Gross Pay Job Definition

Gross income for an individualalso known as gross pay when its on a paycheckis the individuals total pay from their employer before taxes or other deductions. The amount of salary or wages earned by an employee before any deductions or contributions are subtracted from the total earnings.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

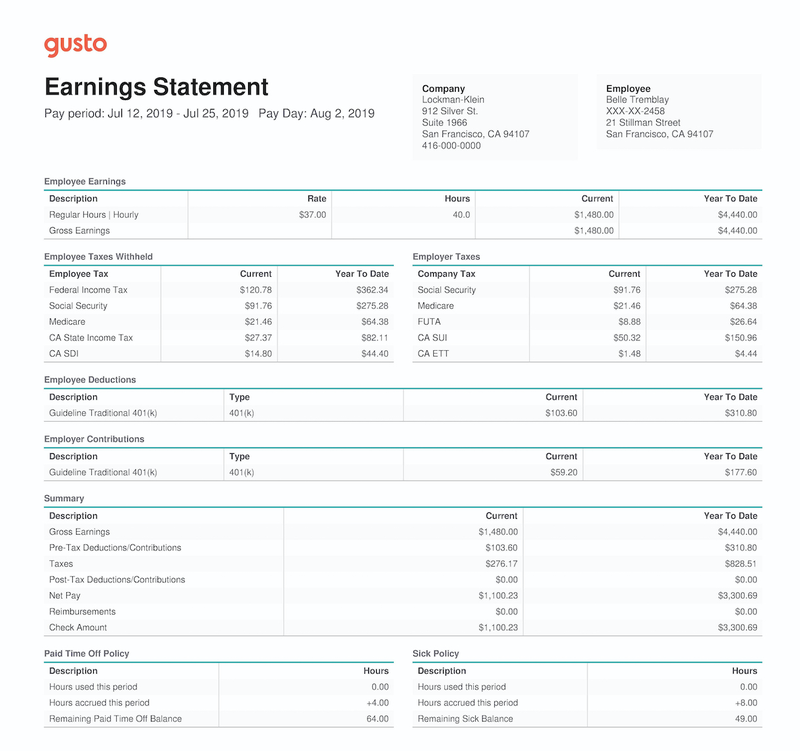

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out.

Gross pay job definition. For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay. If you have a fixed salary then your gross pay is the value of that salary which youll find in your employment contract. It is the amount of money that will finally be.

The earnings base is currently net-gross pay ie. Salary is also determined by leveling the pay rates and salary ranges established by an individual employer. Gross pay often called gross wages is the total compensation earned by each employee.

It means Daves annual gross pay. For example when an employer pays an employee a monthly salary of RM4000 this means the employee has earned RM4000 in gross salary. Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes.

In other words gross pay is the total amount of money an employer agrees to pay an employee as their CTC cost to company or annual salary. Salary is also affected by the number of people available to perform the specific job in the employers employment locale. Overtime payments bonus payments and annual wage supplements AWS.

Gross wage less employees contribution in all years since 1988 moving towards the full lifetime. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. Gross pay is the employees total earnings before deductions are taken out Employee deductions take 2 forms.

Components of Gross Pay. What is Gross Pay. Reimbursement of special expenses incurred in the course of employment.

Gross includes bonuses overtime pay holiday pay etc. Notice I didnt say it was the total amount paid to each employee. Also known as gross wages or gross income gross pay is an individuals total earnings before subtracting federal income tax Medicare and Social Security taxes state and local income taxes.

In this article well provide more details about what gross income is what it means for your monthly and annual income and how to properly calculate your income. Net pay Your gross pay will often appear as the highest number you see on your pay statement. Net Employer is liable.

For both salaried and hourly employees the calculation is based on an agreed-upon amount of pay. Gross pay is the amount an employee receives before any deductions and taxes. This includes income from.

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. Gross pay Noun A payment for the entire years income. Salary is typically determined by comparing market pay rates for people performing similar work in similar industries in the same region.

To get the gross pay at an hourly rate multiply the number of hours worked. For example Dave joined a company as a software developer and his company agrees to pay him 240000 a year. Good-old-europe-networkeu Le salaire de référence qui est actuellement la rémunération brute-nette cest-à-dire la rémunération brute diminuée des cotisations salariales de toutes les années depuis 1988 se rapproche de la durée de la vie active.

If you work on an hourly basis then your gross pay may vary from week to week. Calculating Gross Pay for Hourly Employees. What does gross-pay mean.

For example when an employer pays you an annual salary of 50000 per year this means you have earned 50000 in gross pay. Agreeing a gross pay enables employers to budget more effectively. Gross pay Noun An amount of pay wages salary or other compensation before deductions such as for taxes insurance and retirement.

All other calculations for employee pay overtime withholding and deductions are based on gross pay. Mandatory and voluntary Mandatory deductions are those required by law. Your gross pay is the total amount your employer pays you.

Gross pay is the total amount of money an employee receives before any taxes or deductionssuch as retirement account contributionsare taken out of their paycheck. For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay. If the employee is on a net pay the employer becomes liable for any of the employees unpaid tax from previous jobs court-order or child maintenance payments and even a student loan.

What is Gross Pay. The amount computed by adding the basic salary and allowances but without the taxes and other deductions such as EPF and Socso. An amount of pay wages salary or other compensation before deductions such as for taxes insurance and retirement.

Gross rate of pay includes allowances that an employee is entitled to under a contract of service What is excluded Gross rate of pay excludes. Whether its an hourly rate or annual rate the computation depends on the amount that is.

Tax Definitions What Is Adjusted Gross Income Tax Day Equal Pay Payday

Income Tax On Salary How To Calculate Income Tax On Salary Deduction Applicable On Gross Salary Income Tax Income Federal Income Tax

Accounting Ratios Financial Ratios Are Calculated Within A Firms Financial Statement To See How Profitable In 2021 Accounting Financial Ratio Accounting And Finance

Profit Or Loss Startup Business Plan Gross Margin Start Up Business

Amazon Com Forever Employable How To Stop Looking For Work And Let Your Next Job Find You Ebook Gothelf Jeff Kindle Forever Book Buy Word Finding Yourself

Gross Pay Vs Net Pay Definitions And Examples Indeed Com

What Are Gross Wages Definition And Overview

What Is Inventory Exceldatapro Cash Flow Statement What Is Budget Accounting

Gross Vs Net Income Importance Differences And More In 2021 Bookkeeping Business Accounting And Finance Finance Investing

Gross Wages What Is It And How Do You Calculate It The Blueprint

Profit And Loss Statement Explained Definition Real Examples Analysis And More Business Profitandlosss Profit And Loss Statement Profit And Loss Analysis

Management Nine Elements Of An Effective Hr Department Infographicnow Com Your Number One Source For Daily Infographics Visual Creativity Hr Department Human Resources Career Management Infographic

My Tefl Jobs Esl Jobs In China Tefl Jobs In Japan Korea Asia Job Application Resume Writing Examples Online Job Applications

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Profit Definition And Example 1000 Finance Blog Small Business Finance Business Finance

What Should I Include In My Employee Payroll Records Bookkeeping Business Small Business Bookkeeping Business Tax

Net And Gross Pay Workbook 4 Worksheets Workbook Special Education Students Worksheets

Post a Comment for "Gross Pay Job Definition"