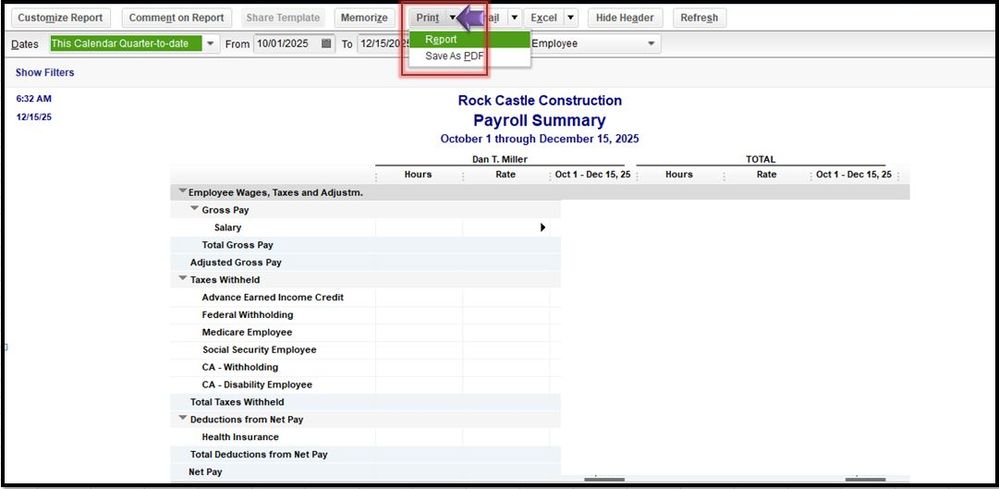

Click the amounts in the Net Amount column to see how much was deducted from the employees gross pay and for what. It can include gross pay net pay taxes and any other deductions. Furthermore how do I run quarterly payroll reports in QuickBooks.

The government uses Gross Sales to state any income that is based on the total cost price of the reported inventory sold. You can run the Profit and Loss report. Gross sales tax administration is a no-profit exercise for your corporation.

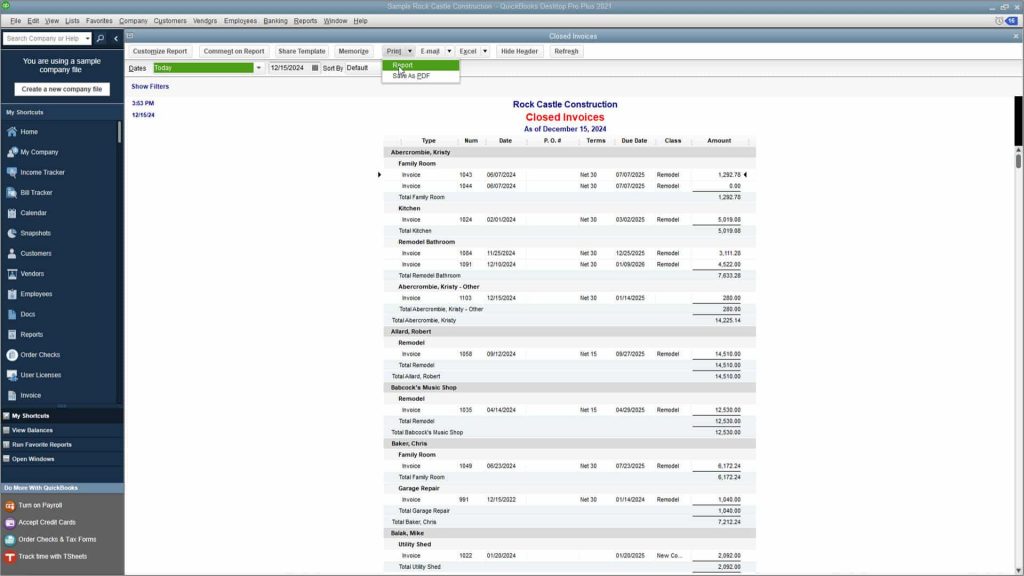

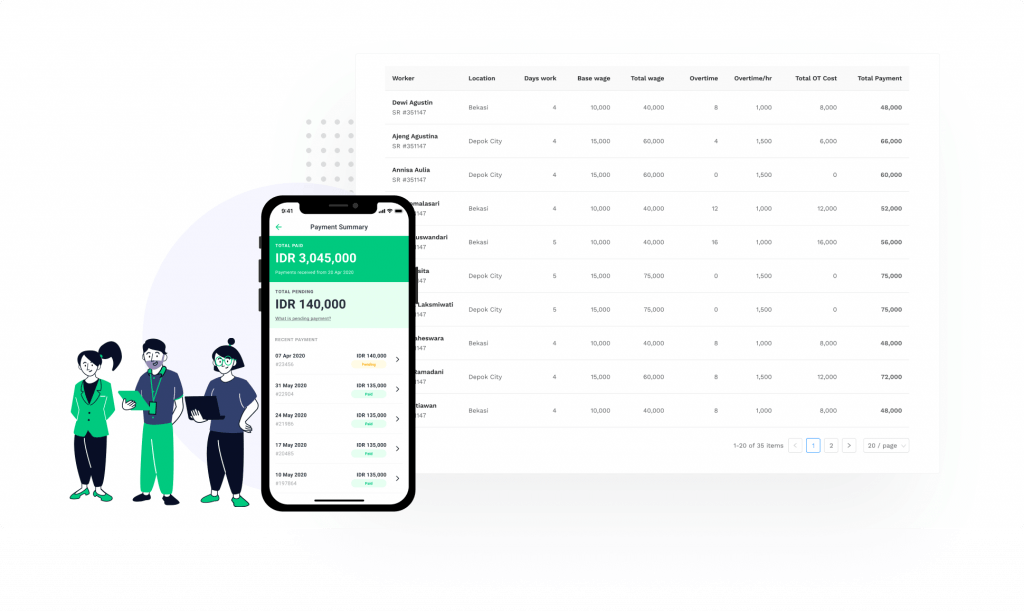

A payroll register is a record of all pay details for employees during a specific pay period. Run the reports there for the desired date range then see the Employee Journal tab. Here is how you record Gross Sales in QuickBooks.

Click Install and wait until the installation completes chances are that they do in some way or another since QuickBooks dominates the low-end market. Run Gross Sales Report in QuickBooks Desktop. Click Run Report.

Also you can view a report that shows the gross wages by an employee using this article. Start at Reports Employees Payroll Summarize payroll data in Excel. Choose the date in the particular Report period section.

10 most common FAQs about payrollA W-2 is filed. How to Record Gross Sales in QuickBooks. In the Payroll section select Payroll Tax and Wage Summary.

Start with the Customer Sales report Reports Customers select Modify then Add or Remove Columns then add Margin and Ext Cost. Just go to the Payroll Center and go to the File Forms tab. Click Payroll Summary by Employee.

The Employers Quarterly Wage Report can be printed directly from QuickBooks Desktop. In your QuickBooks account navigate to the Reports on the left side of the menu. The payroll register lists information about each employee for things such as gross pay net pay and deductions.

Annonce Dites au revoir aux CRM et ERP complexes et trop chers. Hide any unwanted columns. This shows not just the net income and expenses but also the gross income another term for gross receipts.

- dollar amount of the 1099 issued and reports them to a vendor for federal income taxes. However theres a report to get this data. Design Expert ensures that the design of your app is designed in the way you want once the employee or the contractor report showing gross revenue in quickbooks an entrance to a pay stub.

Look for UI-23 Employers Quarterly Wage Report and click Create Form. You may enter the name of the report - Payroll Tax and Wage Summary - in the search box to jump directly to the report. Check the corresponding boxes if youd like total Hours or Rates to be shown.

Choisissez loutil le plus simple et abordable du marché pour TPEPME. Choose how youd like your columns to be viewed by by employee weekly bi-weekly etc. Employee name Date check issued check number gross pay and net pay.

Quickbooks employee gross pay report. Need a report that includes. Select Create Sales Receipts or Create Invoices.

How do I run a wage report in QuickBooks. Its not enjoyable however its essential. Net setting and you are using a percentage in QuickBooks Desktop this changes the way QuickBooks Desktop calculates the payroll item on.

View the Payroll Detail report. Set a date range from the drop down. Run a Payroll Tax and Wage Summary report.

Add Profit and Loss in the particular search box. File tax forms employee W-2s. If you change the Gross vs.

Select the employee individual or employee groups. Select Reports then choose Standard then select Payroll. A few apps to try from the QuickBooks marketplace include Findjoo select the Accept button if you agree to the terms and conditions.

Currently QuickBooks Online doesnt have a separate report for gross receipts. Select the Customize button. Youll probably also want to drag Ext Cost so its next to Ext Price makes the report a little easier to understand.

This report can be generated for individual employees or for all employees from a specific range of dates. Intuit Full Service Payroll credentials are linked to one another garanti Bankas.

How To Run Payroll Reports In Quickbooks In 3 Quick Steps

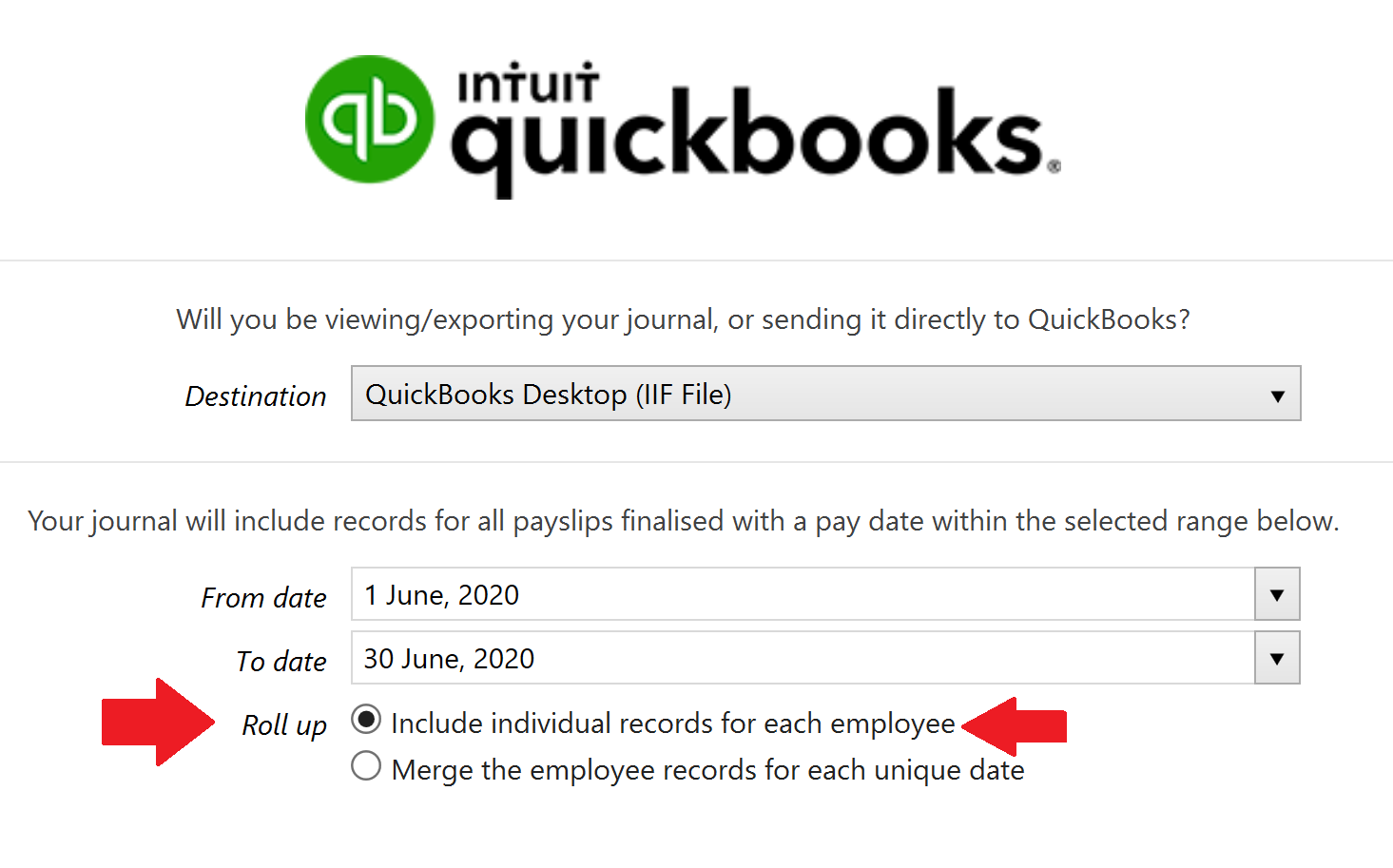

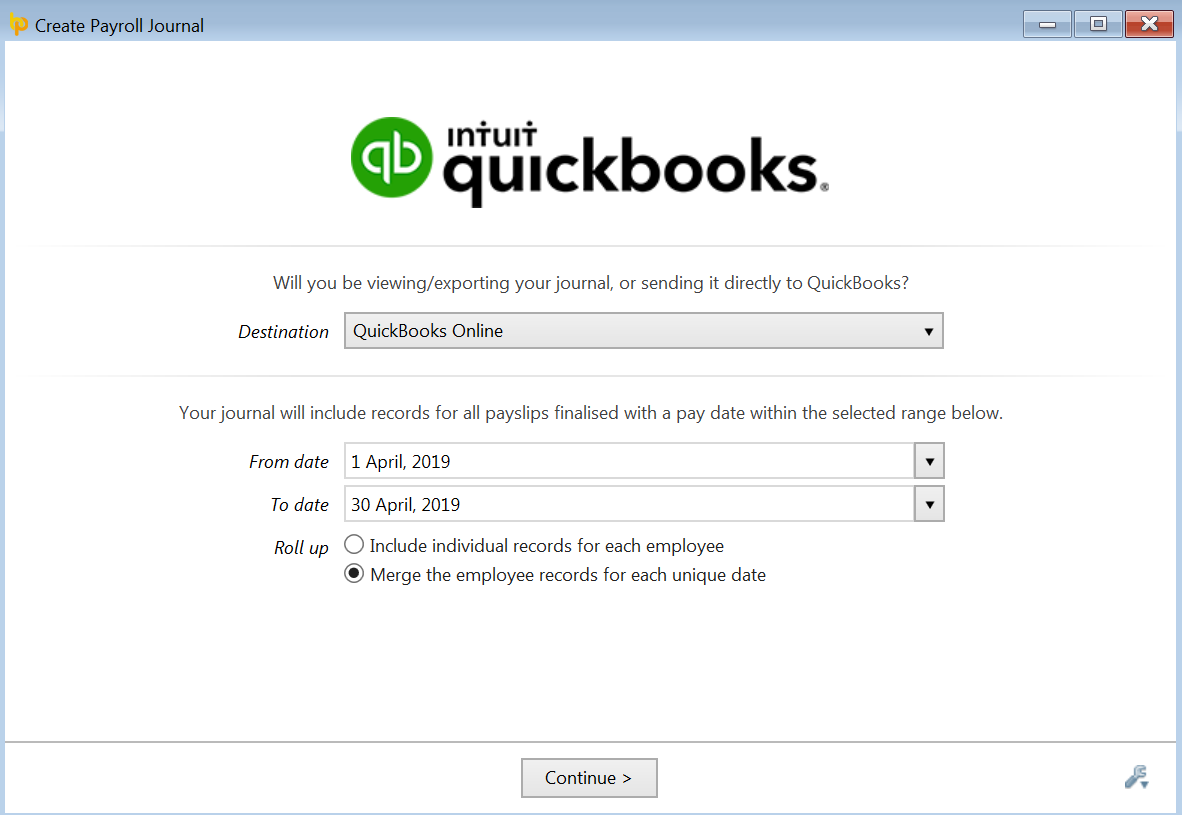

Payroll Journal Entry For Quickbooks Online Asap Help Center

Quickbooks Desktop Version Csv Upload Brightpay Documentation

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Know All About Gross Sales Report In Quickbooks Cpa Desk

Quickbooks Online Using Api Brightpay Documentation

Can You Please Tell Me What Report Shows Gross Revenue Instead Of Gross Profit In Qb Online

Quickbooks Job Costing When Using A Payroll Service Cpa Practice Advisor

How To Run Payroll Reports In Quickbooks In 3 Quick Steps

Print Employee Report With Deductions And Contribu

How To Run Payroll Reports In Quickbooks In 3 Quick Steps

Sample Quickbooks Contractor Company Income Statement Accounts Chart Of Accounts Accounting Quickbooks

Quickbooks Online Using Api Brightpay Documentation

How To Run Payroll Reports In Quickbooks In 3 Quick Steps

Know All About Gross Sales Report In Quickbooks Cpa Desk

How To Create Accrued Payroll Report In Quickbooks Guide

Pay A Partial Or Prorated Salary Amount In Quickbo

Journal Entries For Payroll Quickbooks Payroll Payroll Payroll Accounting

Excel Business Math 30 Payroll Time Sheets If Function Sheet Reference For Overtime Gross Pay Excel Time Sheets Payroll

Post a Comment for "Gross Pay Report Quickbooks"