Wages To Turnover Ratio Meaning

A minimum labour turnover ratio of 3 to 5 is quite desirable. There are exceptions to this rule that we also cover in this article.

Bill Of Exchange Necessity Features Type Format Honorable And Dishonour Bill In 2020 Notary Public Notary Bills

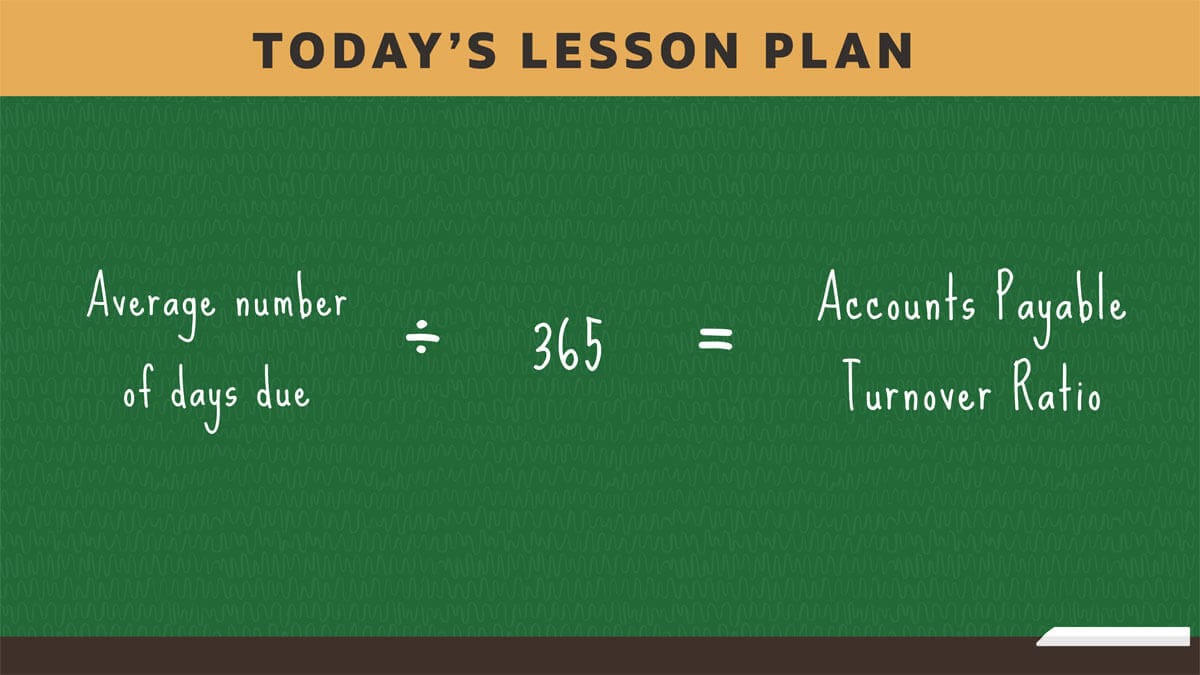

THE wages-to-turnover ratios for all Premier League clubs have been revealed - with Everton sitting on an alarming 85 per cent.

Wages to turnover ratio meaning. Lets look at a hypothetical example. The accounts payable turnover ratio also known as the payables turnover or the creditors turnover ratio is a liquidity ratio Financial Ratios Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company that measures the average number of times a company pays its creditors over an accounting period. The percentage is the percentage of turnover spent on wages.

And conversely if a business has a low turnover ratio it shows it is not efficiently using its assets to generate sales and some changes need to be made. So to know whether its labour turnover ratio is low or high every organisation should measure its actual labour turnover ratio during a. In other words how to calculate turnover rate is basically just percentage math.

The employee turnover rate is the percentage of. The inventory turnover ratio is an efficiency ratio that measures how quickly inventory is turned into sales. The general consensus is that wages-to-revenue ratio of less than 70 is one that can be managed but anything above that is dangerous and needs to be monitored.

Salaries and wages divided by sales andor services plus interest received plus dividends plus rental and lease payments plus other income. The turnover ratio is an important financial figure for calculating the cost of a companys stock option grants to employees. The Asset Turnover ratio can often be used as an indicator of the.

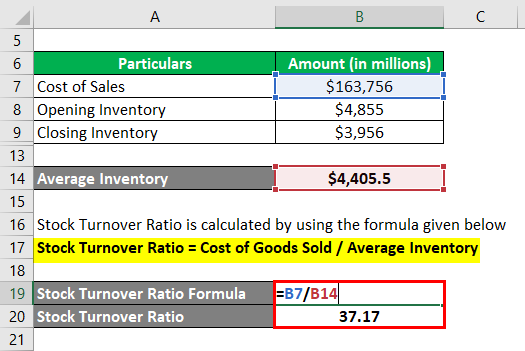

Labour turnover is not undesirable. Inventory turnover ratio or stock turnover ratio basically indicates the number of times inventory was turned over or sold during a period generally a year. The wages to turnover ratio is a key performance indicator used by businesses to evaluate the efficiency of staff players as a generator of income as a function of the clubs revenue.

Salaries and Wages Turnover Ratio. The graph shows that you Bari spend far less on player wages than average and Juventus spend more on player wages than most teams make in total. Lower percentage is better for the owners as it means youre spending less of your annual income on player wages.

Despite their huge wage bill their salary to turnover ratio - an accurate indicator of a clubs health - is 55 per cent. Suppose a company is granting an option to employees with a grant price of. Asset turnover ratio measures the value of a companys sales or revenues generated relative to the value of its assets.

It is a way to keep a check on your success. 75 of the money you are making is going straight out in wages. It is only a high or excessive labour turnover ratio is undesirable.

The Toffees are spending almost all of their income on wages. In a more simple sense it shows how many times the stock of the company was sold during the year. Simply put the turnover ratio is an indicator of the efficiency with which a company is using its assets to generate revenue.

Employee turnover is usually expressed as a turnover rate. Wages to Revenue Ratio is a useful way for recognising which clubs are running sustainable businesses and which are running a little too close to capacity. Let us look at the formula to understand the ratio better.

A high inventory turnover is generally positive and means a company has good inventory control while a low ratio typically indicates the opposite. Inventory turnover ratio meaning. Turnover is the total money in before tax and before expenses So unless you have prize money coming in at the end of the season you wont be turning much of a profit and your budgets may be restricted or you may need to to sell to buy.

This ratio represents the percentage of turnover income that is spent on labour costs. Sheikh-up that makes City a PS2BN business The turnover ratio is a measure of market liquidity given by the value of total shares traded divided by market capitalization. The higher the turnover ratio the more efficient a company is.

It can be calculated by dividing the annual dollar value of option grants by the average market price of the companys common stock at the end of the year.

Inventory Days Formula Meaning Example And Interpretation

Inventory Days Formula Meaning Example And Interpretation

Accounting Worksheet Learn Accounting Accounting Worksheets

Equity Research Analyst Financial Analysis Finance Career Financial Strategies

Finance Quick Review Financial Ratio Accounting And Finance Finance

Break Even Analysis Business Poster Business Studies Economics Lessons Gcse Business Studies

Equity Research Analyst Financial Analysis Finance Career Financial Strategies

2019 Marriage Visa Income Requirements For The Sponsoring Spouse Boundless Immigration Income Statement Profit And Loss Statement Statement Template

Accounts Payable Turnover Ratio Defined Formula Examples Netsuite

Connections Between Income Statement And Balance Sheet Accounts Income Statement Bookkeeping Business Learn Accounting

Football Club Finance Wages To Turnover Ratio Usage 2019 Uk Statista

Wages To Turnover Ratio Footballmanagergames

Median Salaries And Wages To Turnover Ratio For The Cafes And Restaurants Industry In New Zealand Figure Nz

Stock Turnover Ratio Top 3 Examples Of Stock Turnover Ratio

Basic Income Statement Template Beautiful Basic In E Statement Depreciation Income Statement Income Statement Template Statement Template

Inventory Days Formula Meaning Example And Interpretation

Post a Comment for "Wages To Turnover Ratio Meaning"