President Salary Exempted From Income Tax

As per the report the President is not exempted from paying the tax as there was no taxation exemption for the Presidents salary under the Income Tax Act and under the President Emoluments and Pension Act. It is needless to say that the income of the president is Tax free.

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

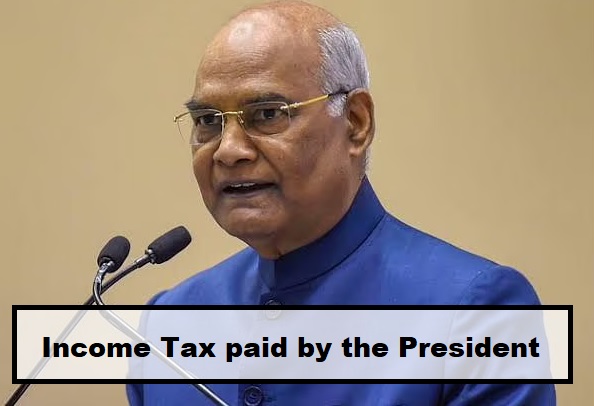

The President is the first citizen of the country and also the highest official.

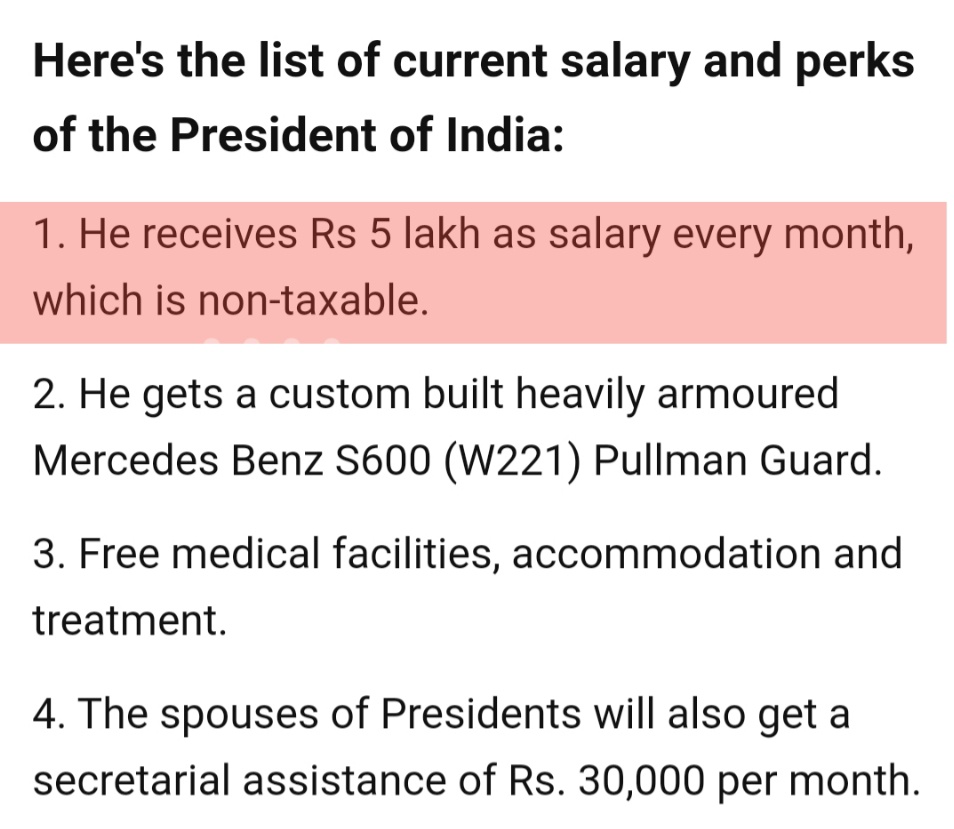

President salary exempted from income tax. Through an amendment to the Finance Bill in 2018 the Presidents salary was last revised to Rs. Further the Income Tax Act and the The Presidents Emoluments and Pension Act 1951 do not exempt the Presidents salary from income tax. - a Agricultural income b Bank profits c Salary income d Profit of public Ltd.

However there is no light on clarity on the nature of the. The salary and emoluments are decided by the Presidents Emoluments and Pensions Act 1951 which was amended recently where the Presidents salary was hiked to five lakhs and is tax. If youre a low-income earner on N30000 per month or less youre now exempted from personal income tax based on the new Finance Act Oyedele said.

The President of India pays Income Tax. The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951. He said I am mentioning this because everyone knows that there is nothing wrong.

They have to pay Income-Tax as per rules applicable to them according to the Income-Tax Act in force. This act has been amended from time to time to review the salary. Neither under the Constitution nor under the The Presidents Emoluments And Pension Act 1951 it has been mentioned that the Salary or emoluments paid to the President of India are Tax Free.

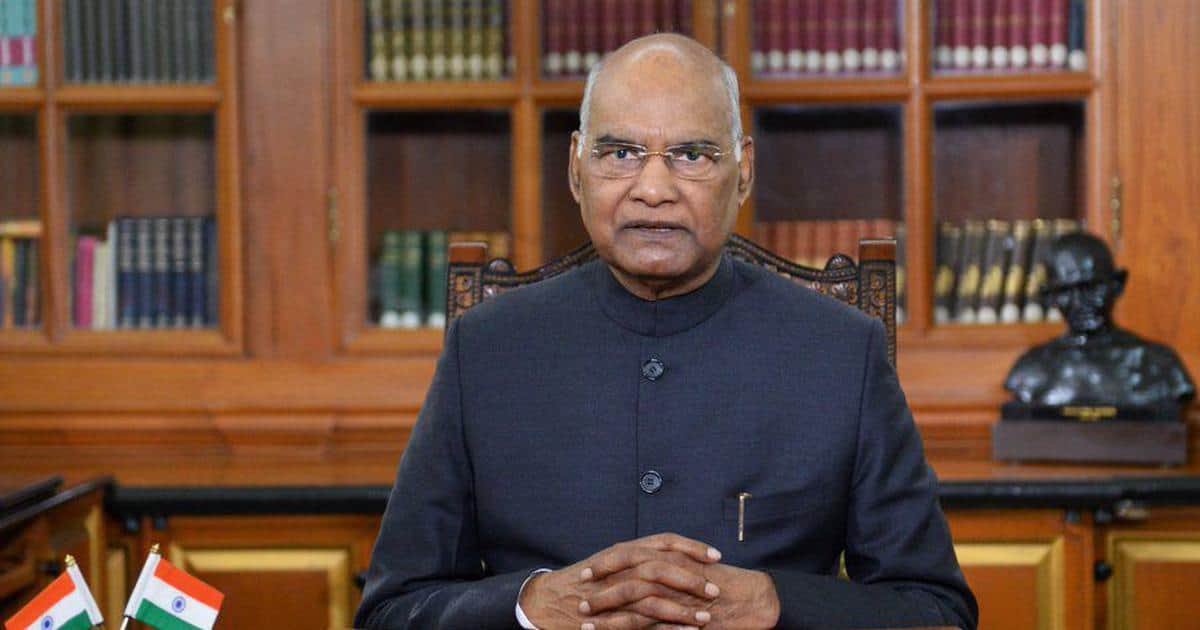

The salary and emoluments is decided by the Presidents Emoluments and Pensions Act 1 9 5 1 which was amended recently where the Presidents salary was hiked to five lakhs and is tax free. Akhilesh Sharma the Executive Editor of NDTV tweeted. President Ram Nath Kovind on June 27 2021 said his salary is Rs 5 lakh a month and of it Rs 275 lakh go into taxes.

So does that mean the President of India pays taxes like any other employee. This act has been amended from time to time to review the salary. It is deducted at the source.

Having said that the President would be paying tax but not likely to the scale of what Ram Nath Kovind has said. 5 lakh rupees per month. First Presidents Salary Is Not Exempt From Income Tax The Presidents Emoluments And Pension Act 1951 lays down provisions for the salary.

He pointed out that as a result of this he makes fewer savings than several other officials in. Neither the Constitution nor the Presidents Emoluments and Pensions Act 1951 exempt the Heads of State from taxation Mridhula Raghavan. Find Answer to MCQ Which of the following is exempted from tax at present.

Speaking at a public event he said that while he does earn a healthy salary of Rs 5 lakh a month as President of India he is not able to save much as he pays Rs 275 lakh as tax every month. The Persons who holds the post of the Prime Minister of India and the President of India also have to pay Income Tax as they are not exempt from paying the Income -Tax as per the Income Tax Act. The answer is NO because of a simple reason that the President of India is not paid Salary as he is not an employee.

The answer is that the President of India is not exempted from Income tax. There is no evidence that says the President of India is exempted from paying Income tax. It is also used to fix the pension and other benefits of retired President.

The salary of the President of India is thus determined by the 1951 Presidents Emoluments and Pensions Act. It is also used to fix the pension and other benefits of retired President. So tell your employer to.

The Salary and other perks are decided through The Presidents Emoluments and Pension Act 1951. Neither the Income Tax Act nor the President Emoluments and Pension Act specify the exemption from the salary of the President of India from taxation.

Does The President Of India Ram Nath Kovind Pay Income Tax

Do U S Presidents Pay Taxes The Official Blog Of Taxslayer

No The President Of India Is Not Exempted From Income Tax

President Of India Salary Controversy How Much Does President Of India Earn Is It Taxable Youtube

No The President Of India Is Not Exempted From Income Tax

Siddharth Setia On Twitter But President S Salary Is Tax Free Why Is He Lying

The Math Behind President Kovind S Tax Outgo

Who Pays U S Income Tax And How Much Pew Research Center

Do You Know The Salary Of The President Of India Education Today News

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

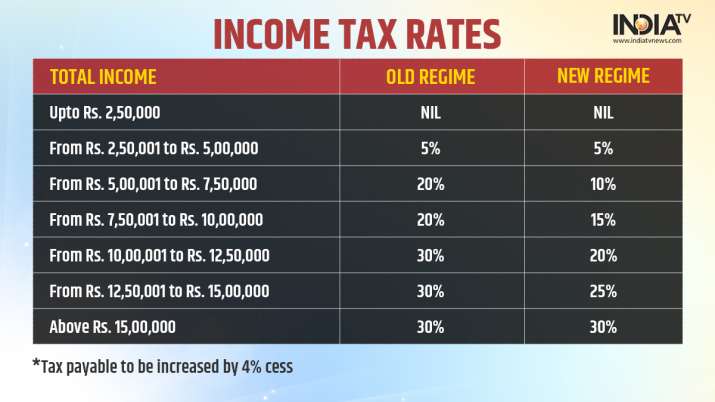

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And New Regime Income News India Tv

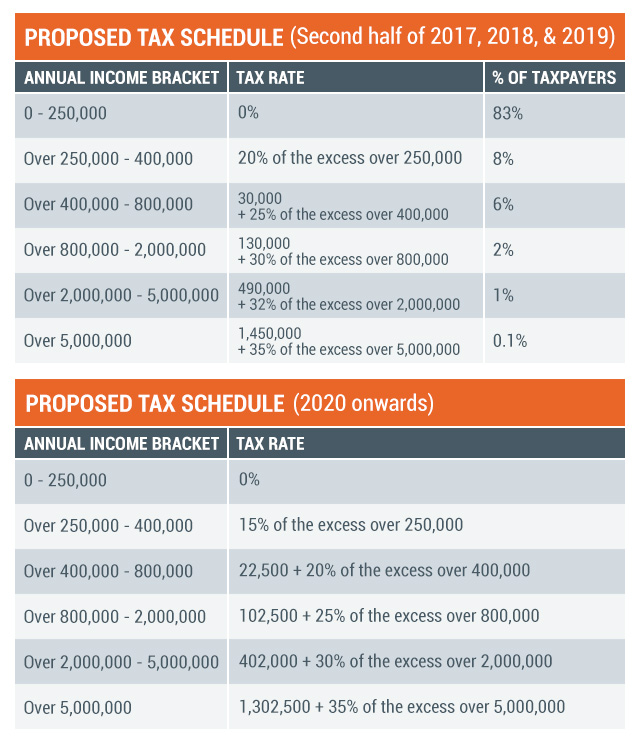

Duterte S Tax Reform More Take Home Pay Higher Fuel And Auto Taxes

Duterte S Tax Reform More Take Home Pay Higher Fuel And Auto Taxes

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

Whether Salary Of The President Of India Is Taxable Law Trend

Yes The President Of India Pay Income Tax But Not More Than 50 Of His Salary Facto News

President Kovind Revealed His Monthly Salary Gulte Ramnath Kovind

Post a Comment for "President Salary Exempted From Income Tax"