Wages Meaning Under Esi Act

Section 29 of the ESI Act defines the term employee where a wide definition has been given to the term. Wages means all remuneration paid or payable in cash to an employee if the terms of the contract of employment express or implied were fulfilled and includes any payment to an employee in respect of any period of authorised leave lock out strike which is not illegal or layoff and other additional remuneration if any paid at intervals not exceeding two months but does not.

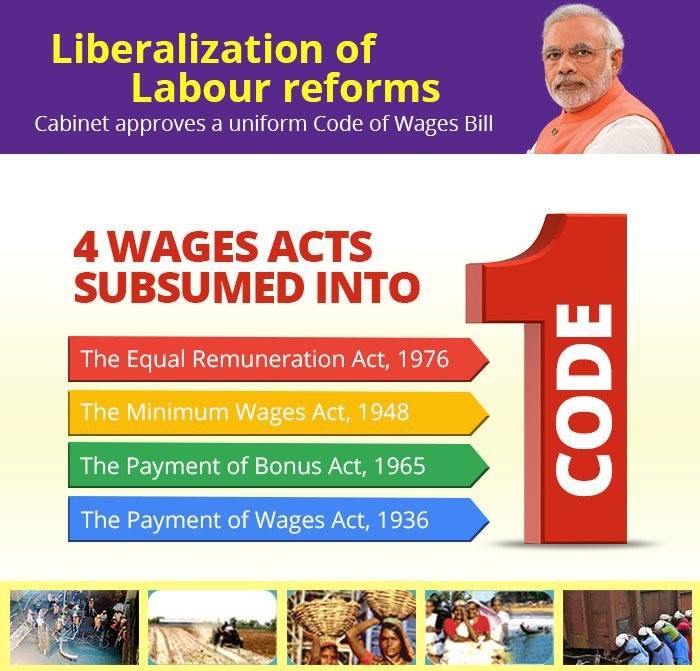

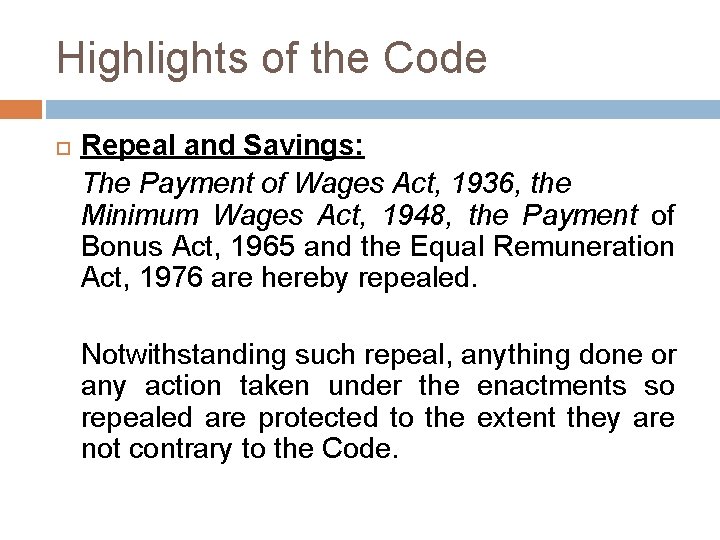

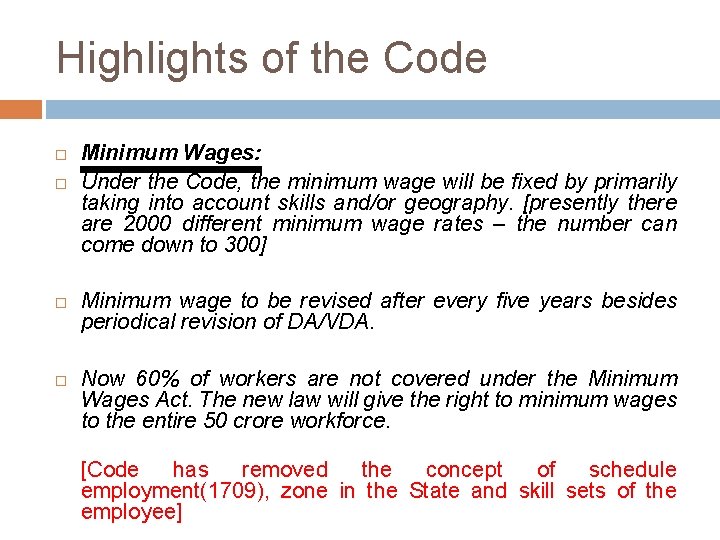

Highlights Of The Code On Wages 2019 Hryogi Com

The scheme provides full medical care to the employee registered under the ESI Act 1948 during the period of his incapacity restoration of his health and working capacity.

Wages meaning under esi act. The definition brings various types of employees within its ken. Therefore the contribution is payable on the overtime allowance. YWages means all remuneration paid or payable in cash to an employee if the terms of the contract of employment express or implied were fulfilled and includes any.

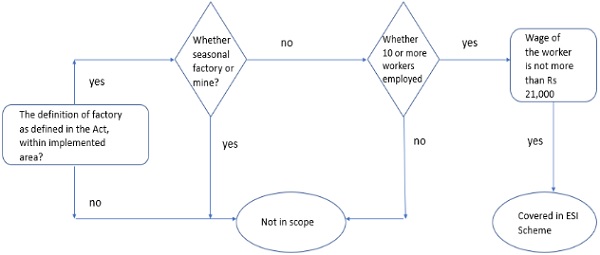

The wage limit for coverage under the Act had been increased from Rs 15000 per month to Rs 21000 in December 2016. But in case your provide food or purchase food coupen or token for hotel or canteen and make bulk payment to such hotel against bill and supply free coupen or token no contribution need to be paid. Definition of Factory under ESI Act Under ESI a factory is defined as any premises including the precincts thereof where ten or more persons are employed or were employed for wages on any day of the preceding twelve months and in any part of which a manufacturing process is being carried on with or without the aid of power.

All remuneration paid or payable in cash to an employee if the terms of the contract of employment express or implied were fulfilled. The number of employees in certain states like Maharashtra and Chandigarh is still 20. The Act is welfare legislation and is required to be interpreted so as to.

In other words employees of factoriesestablishments with 10 or more persons drawing wages up to Rs. If the amount is paid in cash to employee ESI contribution is to paid on it since it is nothing but element of wage. However overtime allowances will be considered as wage for the purpose of charging the contribution only and will not be considered for the purpose of the coverage of.

Meaning of Wages under ESI Act and so on The course will also give insights on. 21000 from the existing Rs. It provides financial assistance to compensate the loss of his her wages during the period of his abstention from work due to sickness maternity and employment injury.

PROVIDED that an employee whose wages excluding remuneration for overtime work exceed 18 such wages as may be prescribed by the Central Government. The scheme provides medical care to hisher family. 17 b any person so employed whose wages excluding remuneration for overtime work exceed 18 such wages as may be prescribed 136 by the Central Government.

The Employees State Insurance Corporation ESIC raised the monthly wage limit to Rs. Recent Amendments Developments in the field of ESI Compliance and Practical aspects that are highly useful while processing employees salary. The employees whose salary does not exceed Rs.

21000 per month are entitled to receive the health benefits under the ESI Act. 15000 for coverage with effect from 1 January 2017 The rate of contribution was reduced from 65 to 4 employers share 325 and employees share 075 effective from 1 July 2019. Moreover ESI act applies to the one drawing the monthly wage up to 21000- wef January 01 2017 In case of a person with a disability this limit is 25000-.

2 22 of the Employees State Insurance Act 1948 defines the term wages as all remuneration paid or payable in cash to an employee if the terms of employment express or implied were fulfilled and includes any payment to an employee in respect of any period of authorized leave lock out strike which is not illegal. A person who is employed for wages in the factory or establishment on any work of or incidental or preliminary to or connected with the work is covered. The definition of wages under Section-2 22 under the ESI Act 1952 states that it means all remuneration paid or payable in cash to an employee if the terms of the contract of employment were fulfilled.

Wage for purpose of ESI Act - Wages means all remuneration paid or payable in cash to employee according to terms of contract of employment and includes any payment made to an employee in respect of period of authorized leave lock-out lay-off strike which is not illegal and other additional remuneration paid at interval not exceeding two months. Both the remuneration received during the working hours and overtime constitutes a composite wage and thereby it is a wage within the meaning of Sec222 of the ESI Act. He term wages has been defined us 2 22 of the Act in three parts as under-.

Whatsoever may be the case if the interim relief is paid to the employees by any employer the same will amount the wages within the meaning of Sec222 of the ESI Act and contribution is payable thereon. Definition of Wage. 21000 are entitled to be covered under the ESI Act 1948.

Wage is under revision or when the payment of Dearness Allowance is delayed due to any reason. For multidimensional social security benefits. Can anybody tell me the wage definition under the ESI Act.

Employees whose wages are upto Rs. 21000 per month come under the ESI Act 1948.

Recent Changes In Labour Laws Index Preliminary Recent

Recent Changes In Labour Laws Index Preliminary Recent

Legally Required Compensation Benefits

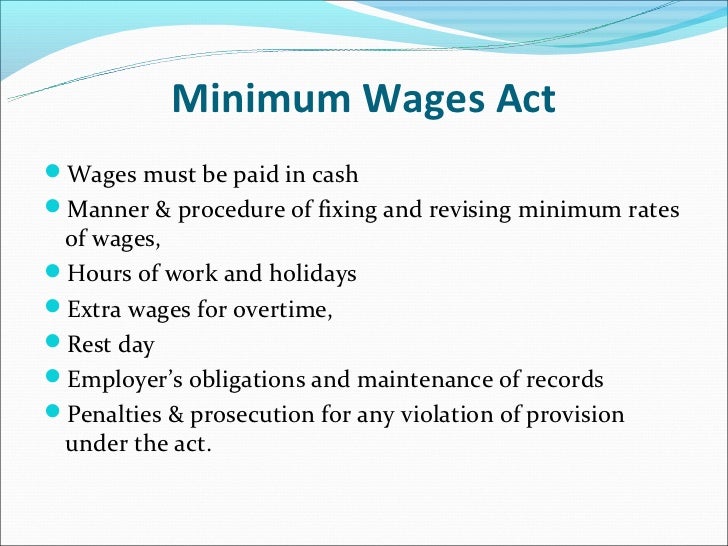

Object Constitutional Validity And Salient Features Of Minimum Wages Act 1948

Introduction The Minimum Wages Act 1948 Specifies Minimum

Workers To Get 50 Wage After 30 Days Of Unemployment Rules Eased For Esic Members Businesstoday

Definition Of Wages And Important Terms Inclusions In Wages

Flourishing Esic A Private Initiative Another Modest Step Towards Ideal Social Security Page 2

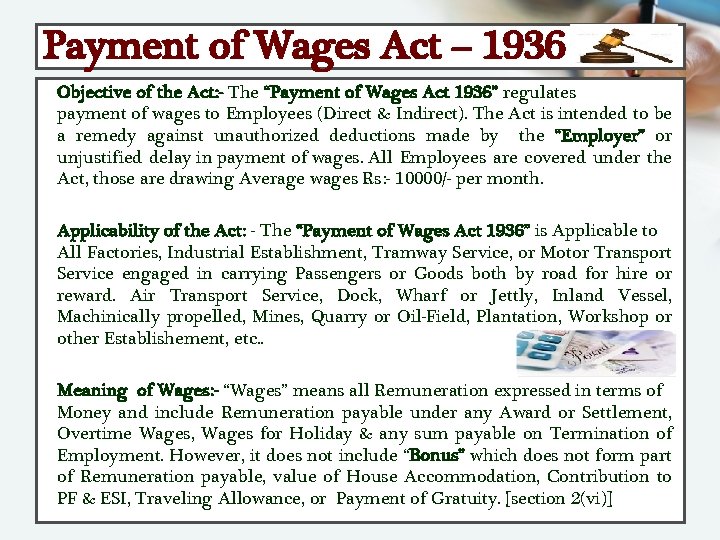

Payment Of Wages Act 1936 Wage Public Law

All About Esic And Pf With New Rates Of Esic

Recent Changes In Labour Laws Index Preliminary Recent

Code On Wages Analyzing The New Definition Of Wages

Code On Wages Changes In Compliance And Expected Impact

Employees State Insurance Act 1948 Important Definitions Questions

Minimum Wages Act 1948 History Objective Applicability

Srivastava Jagdhari And Associates Whats Labour Law Labour

Introduction The Minimum Wages Act 1948 Specifies Minimum

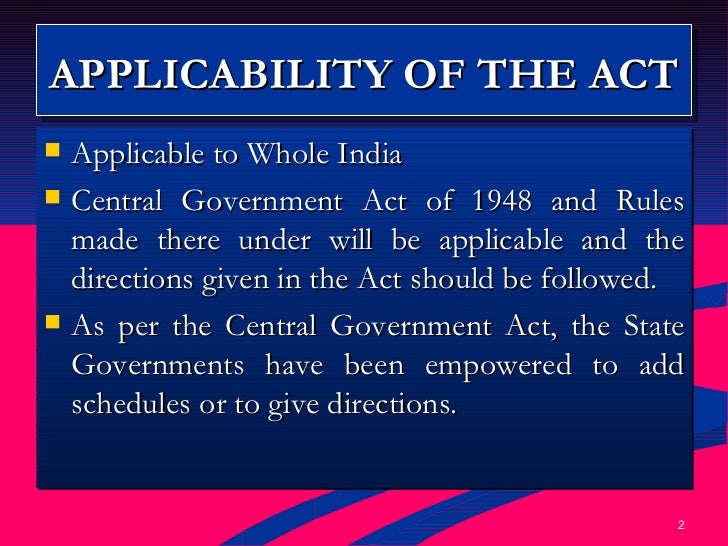

13 50 Ppt On The Minimum Wages Act 1948

Post a Comment for "Wages Meaning Under Esi Act"