Annual Payroll Tax Calculator Nsw

Calculate and lodge tax on the wages paid by your business. View previous rates and thresholds.

Https Www Revenue Nsw Gov Au Help Centre Resources Library Seminar 2019 Payroll Tax Seminar Notes Pdf

2021 payroll payroll tax nsw annual 2021 pay periods payroll tax nsw annual 2021 pay schedule 3 payroll tax nsw annual gsa opm federal pay scale.

Annual payroll tax calculator nsw. Calculate and lodge tax on the wages paid by your business. We collect and audit mineral resources royalties. The 75000 golden handshake and 25000 in leave entitlements totaling 100000 must be included as termination payments in the payroll tax return.

Find out how to determine your. Calculate and pay transfer stamp duty on purchases. Get Payroll Calendar 2020 Sage Download Print Related Payroll.

It can be used for the 201314 to 202021 income years. Please note Correspondence IDs are only valid for a period of 12 months. Calculation of threshold for period of employment.

The information you will need to use in the calculator is your total NSW and interstate wages and grouping information. To assist customers with the impact of COVID-19 the due date for lodgement and payment of the 2021 annual reconciliation has been extended to 7 October 2021. The payroll tax liability if your NSW wages for the full month of April 2021 are 300000 and interstate wages are 50000.

Calculate and pay transfer stamp duty on purchases. We collect and audit mineral resources royalties. Payroll tax annual reconciliation.

Paying tax on property you own. Before you use the calculator. The reason is to make tax calculations simpler to apply but it can lead to discrepancies.

One of the areas which has been harmonised is the treatment of termination payments for payroll tax purposes. Information you need for this calculator. Which tax rates apply.

545 The threshold is reduced by. If you have an annual tax payable amount less than 150000 for the previous financial year you can use the estimate calculation method to estimate your liability. Tax is only paid on wages above the threshold Rate is.

Job a lot easier Another Payroll Calendar. We collect gaming and wagering taxes. Use this calculator to quickly estimate how much tax you will need to pay on your income.

Customers will also have the option of deferring payments for the July and August 2021 return. Rates and thresholds The payroll tax threshold increased to 12 million from 1 July 2020. Monthly - full period.

The Commonwealth government introduced superannuation reforms effective from 1 July 2007. Pdoc payroll deductions online calculator pdoc 2020 bi-weekly payroll calculator 2020 cra pdoc pdoc payroll calculator 2020 how many. 25000 annual leave and other leave entitlements.

Your Client ID and Correspondence ID can be found on any recent letters or assessments issued by Revenue NSW. The 2021 Payroll Tax annual reconciliation is now available. Sage payroll tax calculator How to update cpp max in sage where are payroll calendars found in SAGE This entry was posted in 2020 Payroll and tagged 2020 Payroll on December 8 2018 by airi.

Number of days employing x threshold Number of days in period. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Part-year employment Interstate wages It is possible for a multi -state employer to be liable for payroll tax in some states and not others Grouped business for payroll tax can only claim one threshold with in the group.

The ATO publish tables and formulas to calculate weekly fortnightly and monthly PAYG income tax instalments that can vary from the annual tax amounts. Differences will always be favour of the ATO however these will be refunded when the annual year tax return is processed. Making your total Australian wages 350000.

The current payroll tax rate is 485 per cent. Your Client ID and Correspondence ID can be found on any recent letters or assessments issued by Revenue NSW. For businesses that provide health benefits to contributors.

Providers of general and life. Once you have determined your adjusted liability for each of the months you have paid you will need to manually calculate your overpayment. The Payroll Tax Act 2007 the Act which commenced on 1 July 2007 rewrites the Pay-roll Tax Act 1971 and harmonises the payroll tax legislation in Victoria and NSW.

The Correspondence ID can be found in the top right hand corner of your most recent correspondence. Our online calculator helps you work out your actual monthly tax liability or provides the option to enter an estimate tax liability for the months of July to May each financial year. During the 202021 financial year if you received payments under the JobKeeper Payment scheme when lodging your annual reconciliation you will need to provide a breakdown of the taxable and exempt amounts paid to your employees.

The Correspondence ID can be found in the top right hand corner of your most recent correspondence. We collect gaming and wagering taxes. Please note Correspondence IDs are only valid for a period of 12 months.

10000 in income tax exempt redundancy payments shown as lump sum D on the PAYG payment summary. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. Previous tax paid minus the adjusted tax.

Futa Tax Overview How It Works How To Calculate

How To Create An Income Tax Calculator In Excel Youtube

Your Bullsh T Free Guide To Taxes In Germany

E Tax Depreciation Schedules Australia Can T Avoid Being Australia S Driving Firm Who Give The Best Cost Cheapening Organization Etax Tax Deductions Appraisal

Tax Service That You All Should Know Bryan Patrice Accounting Services Things To Sell Financial Analysis

Https Www Wa Gov Au Sites Default Files 2019 09 Superseded Calculation Of Tax Payable Interstate Group 20161718 Pdf

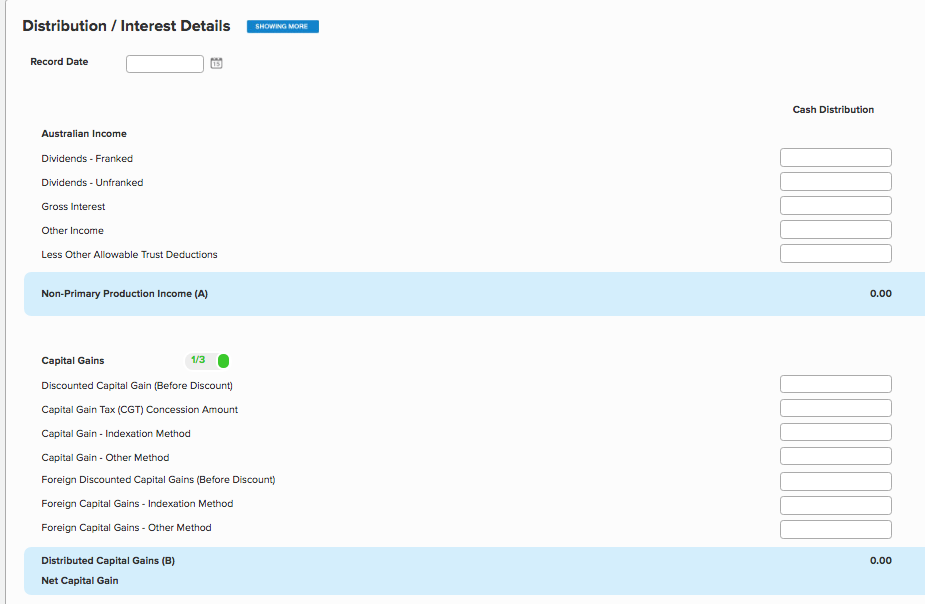

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Correct Errors In A Payroll Tax Annual Return Business Queensland

Annual Returns For Payroll Tax Business Queensland

How To Use Your Raiz Annual Tax Statement For Your Tax Return Raiz Invest

Https Www Revenue Nsw Gov Au Help Centre Resources Library Seminar 2019 Payroll Tax Seminar Notes Pdf

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

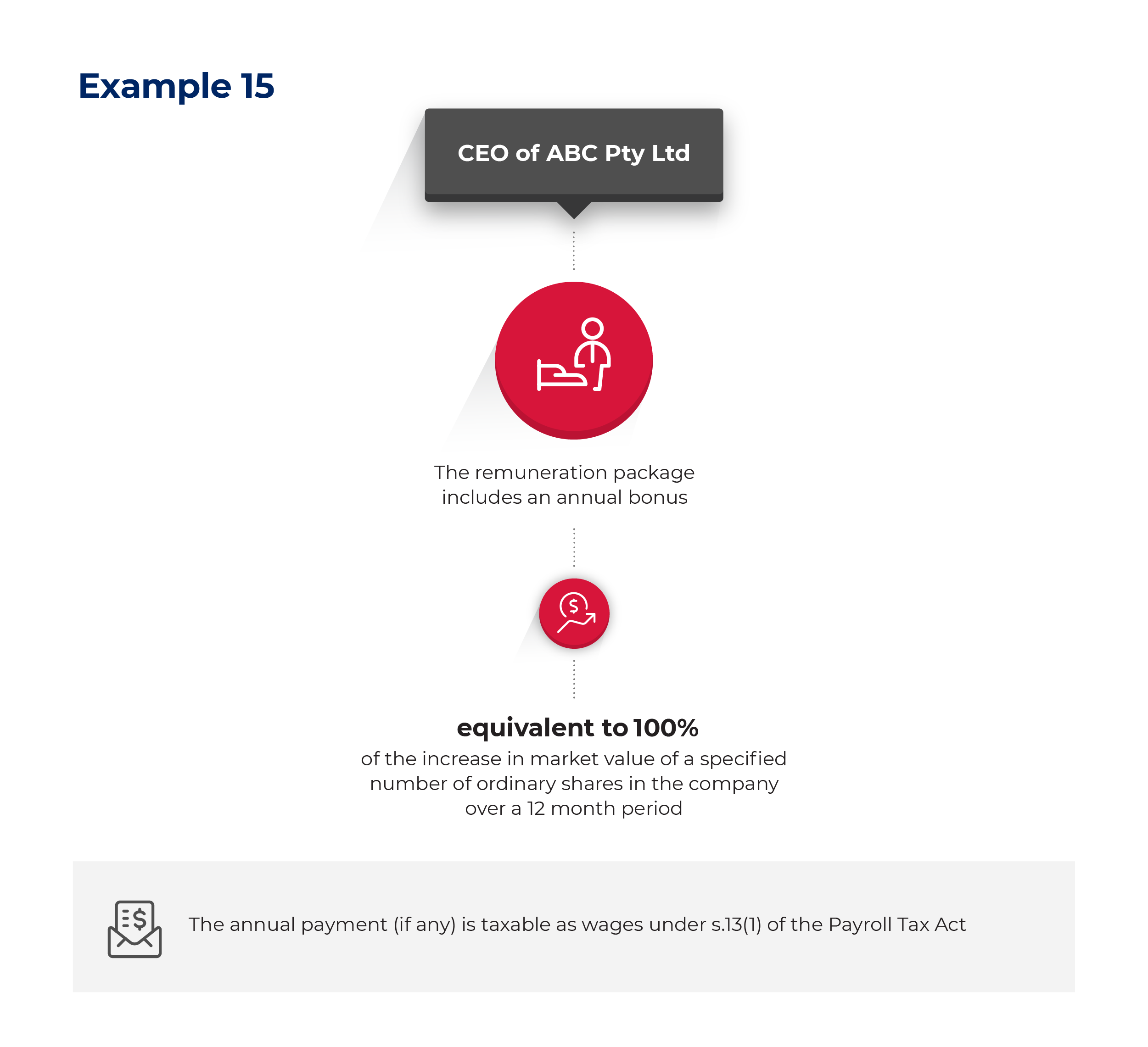

Commissioner S Practice Note Payroll Tax On Shares Options Payroll Tax Act 2007 Ss 18 26 Revenue Nsw

How To Use Your Raiz Annual Tax Statement For Your Tax Return Raiz Invest

Payroll Tax Annual Return Tutorial Business Queensland

Aus Processing State Payroll Taxes For Australia

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Post a Comment for "Annual Payroll Tax Calculator Nsw"