President Salary Exempt From Tax

While in office the US. Government employees in foreign countries and 2 the country of your foreign government employer grants an equivalent tax exemption.

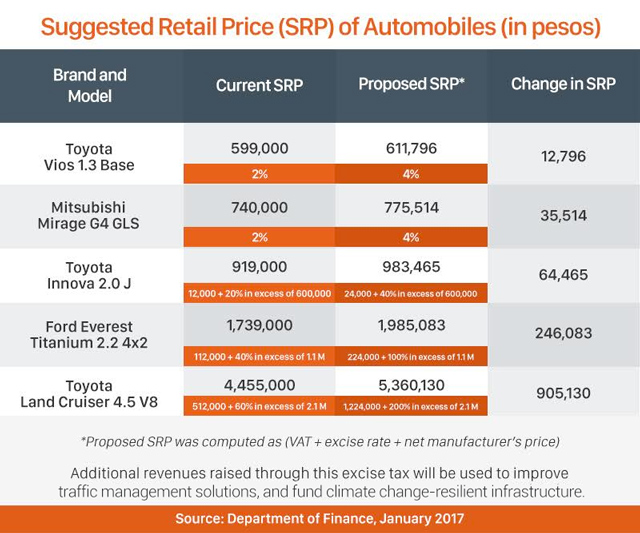

Duterte S Tax Reform More Take Home Pay Higher Fuel And Auto Taxes

So the President does pay tax on his income.

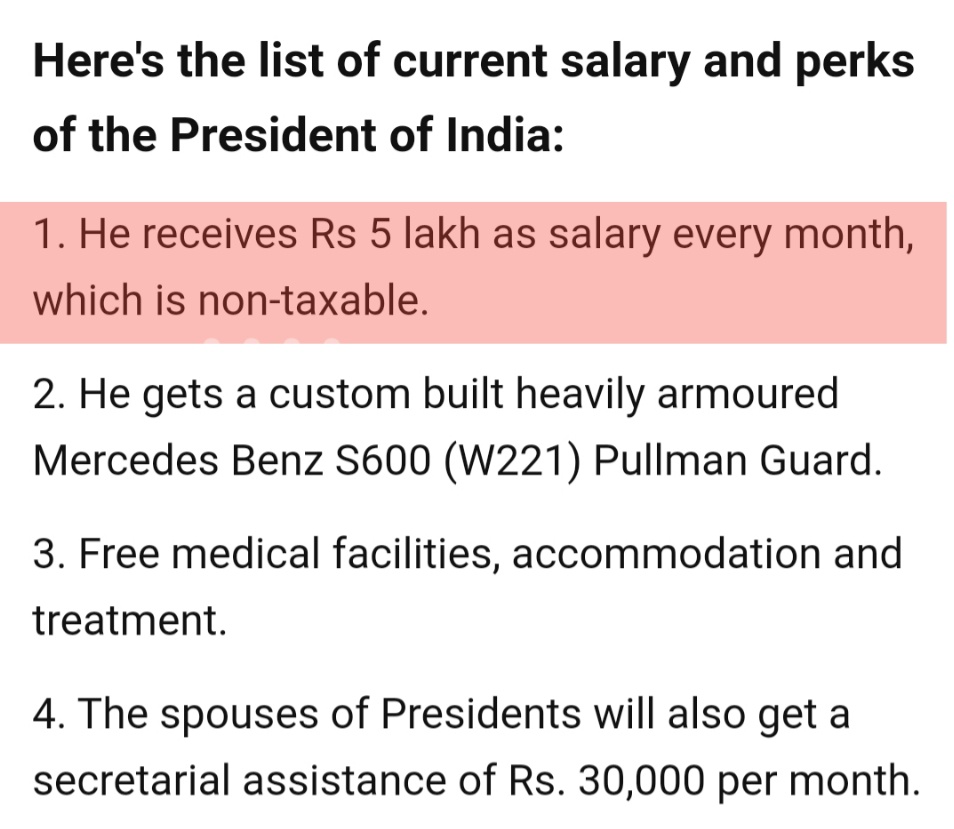

President salary exempt from tax. In 2017 the Government of India had decided to increase the salary of The President of India from Rs 15 lakh per month to Rs 5 lakh per month. Theres no special presidential exemption. Citizen or if you are a US.

What do I have to do and how do I have to do it he asked of his. The presidents salary is about 400000 per year. President William Aramonys annual compensation package totalled 463000 there was an outcry that the amount was excessive for the president of a tax exempt organization.

Citizen but also a citizen of the Republic of the Philippines and you work for a foreign government in the United States your foreign government salary is exempt from US. This act has been amended from time to time to review the salary. Further the Income Tax Act and the The Presidents Emoluments and Pension Act 1951 do not exempt the Presidents salary from income tax.

5 lakh rupees per month. The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951. Income tax if 1 you perform services of a similar character to those performed by US.

Code also grants a 100000 non-taxable travel account. Even though the president must file a tax return they arent required to share information on their tax return with the public. What salary does a PrésidentDirecteur Financier earn in your area.

Neither the Income Tax Act nor the President Emoluments And Pension Act specifically exempt the salary of the President of India from taxation. Thats because the same laws that protect taxpayers also protect the president. Wilson remembered the obligation shortly before the first anniversary of his in-auguration.

It is also used to fix the pension and other benefits of retired President. The Prime Minister is. 110970 PrésidentDirecteur Financier Salaries provided anonymously by employees.

Neither the Income Tax Act nor the President Emoluments and Pension Act specify the exemption from the salary of the President of India from taxation. President receives a salary of 400000 a year and a 50000 expense account. The controversy reflects the publics fears that.

Through an amendment to the Finance Bill in 2018 the Presidents salary was last revised to Rs. Similar questions have been raised about executives of other nonprofits particularly health care organizations. The Persons who holds the post of the Prime Minister of India and the President of India also have to pay Income Tax as they are not exempt from paying the Income -Tax as per the Income Tax Act.

How much does the president make. Congress added the expense account in 1949. The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951 the salary of the president of India is TAX FREE.

For some elected individuals this means they take a pay cut when they become president. The salary of the President of India is thus determined by the 1951 Presidents Emoluments and Pensions Act. This pays for the presidents personal expenses such as food and dry cleaning.

Heres How Much Recent Presidents Have Paid in Taxes. Neither the Constitution nor the Presidents Emoluments and Pensions Act 1951 exempt the Heads of State from taxation Mridhula Raghavan. THE LAST TAX-EXEMPT PRESIDENT 109 the tax code expressly relieved President Wilson from paying taxes on his salaried income through 1916 but not of his duty to file a tax return on his other private resources.

They have to pay Income-Tax as per rules applicable to them according to the Income-Tax Act in force. C 50 of basic salary if the taxpayer is living in a metro city d 40 of basic salary if the taxpayer is living in a non-metro city As the lowest of the above is exempt from tax it is common for employers and employees to structure the salary in a manner to. Is the Salary Taxable.

1 Title 3 of the US. If you are not a US.

Trump S Proposed Payroll Tax Elimination Itep

Biden Tax Plan And 2020 Year End Planning Opportunities

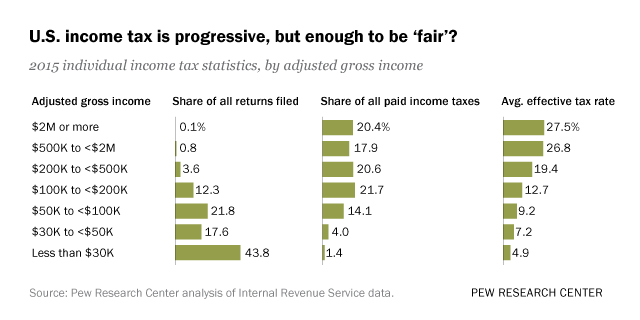

Who Pays U S Income Tax And How Much Pew Research Center

Do You Know The Salary Of The President Of India Education Today News

Whether Salary Of The President Of India Is Taxable Law Trend

No The President Of India Is Not Exempted From Income Tax

No The President Of India Is Not Exempted From Income Tax

Who Pays U S Income Tax And How Much Pew Research Center

Does The President Of India Ram Nath Kovind Pay Income Tax

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

Duterte S Tax Reform More Take Home Pay Higher Fuel And Auto Taxes

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Math Behind President Kovind S Tax Outgo

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

Siddharth Setia On Twitter But President S Salary Is Tax Free Why Is He Lying

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Post a Comment for "President Salary Exempt From Tax"