Wages Earned Meaning Unemployment

Earnings deduction chart EARNINGS DEDUCTION CHART from to from to from to from to from to from to 000 - 500 0 10767 - 10866 78 21167. Since your weekly earnings are less than 100 the first 25 does not apply.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Any earnings greater than 13 of your weekly benefit amount known as your earnings disregard will be deducted dollar-for-dollar.

Wages earned meaning unemployment. What happens if I do not report my wages. If you are selfemployed you must report. Wages or other remuneration were paid to you.

Wages paid to an employee by an employer who is required to pay unemployment insurance taxes. Earned 3600 EXAMPLE A. If you work or earn any wages while receiving Unemployment Insurance UI benefits you must report these wages when you certify for benefits.

If you worked for more than one employer you would add the two gross earnings together and report the total on VICTOR. Generally earnings need to be reported for the week you earn them in not in the week you are paid the earnings. For example if you earned 300 in a week and the state earnings disregard amount is 50 you will be assessed on 250 of income and your eligible partial unemployment benefit wont be as greatly affected.

If the claimant does qualify these wages are also used to determine how much the claimant is entitled to receive during hisher benefit year. There are however a few exclusions such as payments to welfare plans pension payments to retired workers payments to employees serving in the armed. Earned 4050 Worked 4 Hrs.

You must report any earnings you work for during a week you are claiming unemployment benefits whether paid to you or not. Earned 6075 Worked 4 Hrs. DEPARTMENT APPROVED TRAINING An individual attending school or a training course can submit a written application requesting the work search requirement be waived.

If you earned 75 then the first 50 of your WBA is excluded 55 and the difference 20 is subtracted from your WBA and you would get a 90 benefit that week plus the 600 so your total earnings for the week would be 7590600765. WAGES Wages include all remuneration for services from whatever source including commissions bonuses tips paid to an employee which were reported to an employer and payments in any medium other than cash. For a worker a gross wage is simply everything earned during the period before the removal of taxes or any special payments.

Earnings must be reported even if you have not yet received the payment. Earnings or wages must be reported on the weekly claim during the week the wages are earned not when the wages are paid. 18 lignes Base period wages are the wages for covered employment paid during the claimants base period that are used to determine whether a claimant qualifies for unemployment benefits.

Unearned Income is all income that is not earned such as Social Security benefits pensions State disability payments unemployment benefits interest income dividends and cash from friends and relatives. Any person may qualify for regular UI if they worked in covered employment and earned enough wage credits. You need to report gross earnings - thats the full amount you earned.

Types of Unemployment Insurance. If you work during weeks in which you request Unemployment Insurance UI benefits you may still be paid benefits if your gross wages total wages before taxes are deducted are less than your weekly benefit amount. Hours Worked Rate of Pay Total Earned Name and.

Ssa Earned Income is wages net earnings from selfemployment certain royalties honoraria and sheltered workshop payments. You are entitled to receive your final paycheck compensating you for all of your hours worked commissions andor guaranteed. Since a claim for unemployment compensation is effective the Sunday of the week in which it is filed you should file your claim immediately after you are separated from your employment.

Weekly Earnings Worksheet WE 0214xx Total To Report On Weekly Claim Sun. The level of unemployment benefits a worker is eligible to receive depends largely on that employees gross wages during the eligibility period. You would report the answer on VICTOR as your gross earnings.

You will be instructed on filing your continued claim. To calculate the amount to report multiply the number of hours you worked by your hourly wage. Earned wages is essentially legal terminology that means wages that were earned but were never actually paid.

Earned 4800 Worked 3 Hrs. Certifying for benefits while working and not properly reporting wages is considered committing. The amount you report is the gross amount of earnings.

The workers high quarter wages were 3835 攀砀挀攀攀搀椀渀最 琀栀攀 洀椀渀椀洀甀洀 爀攀焀甀椀爀攀搀 漀昀 Ⰰ㠀㜀尩 and total gross wages in the entire 4ഠquarters of the base period totaled 9624 which exceeded 1½ times high quarter wages so this worker is qualified for a new c對laim on the basis of wages. The amount of benefits you will be eligible for is based on wages earned in the first four of the last five calendar quarters. When certifying for UI benefits report your work and gross wages wages earned before any deductions.

There are continuing requirements that a person be available for work able to work and actively seeking work. Because an eligibility period may extend more than a year into the past determining the. Gross earnings or gross wages are your earnings before taxes or other payroll deductions are made.

When an employee resigns or is terminated employers owe the former employee all wages for any work that was performed as an employee. You worked and earned 26 during the certification week. We suggest you keep a record of your work and wages earned for each day to correctly report information on the DE 4581.

Earned 2400 Worked 45 Hrs. You can certify with UI Online SM or by mail using the paper Continued Claim Form DE 4581 PDF. Earned 3600 Worked 675 Hrs.

You must file your initial claim for total unemployment in person.

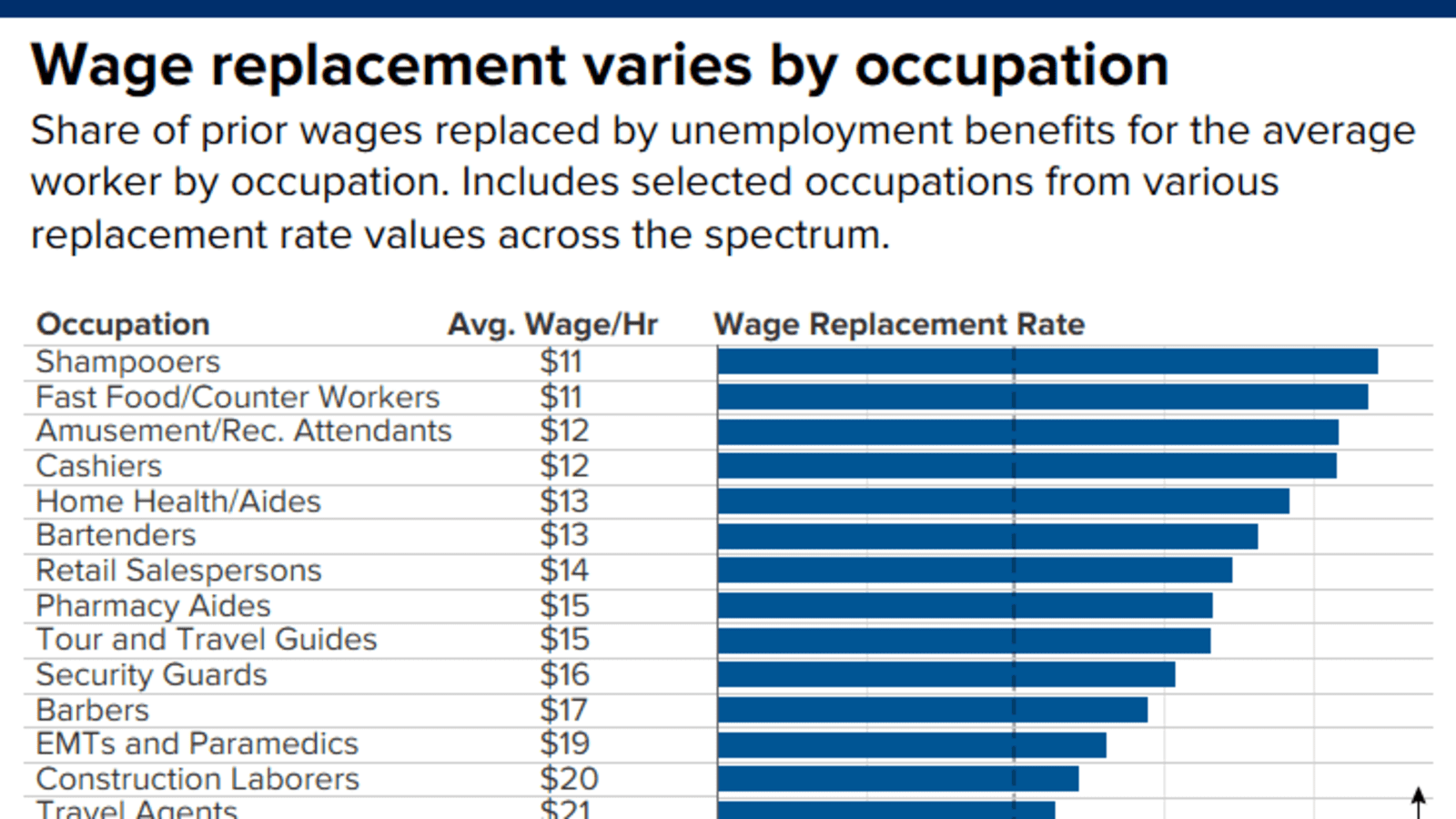

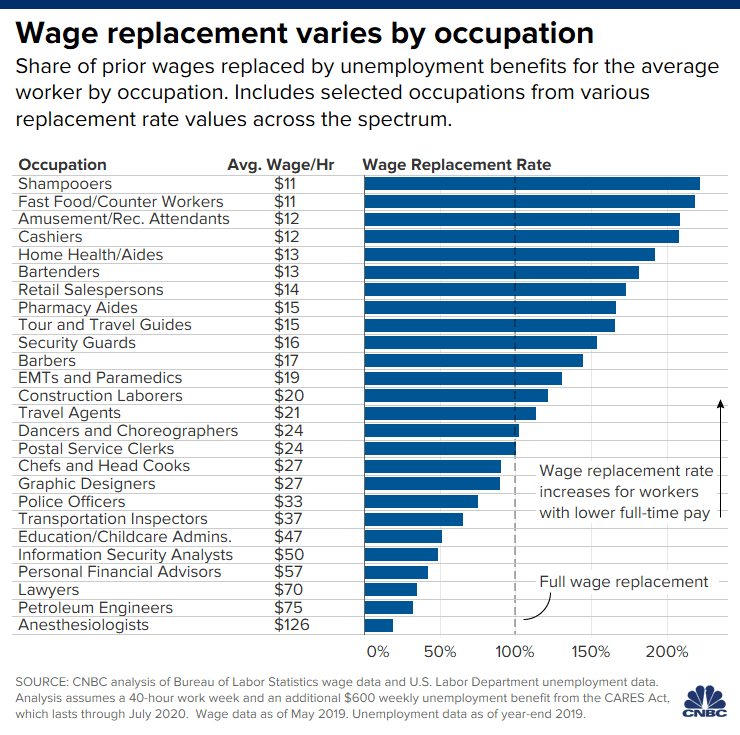

It Pays To Stay Unemployed That Might Be A Good Thing

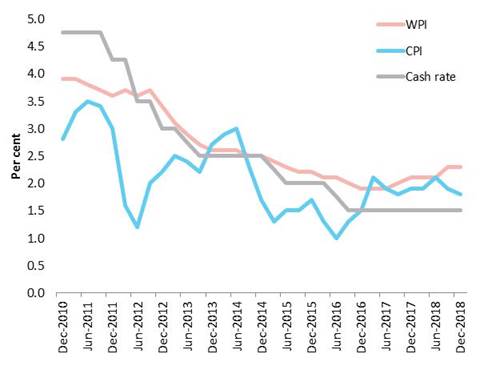

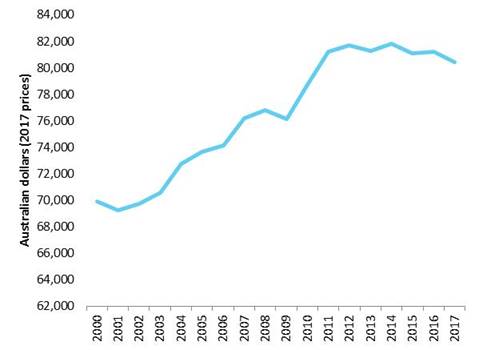

The Extent And Causes Of The Wage Growth Slowdown In Australia Parliament Of Australia

It Pays To Stay Unemployed That Might Be A Good Thing

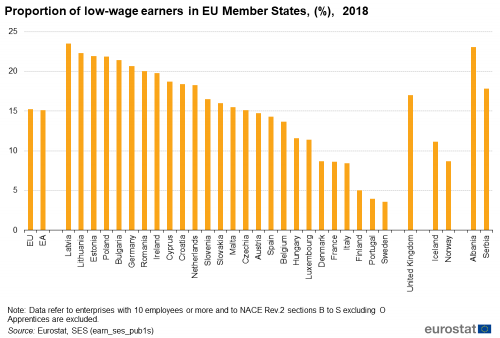

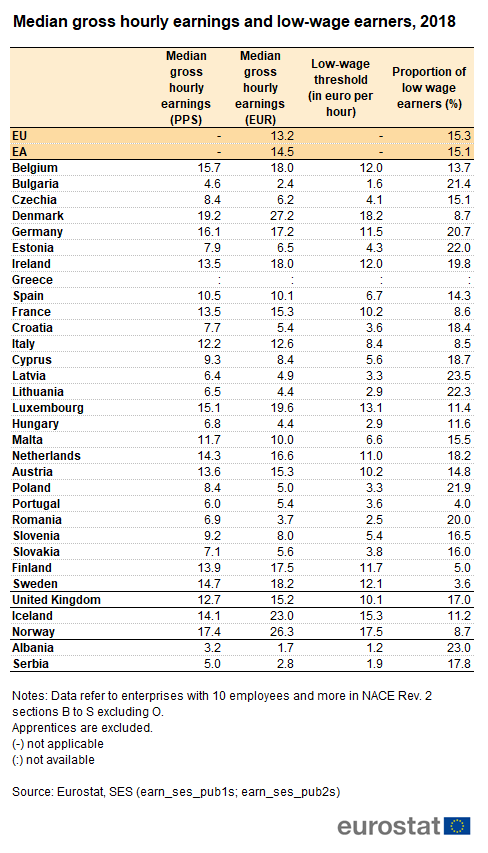

Earnings Statistics Statistics Explained

Earnings Statistics Statistics Explained

Earnings Statistics Statistics Explained

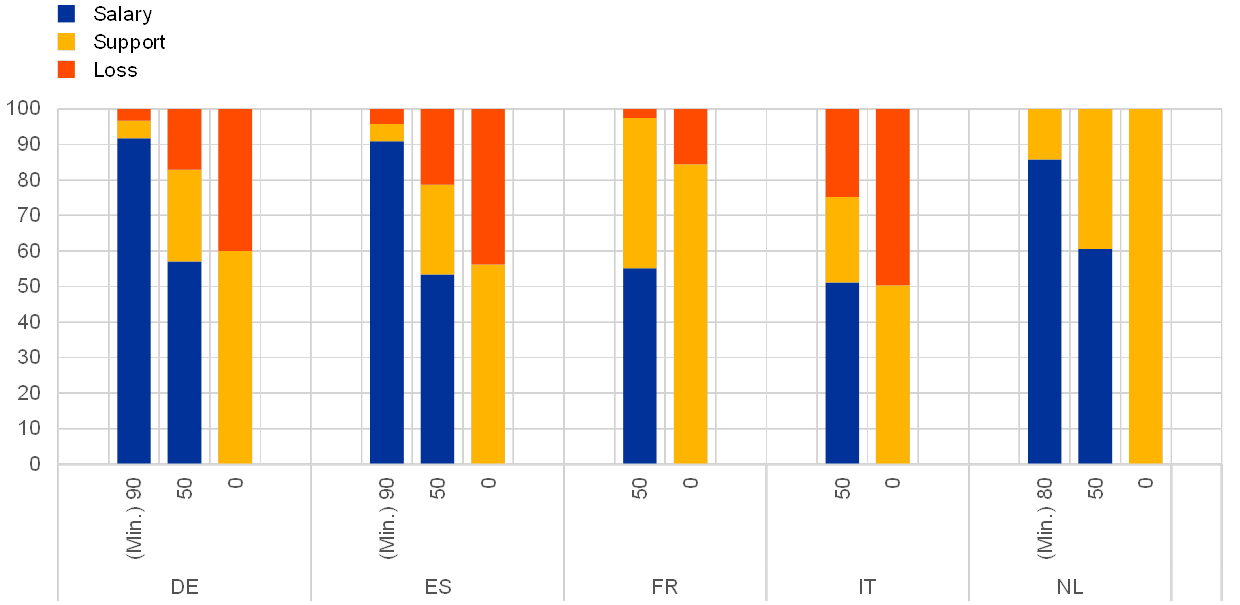

Short Time Work Schemes And Their Effects On Wages And Disposable Income

Opinion Minimum Wage In A Pandemic In 4 Graphs Chicago Policy Review

Career Trajectories And Cumulative Wages The Case Of Temporary Employment Sciencedirect

Earnings Statistics Statistics Explained

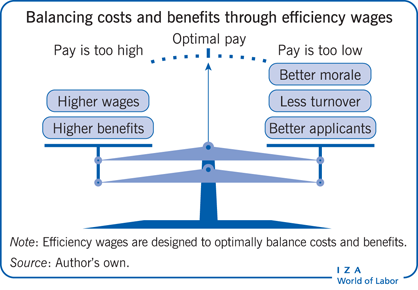

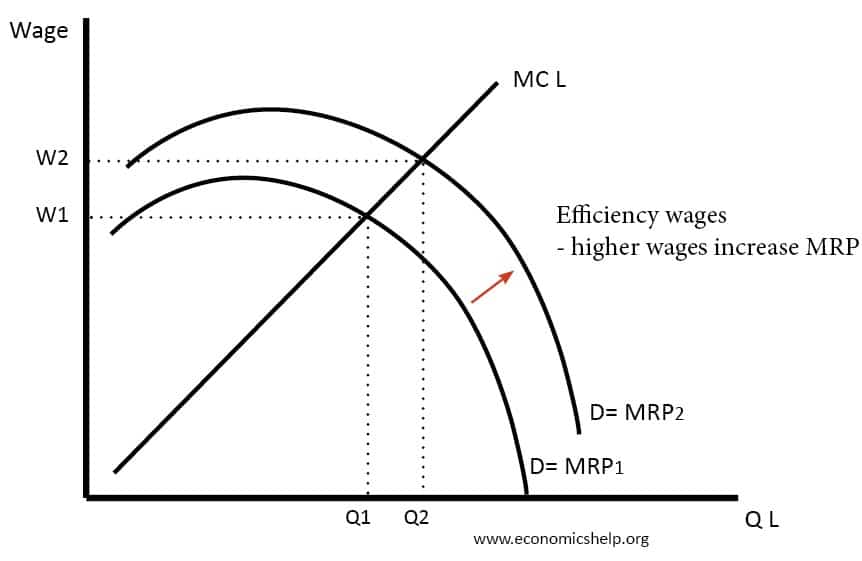

Iza World Of Labor Efficiency Wages Variants And Implications

The Extent And Causes Of The Wage Growth Slowdown In Australia Parliament Of Australia

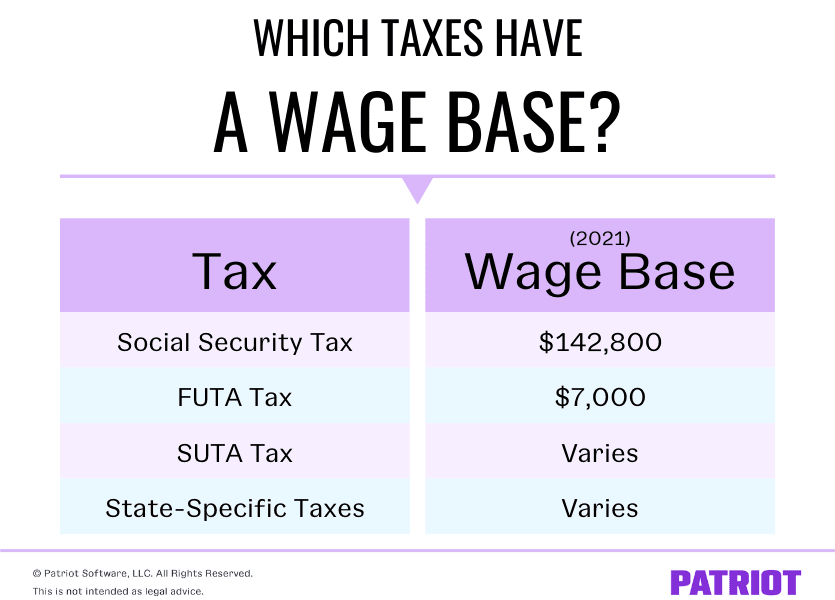

What Is A Wage Base Definition Taxes With Wage Bases More

What Are Gross Wages Definition And Overview

The Extent And Causes Of The Wage Growth Slowdown In Australia Parliament Of Australia

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Efficiency Wage Theory Economics Help

What Is A Living Wage In Hawaii In 2020 Raise Up Hawaiʻi

Post a Comment for "Wages Earned Meaning Unemployment"