President Salary Non Taxable

14 - Calvados. Son assiette correspond aux rémunérations perçues par les salariésCertains dirigeants de société peuvent voir leurs rémunérations soumises à la taxe sur les salaires sans pour autant avoir la qualité de salarié au sens du droit.

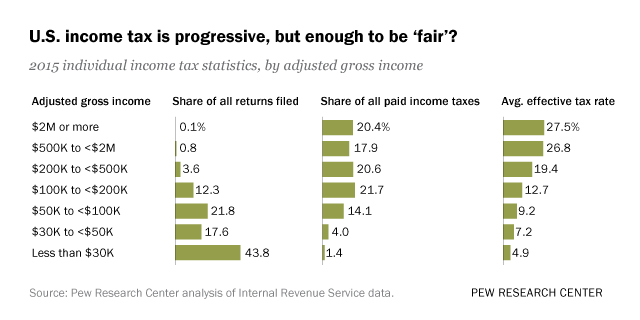

Who Pays U S Income Tax And How Much Pew Research Center

Upon leaving office former presidents are given a pension and office space.

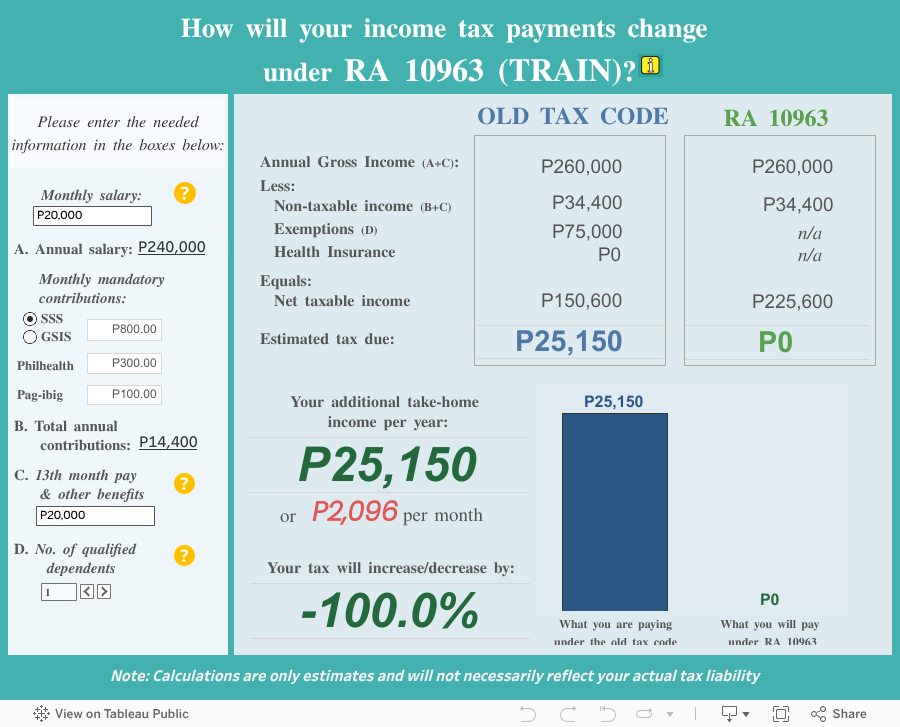

President salary non taxable. Le statut TNS symbolise dans le monde du travail le fait dêtre Travailleur Non Salarié. Medical allowance is a fixed part of an employees monthly. Is Salary of President of India Tax Free.

Statut salarié du président de SAS. Il devra déclarer chaque mois à Pôle Emploi le montant de son salaire de Président et le montant de ses allocations sera réactualisé comme suit. Le Président de SASSASU peut demander le maintien de ses droits au chômage.

But I think presidents compensation is tax free. While in office the US. La taxe sur les salaires est due par les entreprises dont le chiffre daffaires nest pas soumis à la TVA à hauteur dau moins 90 de son montant.

Sur le forum juridique Village de la justice. Basic salary is always taxable and should not be more than 40 of the cost to the company. Why Does the President Have a Salary.

This pays for the presidents personal expenses such as food and dry cleaning. The first ladies of deceased ex-presidents also receive pensions. 5 lakh rupees per month.

The president also receives a 50000 expense allowance a. They have secret service protection. Vice President Non-Alternative Finance Procurement Early WorksVice-président Travaux préliminaires liés aux modes de financement et dapprovisionnement non diversifiés.

Any allowance provided by the employer to meet the medical expenses of employees is fully taxable. Not open for further replies. Salary to non resident director taxable in the UK.

Neither the Constitution nor the Presidents Emoluments and Pensions Act 1951 exempt the Heads of State from taxation Mridhula Raghavan Program Manager responsible for media and citizen outreach at PRS Legislative told BOOM. 2 réponses 1 819 lectures 1 vote. According to 3 US.

Président SAS non salarié et facturation de sa propre société Accueil Forum Droit Fiscal droit des sociétés droit des affaires Président SAS non salarié et facturation de sa propre société. All expenditures of Rashtrapati Bhawan medical travel and all expenditures as a president are borne by the government. En fonction de la forme juridique de sa société ainsi que de son pourcentage de détention il se peut que le chef dentreprise choisisse entre le statut de dirigeant assimilé.

Discussion in Accounts Finance started by nick34785 Oct 19 2014. Through an amendment to the Finance Bill in 2018 the Presidents salary was last revised to Rs. However it should also not be kept too low since it will then result in a reduction in the other constituents of the salary.

President receives a salary of 400000 a year and a 50000 expense account. Voir la meilleure réponse. Président de SAS non rémunéré.

The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951 the salary of the president of India is TAX FREE. Un choix ou une nécessité. On Monday one public statement of the Honble President of India Shri Ram Nath Kovind sparked the discussion - president of india Salary -.

Au moment de créer une société comme une SAS ou une SASU les actionnaires ne disposent pas nécessairement des fonds suffisants pour se rémunérer eux-mêmes ou leur dirigeantPendant les premières années du démarrage de lactivité de la même manière les associés peuvent être contraints déconomiser sur ce. The Prime Minister is. Code also grants a 100000 non-taxable travel account.

Director Freight BypassDirecteur Contournement du transport de marchandises. 171 13 I have done a fair amount of research on this and have confirmed from several sources that payments to a non UK resident director is not subject to UK tax and NI. Factoring in all of those other perks and the power that comes with the position why do the taxpayers pay the president.

Congress added the expense account in 1949. Code 102 the president of the United States makes 400000 per year. Cela sexplique par le fait que le chef dentreprise nobtient pas un statut identique à celui dun salarié.

Montant de lallocation moins 70 du salaire. On top of their pay the President of the United States is given separate expense accounts including non-taxable travel accounts and entertainment funds. 1 Title 3 of the US.

However then I saw this.

Does The President Pay Taxes Brut

What Is The Salary And Perks Of The President Of India

Whether Salary Of The President Of India Is Taxable Law Trend

Who Pays U S Income Tax And How Much Pew Research Center

No The President Of India Is Not Exempted From Income Tax

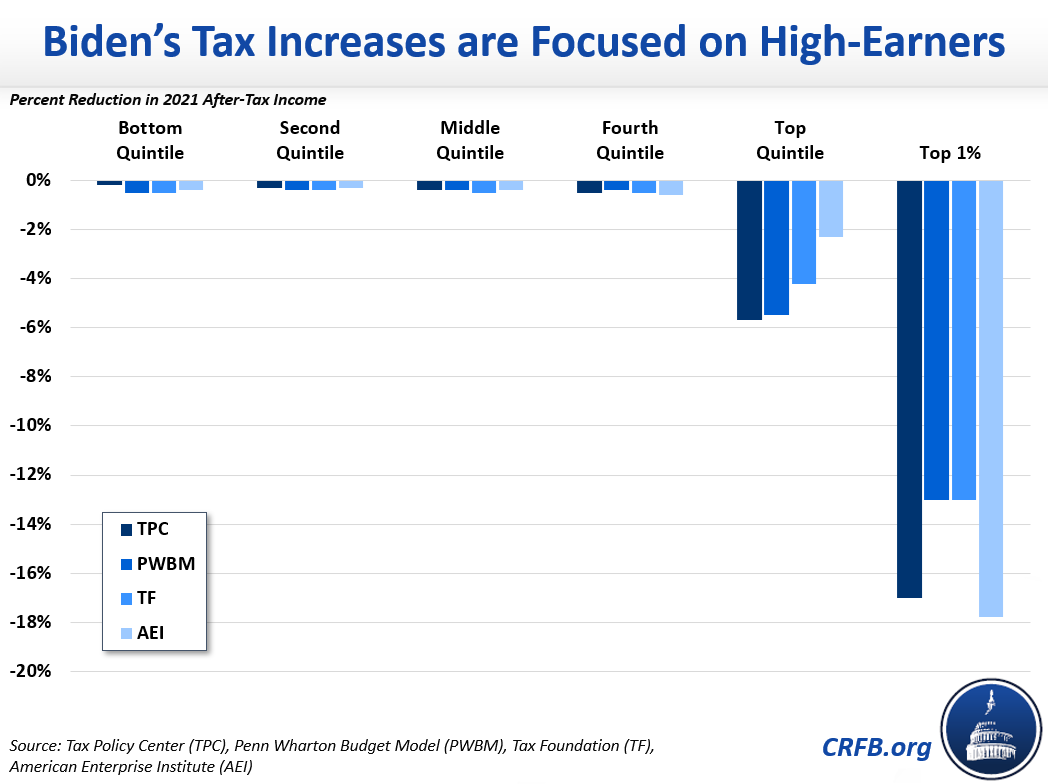

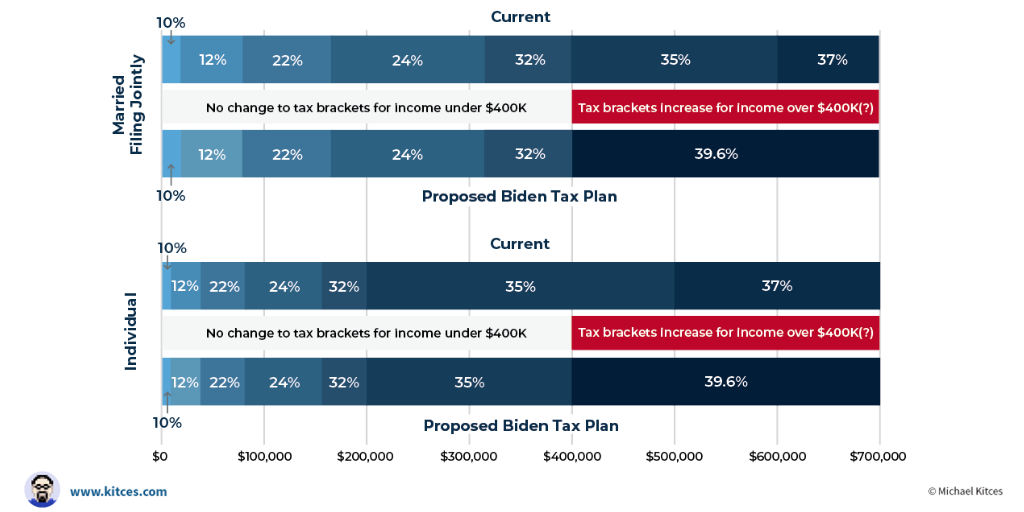

Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget

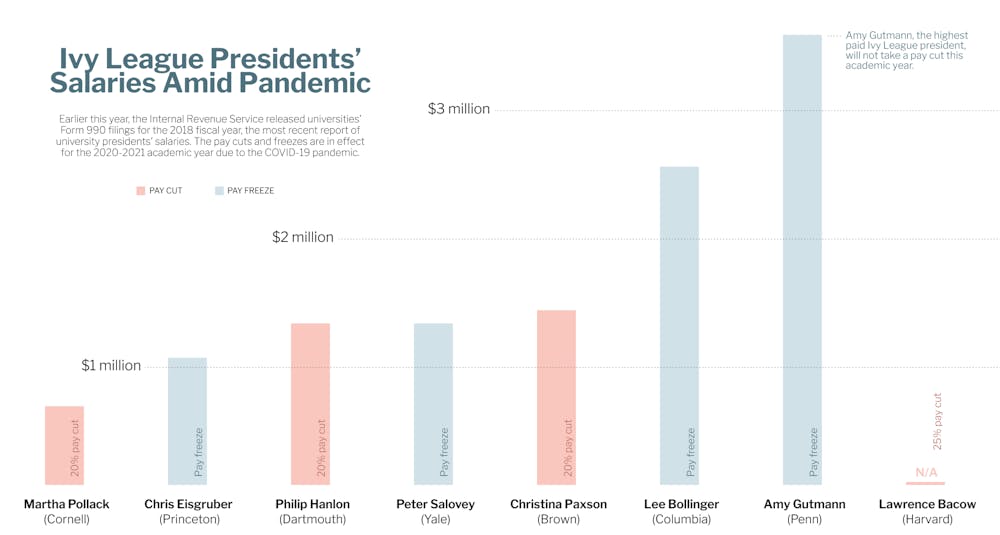

Gutmann Highest Paid Ivy League President Will Not Take Covid Induced Pay Cut Like Peers The Daily Pennsylvanian

What Is The Indian President S Salary Quora

No The President Of India Is Not Exempted From Income Tax

Biden Wants To Limit The Capital Gains Tax Preference History Shows It Will Be Hard

President Of India Salary Controversy How Much Does President Of India Earn Is It Taxable Youtube

My Tax Amount Is President Kovind On His Salary And How Teachers Save More Youtube

Biden Tax Plan And 2020 Year End Planning Opportunities

Do You Know The Salary Of The President Of India Education Today News

Does The President Of India Ram Nath Kovind Pay Income Tax

Us Tax Burden On Labor Tax Burden On Labor In The United States

Do U S Presidents Pay Taxes The Official Blog Of Taxslayer

Tax Form Presents Collado S Starting Salary The Ithacan

Post a Comment for "President Salary Non Taxable"