Annual Pension Income Tax Calculator Uk

The calculator is updated for the UK 2021 tax year which covers the 1 st April 2021 to the 31 st March 2022. See how we can help improve your knowledge of Math Physics Tax.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

And you can print out your results afterwards to refer to later on if you wish.

Annual pension income tax calculator uk. Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Pension tax calculator If youre 55 or older you can withdraw some or all of your pension savings in one go. Using the State Pension as the foundation of your pension pot you will also want to have an idea of your planned.

Go to the standard pension savings annual allowance calculator. The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below.

Higher contributions may be possible if you have any unused Annual Allowance from the previous three tax years. Using your date of birth your state pension date will be 01012037. Calculate tax on your pension.

Calculate how much tax relief you can get on your pension in the 2020-21 tax year and see how it compares to 2019-20 and 2018-19. One of a suite of free online calculators provided by the team at iCalculator. You must have been a.

PAYE income tax calculation with employeeemployer NI calculations. Pension tax calculator If youre 55 or older you can withdraw some or all of your pension savings in one go. Normally up to 25 of your pension can be paid to you tax free but the rest is taxed as income.

Use this calculator to calculate your take home salary. For example if you contribute 1000 to your pension this reduces your taxable income by 1000 and if you were a basic rate payer would save you 200 in tax. It will show you PAYE NI and Net Salary.

If you have taken flexible benefits from any of your pension. You will be 67 years old when you reach state pension age. Find out how Universal Credit works and how to manage your payment.

Work out your take home salary as well as PAYE and NI contributions determined by your gross annual salary with this calculator. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more. UK Tax Salary Calculator Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

Completed overhauled for 2019-19 tax year our new salary and tax calculator is built to support all your salary and payroll audit needs. Cymraeg Close search box. Where your income exceeds two amounts in the tax year the threshold income cap and adjusted income cap your annual allowance the tax free amount of pension.

You can take 25 of your pension tax-free. Even if you dont have any earnings you can still pay up to 2880 a year which is topped up to 3600 with tax relief. Our Pension Taxation Calculator will help you work out how much income tax you would need to pay if you took your whole pot as cash.

The rest is subject to income tax. Use our free pension calculator to estimate your retirement income from workplace schemes private pension contributions plus State Pension entitlement age and more. Extra support if youre working self-employed or you.

After all only 25 of your total pot is tax free you will need to pay income tax on anything taken after that and depending on how much cash you take this could reduce your pension pot significantly. Theres also a limit on how much can be paid into your pension each year without incurring tax charges this is known as your Annual Allowance and is currently 40000 per year. The rest is subject to income tax.

2 March 2017 Replaced Employment Status Indicator with Check your employment status for tax service. Calculate tax on your pension. If youve already checked your State Pension external website this pension calculator by the Money Advice Service external website can help you understand how much you could get from your total pension pot.

New calculator added to help you check your pension annual allowance. If you are looking for a feature which isnt. Use our pension calculator.

Personal Allowance taking into account your age tax code and the 20212022 year is 12570 Your total tax free allowance is 12570. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 and 2021-22 tax years. Pension contributions made in a year reduce the amount of income subject to tax up to a certain limit known as the annual allowance.

Income tax calculator Do you pay tax on your pension. You can take 25 of your pension tax-free. We use some essential cookies to.

Income Tax on payments from pensions tax-free allowances how you pay tax on pensions. The enhanced pension savings annual allowance calculator - for tax years up to and including 2014 to 2015. Detailed Income tax and National Insurance contribution calculations included.

The amount of taxable income you withdraw will. How much tax do I pay on 455716000 annual salary.

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

Self Assessment Calculator And Deadlines Money Donut

Seven Steps To Heaven Taxation

2018 19 Salary And Dividend Tax Calculator It Contracting

Ask Sage Income Tax Paye General Information And Manual Calculations

Income Tax Calculator For Fy 2021 22 Old Vs New Eztax In

80 000 After Tax 2021 Income Tax Uk

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

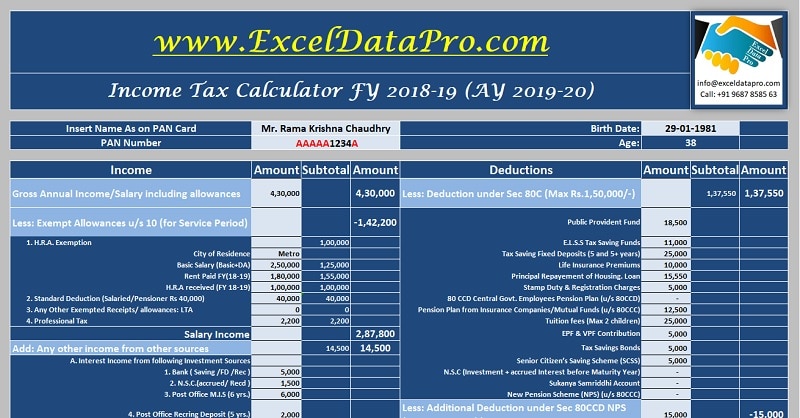

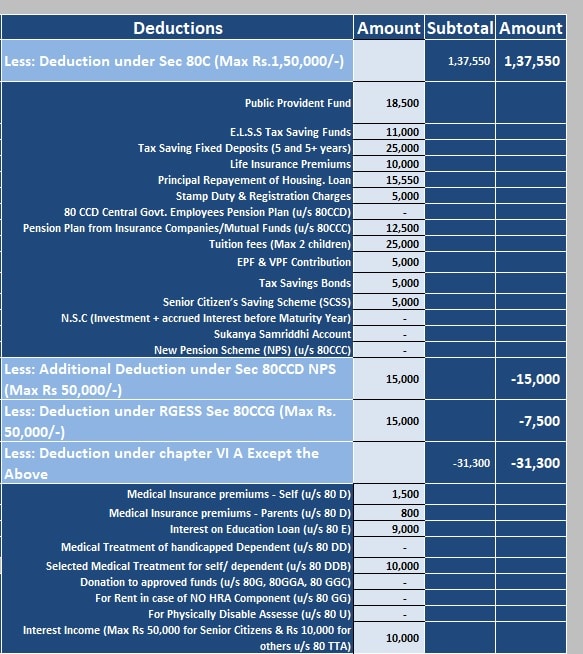

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Income Tax Calculator On Employed And Self Employed Income Taxscouts

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Seven Steps To Heaven Taxation

![]()

Small Business Tax Planner Uk Tax Calculators

Uk Salary Tax Calculator 2021 2022 Calculate My Take Home Pay

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

Income Tax Computation Savings Income Acca Taxation Tx Uk Fa2018 Youtube

Biden S Tax Plan Calculator See How Your Taxes Might Change Forbes Advisor

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Post a Comment for "Annual Pension Income Tax Calculator Uk"