Gross Pay Definition Uk

Few versions of gross pay definition and key points are listed below. This is in contrast to the term Gross Salary which is the total amount an employee earns per month.

What Is Gross Income For A Business

It is the total amount of money an employee receives before taxes and deductions are taken out.

Gross pay definition uk. The first 1000 of income from self-employment - this is your trading allowance. Qualifying earnings are a slice of an employees salary currently set at the band from 6240 to 50000 and including all forms of payment including bonuses etc. Gross pay Noun A payment for the entire years income.

The first 1000 of income from property you rent unless youre using the Rent a Room Scheme income. Gross pay often called gross wages is the total compensation earned by each employee. Gross rate of pay means the total amount of money including allowances to which an employee is entitled under his contract of service either for working for a period of time that is for one hour one day one week one month or for such other period as may be stated or implied in his contract of service or for each completed piece or task of work but does not include.

An amount of pay wages salary or other compensation before deductions such as for taxes insurance and retirement. This will be the. Gross margin is often expressed as a percentage.

Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes. Definition of Gross Salary 2019. SMP Please note that not all items of pay can be included when calculating pension contributions.

Uk Balance Of Payments Economics Help. The earnings base is currently net-gross pay ie. Gross domestic product or GDP is a measure of the size and health of a countrys economy over a period of time usually one quarter or one year.

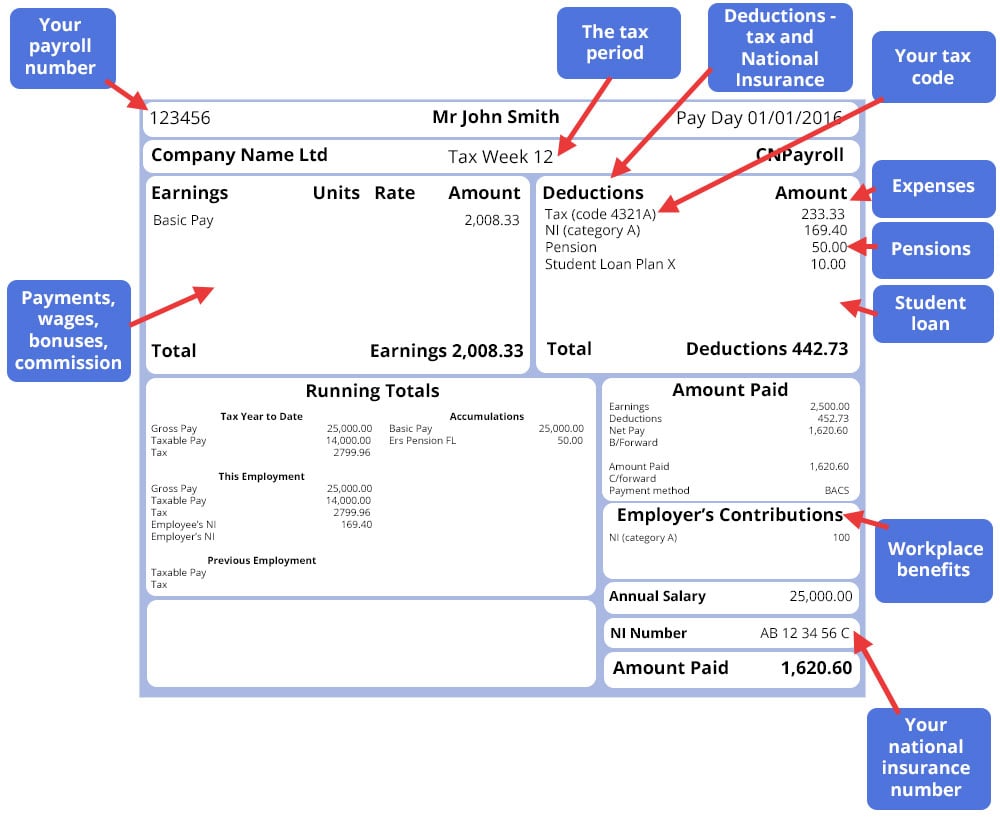

The percentage of a persons pay that goes towards taxes and national insurance contributions depends on a variety of factors including how much a person earns per month. Gross pay Noun An amount of pay wages salary or other compensation before deductions such as for taxes insurance and retirement. 49 lignes Gross pay is the total amount of pay received before any deductions.

This total income is usually described as an annual salary and it is the total amount an employee will receive for work completed before tax or national contributions are deducted. Gross wage less employees contribution in all years since 1988 moving towards the full lifetime. Items such as expenses or travel money should be excluded.

Gross margin or gross profit margin is a way of measuring the amount of profit a company has left after subtracting the direct costs associated with selling its goods and services. Notice I didnt say it was the total amount paid to each employee. Gross pay refers to the amount used to calculate the wages of an employee hourly or salary for the salaried employee.

Good-old-europe-networkeu Le salaire de référence qui est actuellement la rémunération brute-nette cest-à-dire la rémunération brute diminuée des cotisations salariales de toutes les années depuis 1988 se rapproche de la durée de la vie active. It is defined as the amount of income before any deductions or contributions are subtracted from the total earnings. The higher the margin percentage the more effective the companys management is in.

It is also used to compare the size of different economies at a different point in time. The meaning of gross salary is the total income before any deductions are removed from that amount. Also known as Gross Qualifying Earnings this is the amount of pay that the employee typically sees on their payslip.

Gross annual income and gross monthly income will always be larger than your net income. What is gross margin. It can illustrate if a company is generating revenue despite its outgoings.

This method is most commonly used for defined benefit pension schemes. What does gross-pay mean. Trending posts and videos related to Gross Pay Definition.

The best Gross Pay Definition images and discussions of June 2021. It is the total amount of remuneration. Both of these amounts are reflected on a pay slip along with an outline of the deductions made for that month.

Wiktionary 000 0 votesRate this definition.

File Tax Free Online In Easy 3 Steps Filing Taxes Tax Free Tax Brackets

The Difference Between Net Pay And Gross Pay A Simple Guide Hourly Inc

What Is Depreciation Meaning And Calculation Striaght Line Method In Ur Meant To Be Method Financial Accounting

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

What Are Gross Wages Definition And Overview

The Difference Between Gross Profit Margin And Net Profit Margin In 2021 Net Profit Profit Company Financials

The Difference Between Gross And Net Pay Economics Help

Statement Of Retained Earnings Reveals Distribution Of Earnings Financial Statements Income Statement Statement

Leisure Spending In The Uk Infographic Data Sport Leisure

Payslip Checker Your Payslips Explained Reed Co Uk

Pin By Carmie Mo On Art Tutorials Inspo Net Profit Accounting Training Profit

Profit And Loss Statement Explained Definition Real Examples Analysis And More Business Profitandlosss Profit And Loss Statement Profit And Loss Analysis

What Is Yield Rate Selection Rate Definition Uses And Formula Exceldatapro Federal Income Tax Dearness Allowance Tax Deductions

Simple Salary Slip Format Without Deductions Payroll Template Salary Schedule Template

Post a Comment for "Gross Pay Definition Uk"