Gross Income Meaning Bank

Each year the bank is required to send you and the IRS a 1099-INT reporting how much interest was pay to the bank account. What Is Gross Income.

What Is Gross Income For A Business

This item is generally the net result of a number of different income and expense items other than those included in items 1 and 2 such as the following.

Gross income meaning bank. Gross income is the amount of money you earn typically in a paycheck before payroll taxes and other deductions are taken out. Gross income is the total amount of pay a person receives in their paycheck before any deductions or taxes are taken out. It represents that income which an entity earns without incurring non-operating expenses such as interest rent.

The core purpose of a banks business model is to loan money so. Commissions received and paid in connection with payments services securities transactions and related. Net banking income measures the balance between bank operating revenues and expenses.

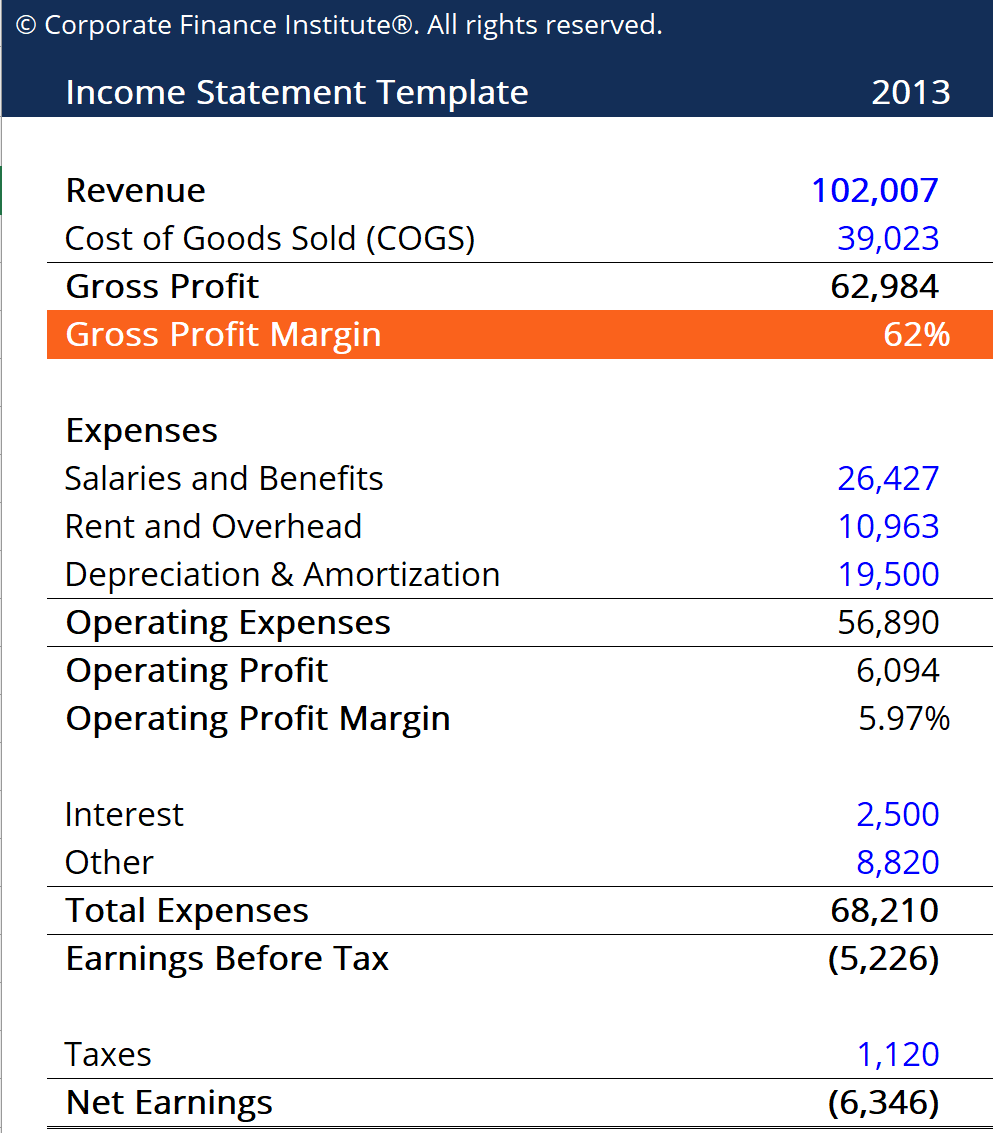

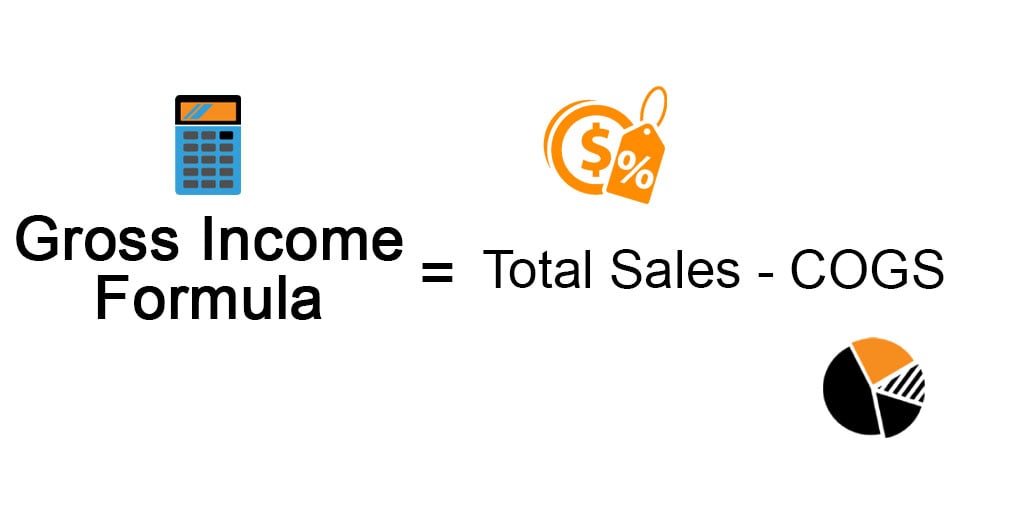

The total of all sources of gain or revenue before any considerations of deductions like expenses or taxes. 1 For companies gross income is interchangeable with gross margin or. The amount a company receives from selling goods or services in a particular period before costs directly related to producing them are subtracted.

Gross annual income is the amount of money a person earns in one year before taxes and includes income from all sources. Want to learn more. Gross operating income was 16 lower this year.

It is not a concept of national. But how to calculate it and what it constitutes differs in practice based on if the accounting is occurring for an individual or a business. An individuals gross income is important to determining eligibility for certain social programs while a companys gross income is one measure among many of how well it uses its resources to produce a profit.

Gross income is the profit margin earned by a company from its operating activities and is denoted as sales as reduced by the cost of goods sold which means the cost associated directly with the sale of goods sold by the company. In simple terms Gross Total Income is the aggregate of all your taxable receipts in the previous year. More specifically operating revenues are composed of interest and commissions excluding interest on doubtful debts but including provisions and recovery of provisions for depreciation of investment securities as weel as gains or losses on securities.

While the first is one of the lines of a banks typical income statement and will therefore be shown in euro or in the currency used in the financial statements of the institution the customer spread is calculated as the average asset yield minus the. Its important to note that there are two sides to each interest. The net interest income is different from another indicator that we often find in the financial information provided by institutions.

In a company it is calculated as revenues minus expenses. Improve your vocabulary with English Vocabulary in Use from Cambridge. For financial institutions such as banks interest represents operating income which is income from normal business operations.

Gross income includes following. But will not include any deductions from section 80C to 80U. It will also include profit or loss carried forward from past years and any income after clubbing provisions.

De très nombreux exemples de phrases traduites contenant bank gross income Dictionnaire français-anglais et moteur de recherche de traductions françaises. All calculations for employee pay for instance over time withholding and deductions are based on it. When looking at a pay stub net income.

It impacts how much you can borrow for a home and its also used to determine your federal and state income taxes. It is not limited to income received in cash. It also includes property or services received.

An asset including a leased asset becomes non performing when it ceases to generate income for the bank. As a concept gross income is exactly what it sounds like. This statement outlines the amount of taxable interest income earned on the financial assets held at the bank and is used to prepare tax returns.

Gross pay also called gross income is the individuals total pay from his or her employer before any taxes and deductions.

Annual Income Learn How To Calculate Total Annual Income

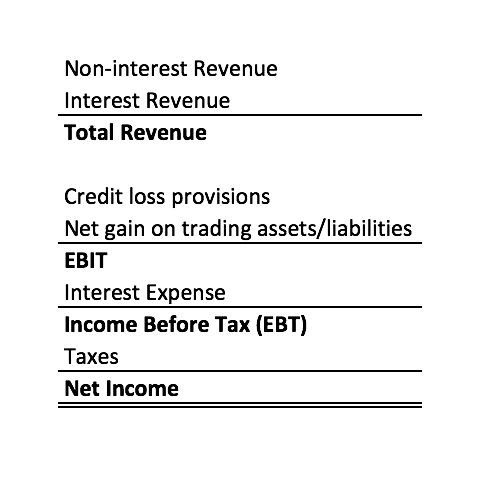

Analyzing A Bank S Financial Statements

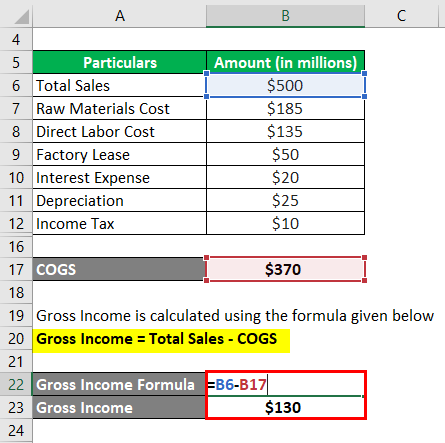

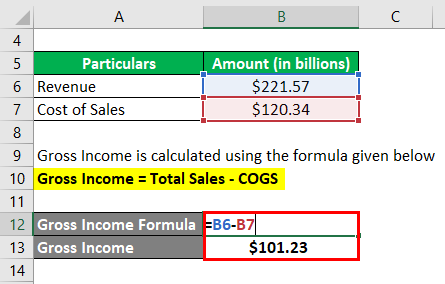

Gross Income Formula Calculator Examples With Excel Template

Financial Statements For Banks Assets Leverage Interest Income

Gross Income Formula Step By Step Calculations

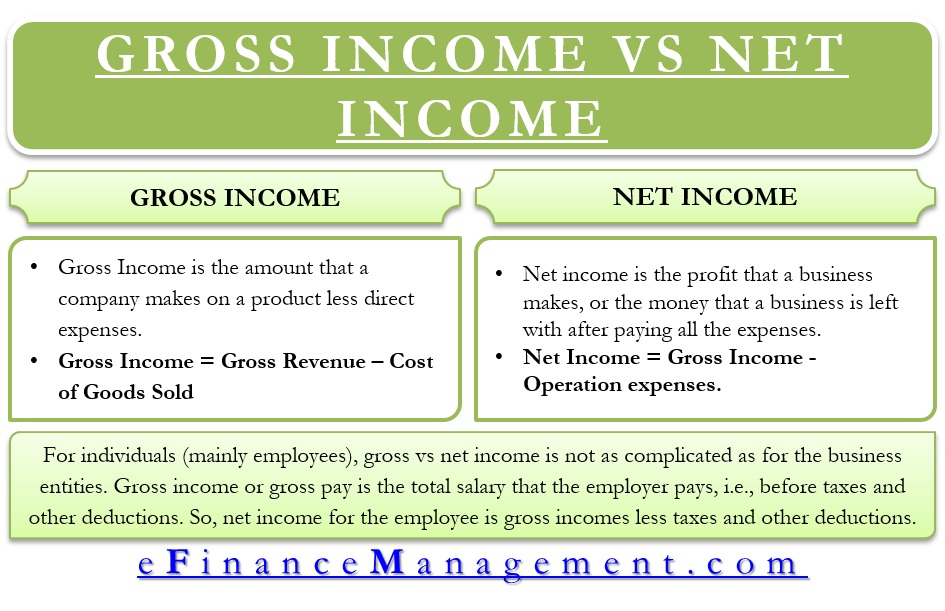

Difference Between Gross Income Vs Net Income Definitions Importance

Revenue Definition Formula Example Role In Financial Statements

Difference Between Gross And Net Economics Help

Analyzing A Bank S Financial Statements

What Is Gross Margin Definition Formula And Calculation Ig Bank

Gross Margin Ratio Learn How To Calculate Gross Margin Ratio

Gross Income Formula Step By Step Calculations

Gross Income Definition How To Calculate Examples

Gross Income Formula Calculator Examples With Excel Template

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross Income Formula Calculator Examples With Excel Template

/dotdash_Final_Gross_National_Income_GNI_May_2020-01-53d357d45bae47f29d3c72a98f190f8d.jpg)

Gross National Income Gni Definition

What Is Gross Income And How Is It Calculated Scripbox

Post a Comment for "Gross Income Meaning Bank"