Gross Income Credit Meaning

1 For companies gross income is interchangeable with gross margin or. You can also include alimony child support or other maintenance income but youre not required to do so by US.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Gross receipts for purposes of the Employee Retention Credit for an employer other than a tax-exempt organization has the same meaning as when used under section 448c of the Internal Revenue Code the Code.

Gross income credit meaning. Gross annual income is the amount of money a person earns in one year before taxes and includes income from all sources. The income can be from any source or multiple sources such as part-time work or self-employment. Deductions from gross revenue include sales discounts and sales returns.

Gross income means all of your income whether its from working a salaried job making money working for yourself or gaining interest on savings or investments. Credit card companies usually prefer to ask for net income because that is what you have available with which to pay your monthly payment. It impacts how much someone can borrow for a home and its also used to determine your federal and state income taxes.

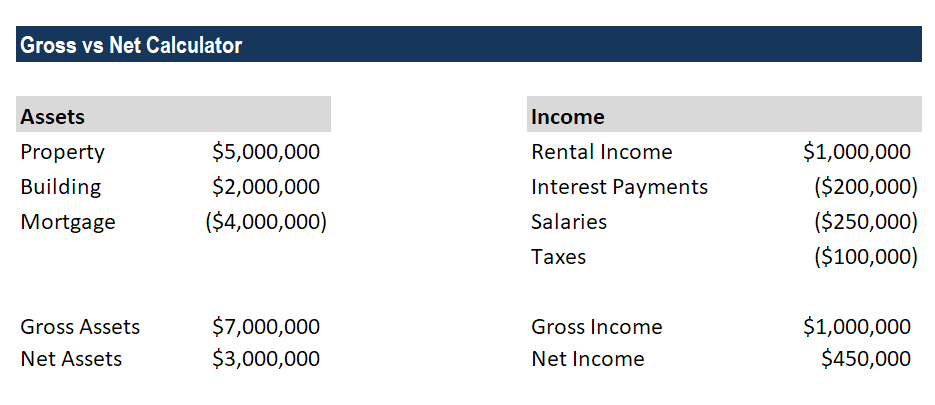

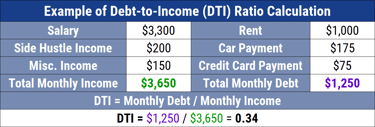

Lenders calculate the DTI ratio by taking the total monthly amount of debt of a borrower and dividing it by a monthly gross income. This figure indicates the ability of a business to sell goods and services but not its ability to generate a profit. Annual gross income is your income before anything is deducted.

Adjusted gross income is all the money you made in a year minus specific deductions and credits. Gross income definition total revenue received before any deductions or allowances as for rent cost of goods sold taxes etc. But its not the number the IRS actually uses to calculate your federal income tax obligation.

GNWPI is the base to. Your gross income can be from a salary hourly wages tips freelancing and many other sources. A document published by the Internal Revenue Service IRS that provides information on the earned income credit EIC available to individuals earning below a certain income.

The refundable tax credit for both checks phased out at an adjusted gross income AGI of 75000 to 99000 for singles or 150000 to 198000 for joint taxpayers at a rate of 5 percent per. The lower the debt-to-income ratio the better chance there is for a borrower to secure a new loan. Many translated example sentences containing gross credit French-English dictionary and search engine for French translations.

Pay received for gig work or contracting. Instead gross income serves as the basis for determining adjusted gross income which is where federal tax calculations really begin. Typically lenders prefer to see an applicants DTI of about 35 or below.

Annual household income is the combined gross pay -- before taxes are deducted -- of every income-contributing person in the home. Law if you dont want it to be considered. In addition gross receipts include any income.

Gross income is the sum of all the money you earn in a year -- including wages dividends alimony capital gains interest income royalties rental income and retirement distributions. Gross income is the amount of money you earn before any taxes or other deductions are taken out. Under the section 448c regulations gross receipts means gross receipts of the taxable year and generally includes total sales net of returns and allowances and all amounts received for services.

An amendment to the CARD Act of 2009 broadened the definition of income for credit card applicants. Income eligibility for the EITC is based on your adjusted gross income and your earned income. Gross revenue is the total amount of sales recognized for a reporting period prior to any deductions.

Wages salaries and tips. Gross net written premium income GNWPI is the dollar amount of an insurers premiums that are used to determine the amount owed to a reinsurer.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

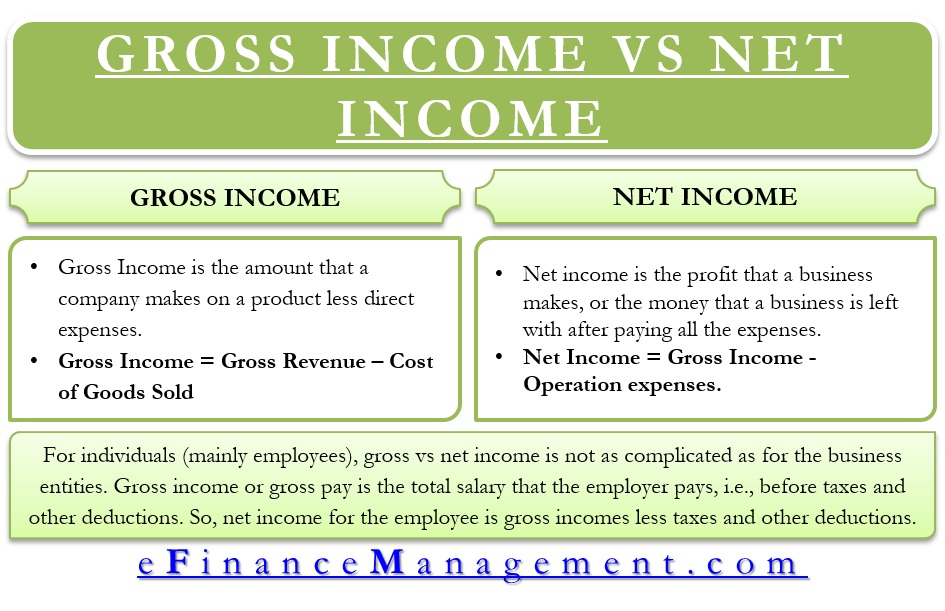

Difference Between Gross Income Vs Net Income Definitions Importance

What Is Gross Income For A Business

Taxable Income Formula Examples How To Calculate Taxable Income

Child Tax Credit How Does The Child Tax Credit Work Tax Foundation

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

Gross Profit Vs Net Income What S The Difference

Gross Vs Net Learn The Difference Between Gross Vs Net

15 Faqs Annual Income On Credit Card Applications 2021

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

What Is Yield Rate Selection Rate Definition Uses And Formula Exceldatapro Federal Income Tax Dearness Allowance Tax Deductions

Standard Deduction Tax Exemption And Deduction Taxact Blog

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Operating Income Vs Gross Profit

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Post a Comment for "Gross Income Credit Meaning"