Annual Payroll Deductions Calculator

Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage. How to calculate taxes taken out of a paycheck.

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

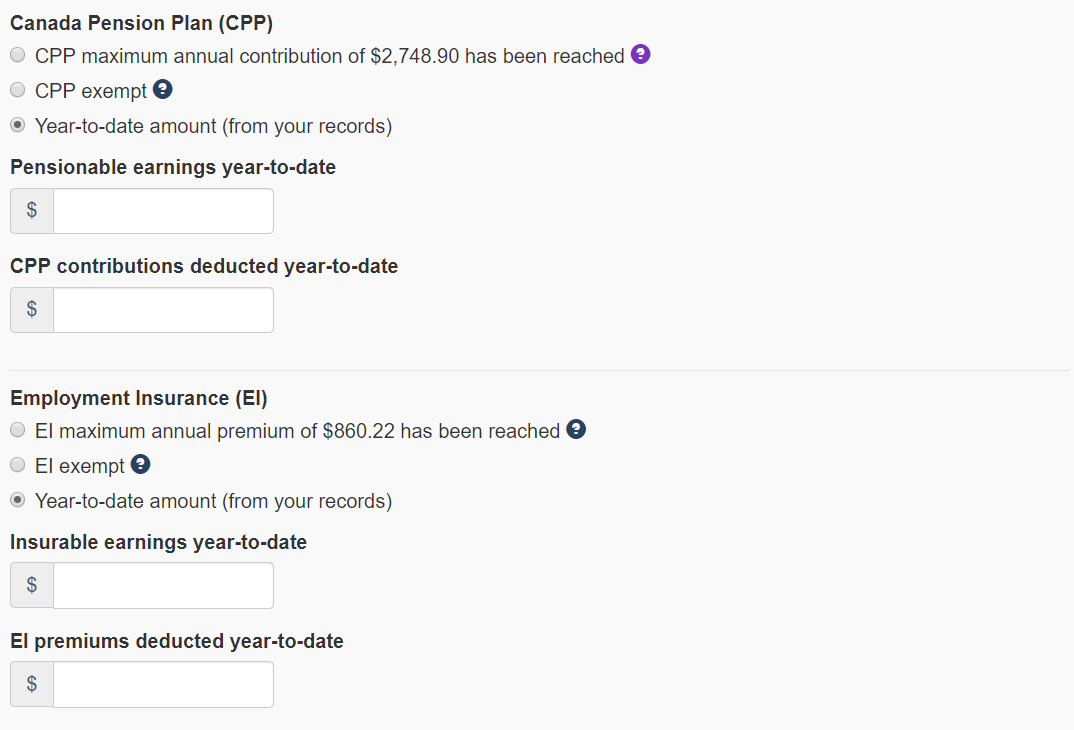

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Annual payroll deductions calculator. TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard deduction 50000 FY 2020 2021 Income Tax formula for FY 2020 2021 Basic Allowances Deductions ESI 12 IT Declarations Only ESI is considered as a deduction. Divide that number by 2 and you have the semi-monthly salary. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Extra pays like redundancy or special bonuses. Its useful for weekly fortnightly four weekly or monthly pays but it will not allow for. Our free payroll tax calculator makes it simple to handle withholdings and deductions in any state.

The latest budget information from April 2021 is used to show you exactly what you need to know. Thats because your employer withholds taxes from each paycheck lowering your overall pay. To calculate net pay subtract all authorized withholdings and pay deductions from gross pay.

Weekly biweekly or monthly pay periods are all acceptable. This total should not include the current payroll period or any income from other sources or employers. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

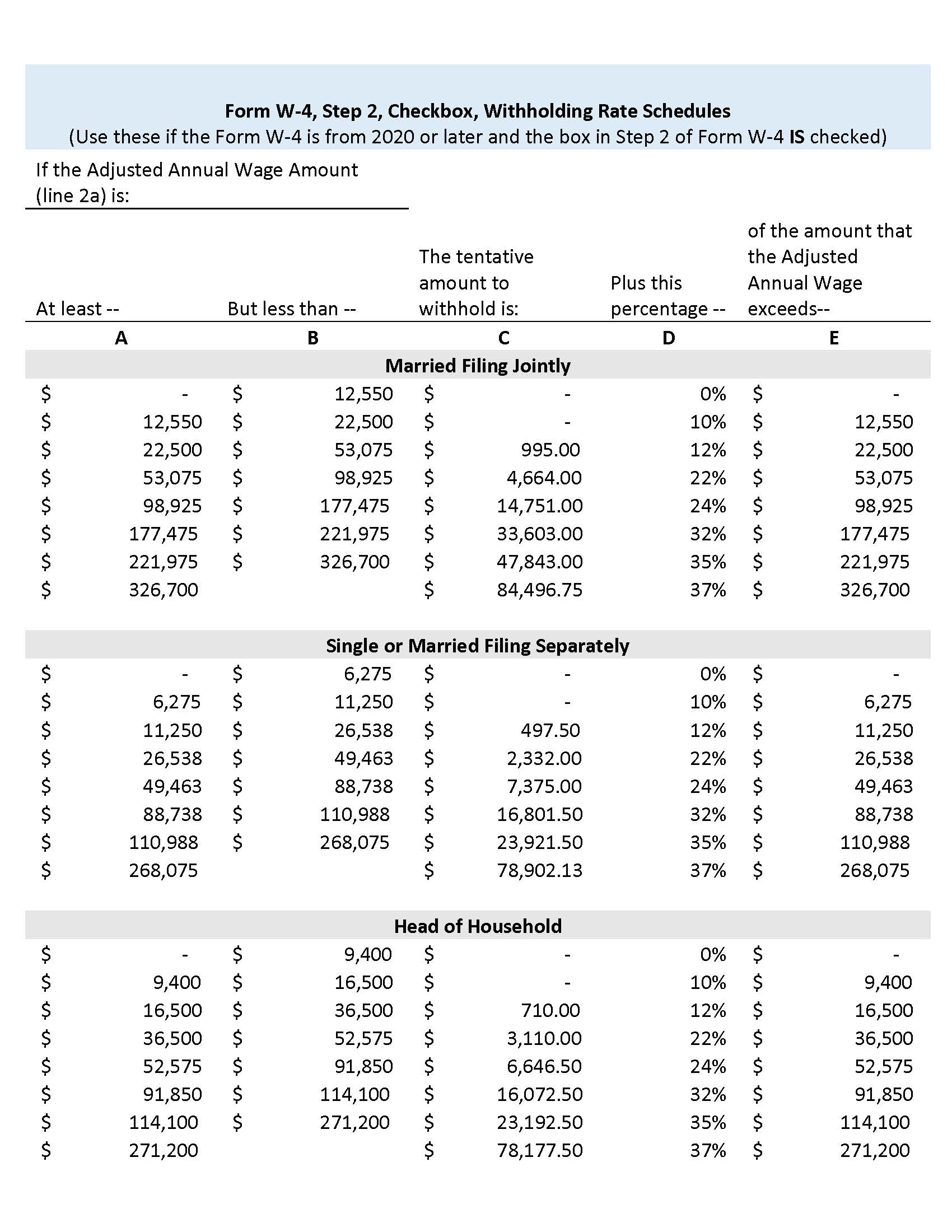

The federal income tax deduction depends on the level of the annual income and it ranges between 15 and 33. We use this amount to determine if you are required to have Social Security tax or additional Medicare tax withheld for. Federal income tax withholding was calculated by.

Why not find your dream salary too. It will confirm the deductions you include on your official statement of earnings. Enter your details on the left and click calculate.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. This calculator is intended for use by US. The reliability of the calculations produced depends on the accuracy of the information you provide.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Employers can use it to calculate net pay figure out how much to withhold and know how much to include in employees paychecks. Hourly rates weekly pay and bonuses are also catered for.

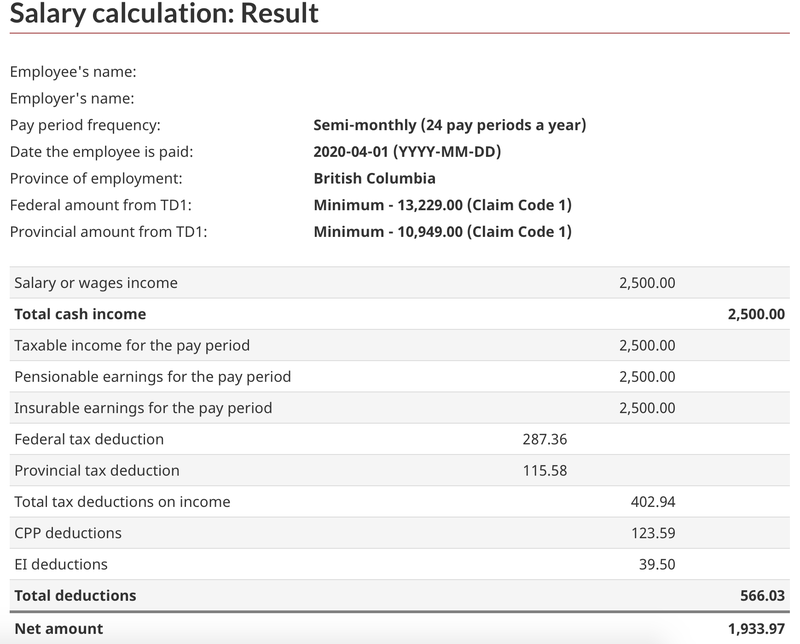

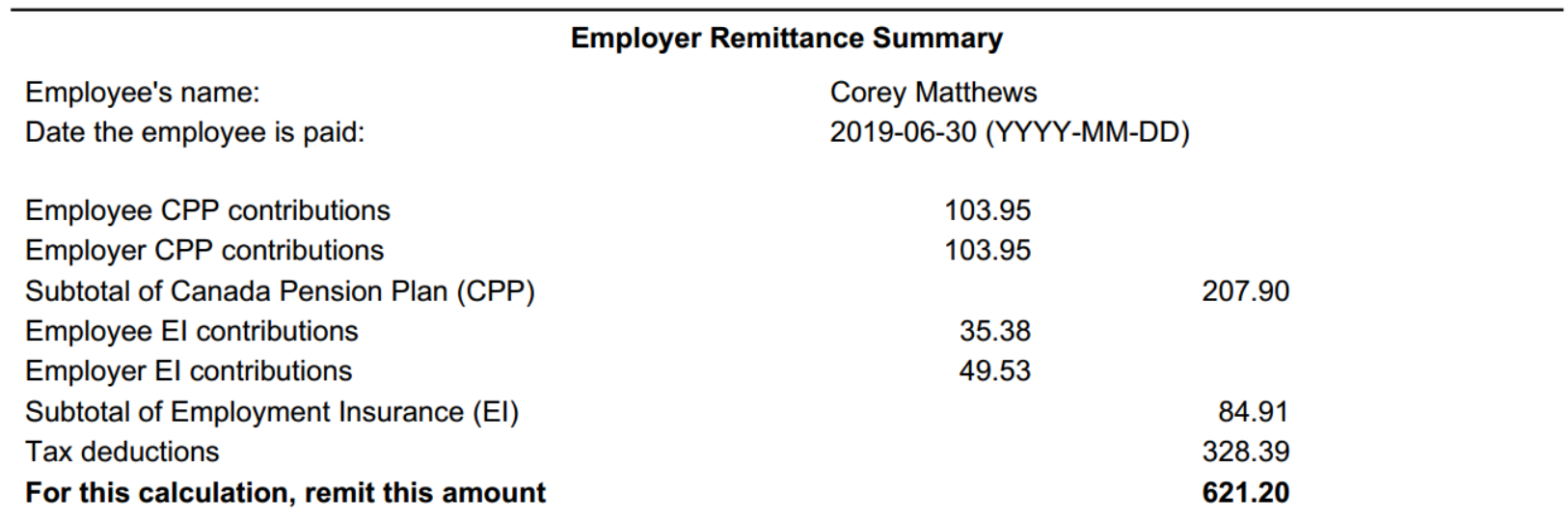

Holiday pay that is paid as a lump sum. Once you finish entering employee information the payroll deductions calculator generates a salary calculation result that shows the gross wages federal and provincial deductions CPP and EI contributions and the employees actual net pay. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 24.

Employers and employees can use this calculator to work out how much PAYE should be withheld from wages. You assume the risks associated with using this calculator. Because of the numerous.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. Deductions are the sum of PF ESI and PT etc. It can also be used to help fill steps 3 and 4 of a W-4 form.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. The provincial income tax deduction also depends on the annual income but it has different rates from province to province.

You must enter both your gross income to date and tax deducted to date for an accurate result. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Remember to account for any overtime bonuses or commissions earned during the pay period.

Les déductions sont calculées en utilisant les formules fournies par Revenu Québec guide TP-1015F version 2021-01 Formules pour le calcul des retenues à la source et des cotisations et par lAgence du Revenu du Canada guide T4127 Formules pour le calcul informatisé des retenues sur la paie 113e édition en vigueur le 1er janvier 2021. Payroll Deductions Calculator Definitions. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Check your payroll calculations manually -. Salaire de base pour la période. If you dont have that information you can use our tax calculator which is annual deduction based.

Work out PAYE deductions from salary or wages. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. Year-to-date earnings Your current year gross earnings that were subject to FICA taxes Social Security tax and Medicare tax.

Subtracting the value of allowances allowed for. Below our calculator youll also find federal tax rates state tax rates and links to other employer tax calculators.

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Payroll Tax Deductions Business Queensland

Payroll Tax Deductions Business Queensland

Different Types Of Payroll Deductions Gusto

Mathematics For Work And Everyday Life

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Payroll Tax Deductions Business Queensland

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Paycheck Calculator Take Home Pay Calculator

Http Www Gov Pe Ca Photos Original Cssf Cra Calc Pdf

Paycheck Calculator Take Home Pay Calculator

Mathematics For Work And Everyday Life

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Formula Step By Step Calculation With Examples

How To Do Payroll In Canada A Step By Step Guide The Blueprint

Post a Comment for "Annual Payroll Deductions Calculator"