Annual Income Calculator Ny

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds 1077550 pay that rate.

New York Salary Paycheck Calculator Paycheckcity

After a few seconds you will be provided with a full breakdown of the tax you are paying.

Annual income calculator ny. For example if you are a filing your taxes as single have no children are below the age of 65 and you are not blind with the consideration of the standard tax deduction your calculation would look like this. The adjusted annual salary can be calculated as. Bi-Weekly Gross Annual Salary 365 days X 14 days.

If you make 55000 a year living in the region of New York USA you will be taxed 12213. Hourly to salary calculator to calculate your income in hourly weekly bi. The other 2 weeks are vacation.

How to calculate annual income from hourly. Living Wage Calculation for Rochester NY. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Your average tax rate is 222 and your marginal tax rate is 361. That means that your net pay will be 42787 per year or 3566 per month. New York Tax Credits.

Contact Customer Service at 855-355-5777 to learn more. First determine your hourly pay rate and working time. Calculating Bi-Weekly Gross Using Annual Salary 365 days in a year please use 366 for leap years 14 days in a bi-weekly pay period Formula.

The tool provides information for individuals and households with one or two. Why not find your dream salary too. All bi-weekly semi-monthly monthly and quarterly figures.

To use our New York Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Your working time will include days per week hours per day and weeks per year. The latest budget information from April 2021 is used to show you exactly what you need to know.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Based on your yearly household income you andor your children may qualify for low-to-no cost insurance. New Yorks income tax rates range from 4 to 882.

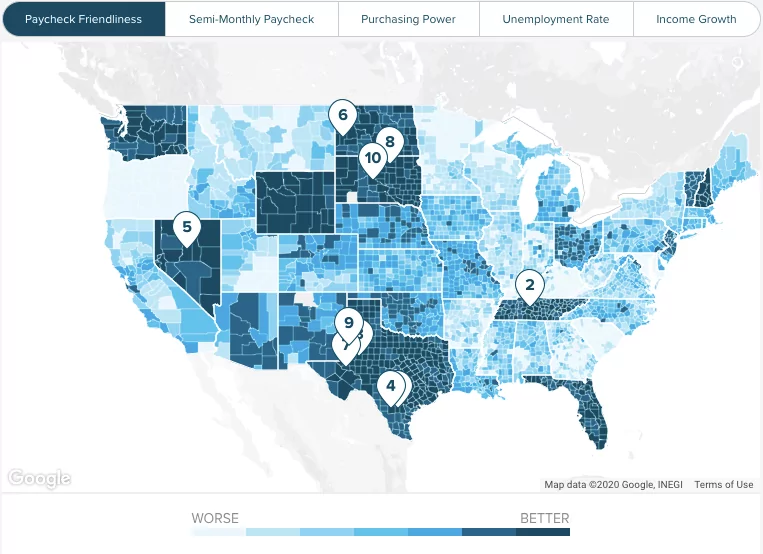

If you move from New York NY San Francisco CA or Washington DC the percent reduction of your cost of living could be -4350 -23 and -2010 thats good news to you that you could be looking at a positive net change in disposable income. On average the number of weeks worked per year is around 50 weeks. Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator.

15 40 52 31200. If you have vacation pay for these days enter your weeks as the full 52 weeks. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Use this New York gross pay calculator to gross up wages based on net pay. To determine her annual income multiply all the values. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

If youre still curious about how our yearly salary calculator works here are two examples showing it in practice. The calculator takes your gross income along with the other information you provided it with and uses it to calculate the final amount that you take home. Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inNew York the net effect for those individuals is a higher state income tax bill in New York and a higher Federal tax bill.

In counties where two-thirds of median income would fall close to the poverty line. Living Wage Calculation for New York County New York. For this calculator we define middle class as two-thirds to two times median income for the county.

This means that when calculating New York taxes you should first subtract that amount from your income unless you have itemized deductions of a greater amount. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Hourly rates weekly pay and bonuses are also catered for. Taxable Income in New York is calculated by subtracting your tax deductions from your gross income. The assumption is the sole provider is working full-time 2080 hours per year.

Taxpayers in New York City have to pay. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. Online Calculators Financial Calculators How Much do I Make a Year How Much do I Make a Year.

In New York the standard deduction for a single earner is 8000 16050 for joint filers. The assumption is the sole provider is working full-time 2080 hours per year. The annual net income calculator will display the result in the last field.

For heads of household the threshold is 1616450 and for married people filing jointly it is 2155350. How to find annual income - examples. Estimated Annual Medical Costs.

The tool provides information for individuals and households with one or two. Next determine any additional. How Much do I Make a Year Calculator to convert hourly wage to annual salary.

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

New York Paycheck Calculator Smartasset

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Average Income In New York City What Salary Puts You In The Top 50 Top 10 And Top 1 Sportofmoney Com

Average Income In New York City What Salary Puts You In The Top 50 Top 10 And Top 1 Sportofmoney Com

Health Insurance Marketplace Calculator Kff

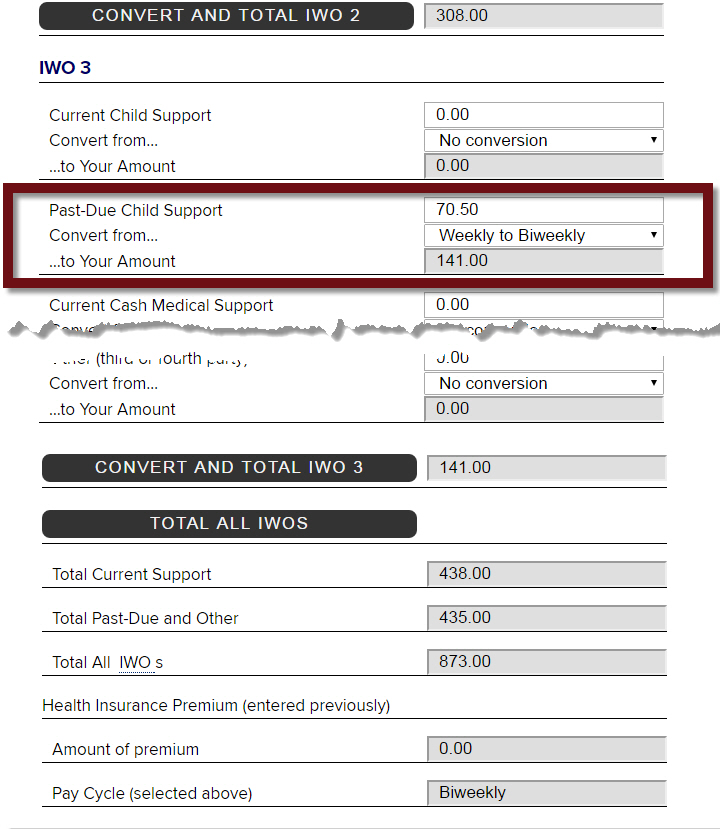

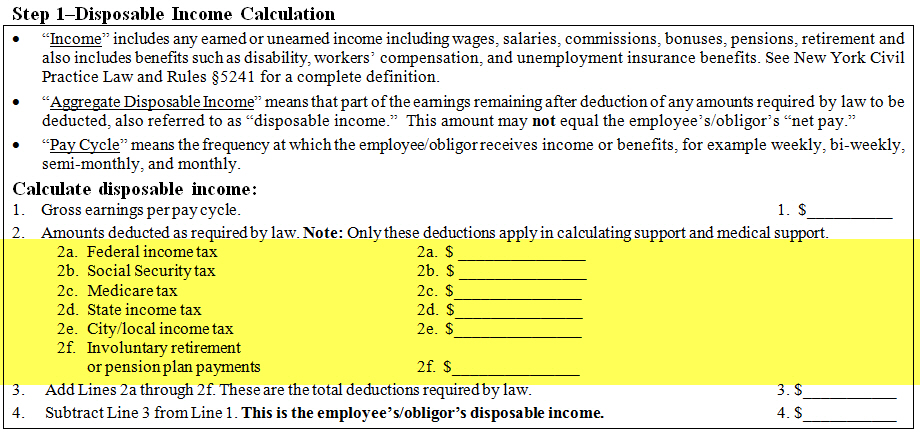

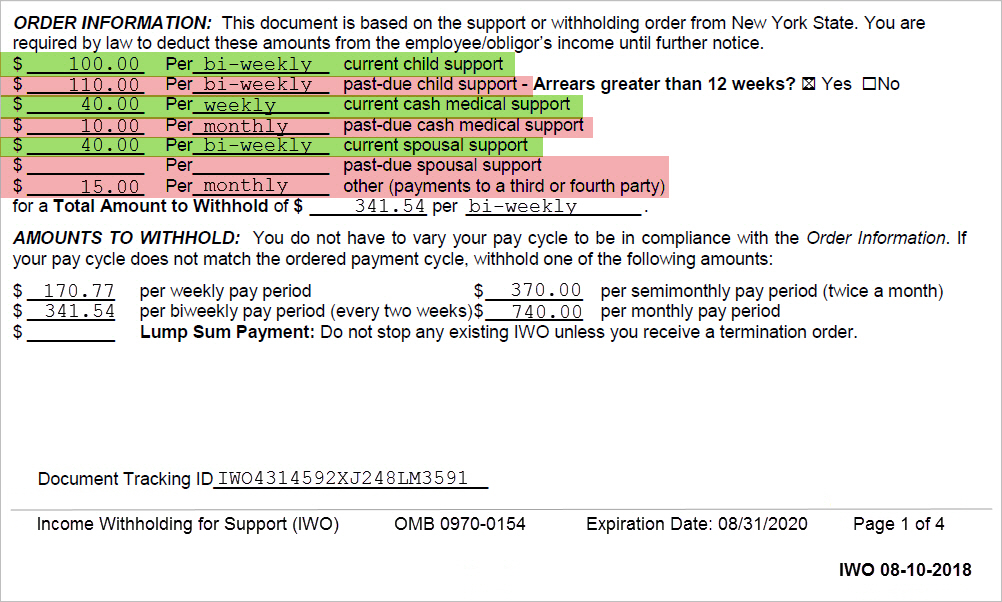

Nys Dcss Income Withholding Worksheet

New York Paycheck Calculator Smartasset

Nys Dcss Income Withholding Worksheet

New York Paycheck Calculator Smartasset

Pin On Life Tips Finances Trivia

Nys Dcss Income Withholding Worksheet

Graphic Designer Average Salary In New York 2021 The Complete Guide

New Tax Law Take Home Pay Calculator For 75 000 Salary

New Tax Law Take Home Pay Calculator For 75 000 Salary

Average Salary In New York 2021 The Complete Guide

Average Income In New York City What Salary Puts You In The Top 50 Top 10 And Top 1 Sportofmoney Com

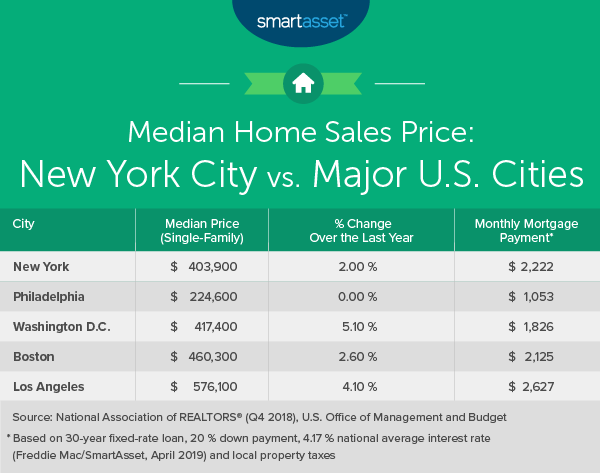

What Is The True Cost Of Living In New York City Smartasset

Post a Comment for "Annual Income Calculator Ny"