Gross Pay Calculator Georgia

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the Georgia Salary Calculator uses Georgia as default selecting an alternate state will use the tax tables from that state. The Georgia standard deduction is 2300 for single residents and 3000 for married couples filing jointly.

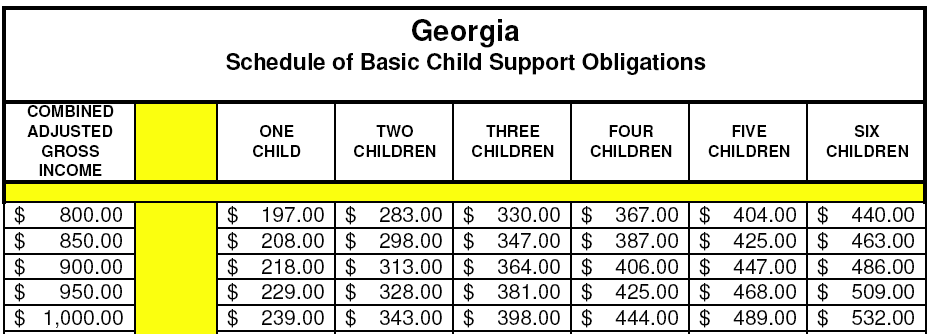

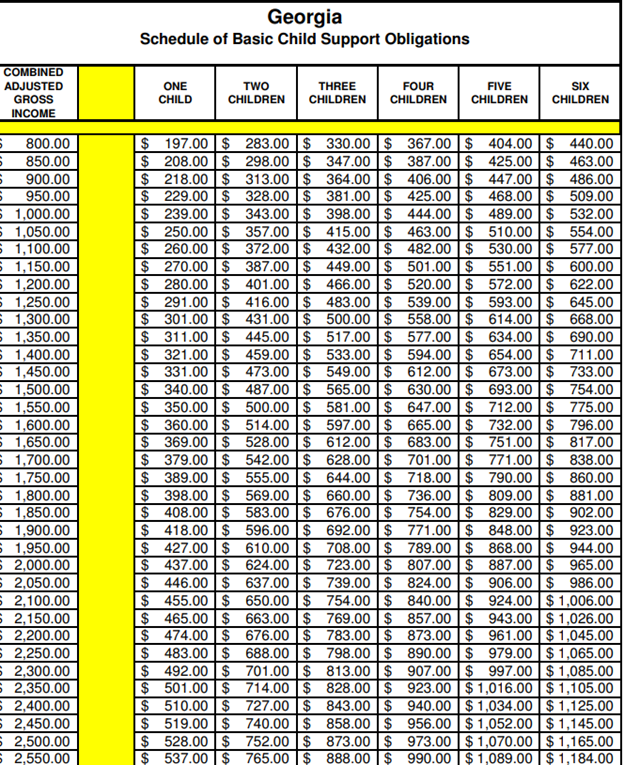

Georgia Child Support Calculator 2020 Georgia Food Stamps Help

The results are broken up into three sections.

Gross pay calculator georgia. Irish Income Tax Universal Social Charge USC and Pay Related Social Insurance PRSI. An Independent Earner Tax Credit IETC of has been applied. If you file in Georgia as a single person you will get taxed 1 of your taxable income under 750.

All you have to do is enter wage and W-4 information for each employee and our calculator will process your employees gross pay net pay and deductions for Georgia and Federal taxes. Georgia Salary Paycheck Calculator Results Below are your Georgia salary paycheck results. All but low-income people will end up in the 6 percent bracket.

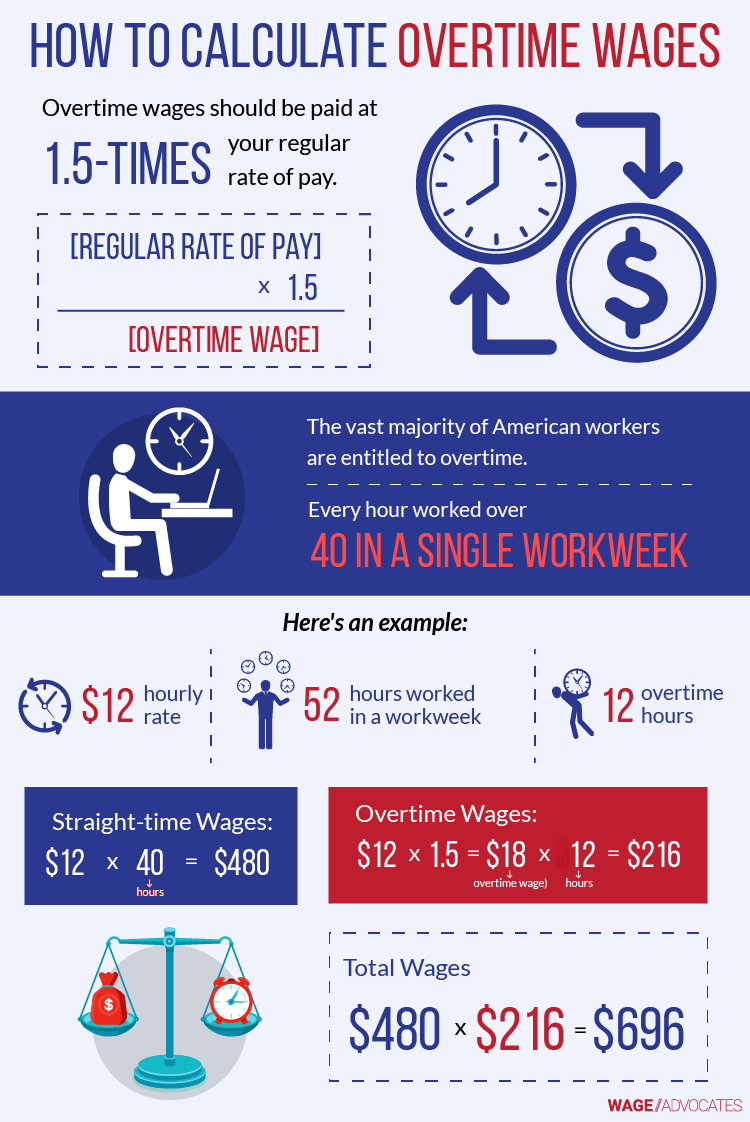

Your income was calculated as hourly. Enter your salary or wages then choose the frequency at which you are paid. Calculate the gross amount of pay based on hours worked and rate of pay including overtime.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck calculator.

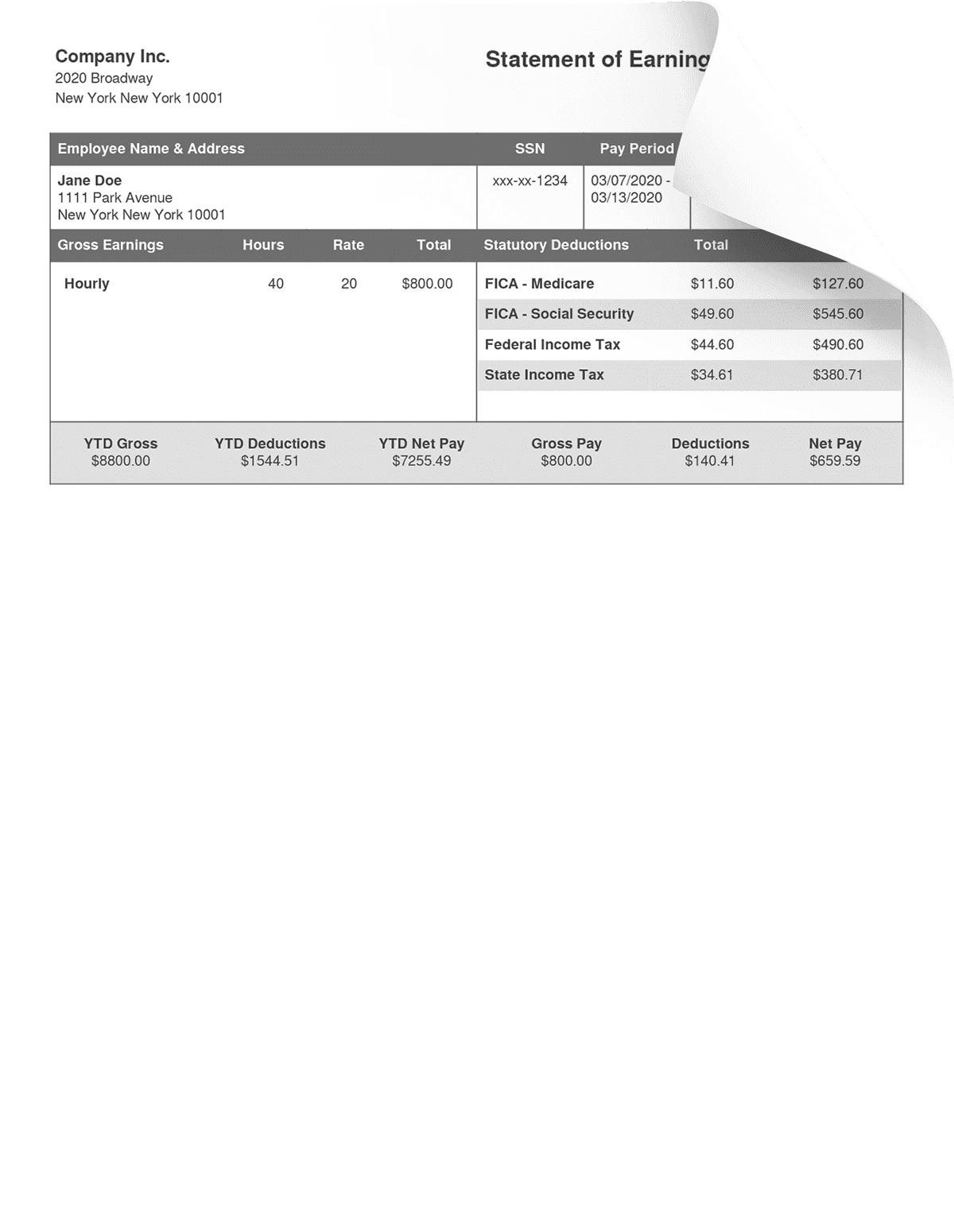

Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Married filers no dependent with an annual income of 112400 will take home 8805640 after income taxes.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. How much do you make after taxes in Georgia. The results are broken up into three sections.

1 2007 and many factors other than the gross income of the non-custodial parent became relevant. If you earn more than that then youll be taxed 2 on income between 750 and 2250. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

Georgia Gross-Up Calculator Results Below are your Georgia salary paycheck results. Using our Georgia Salary Tax Calculator To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. See how your monthly payment changes by.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. It also changes your tax code. To calculate your state income tax youll need to look at the current tax rates which currently vary from 1 to 6 percent.

Use this Georgia gross pay calculator to gross up wages based on net pay. This reduces the amount of PAYE you pay. See Georgia tax rates.

Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. Calculate your Gross Net Wage - German Wage Tax Calculator. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

Georgia moved to what is known as the Income Shares Model for calculation of child support. Calculate Georgia State Income tax. There is also a personal exemption of 2700 for a single filer.

The child support is calculated by using a worksheet created by the Georgia legislative branch. The calculator covers the new tax rates 2021. Georgia child support law changed on Jan.

Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull. Supports hourly salary income and multiple pay frequencies. This free easy to use payroll calculator will calculate your take home pay.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Easy-to-use salary calculator for computing your net income in Ireland after all taxes have been deducted from your gross income. If it was supposed to be weekly click the button below.

A single Georgian with an annual wage of 56200 will earn 4417895 after federal and state income taxes. How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany. Use this free Georgia Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

Summary report for total hours and total pay. W4 Employee Withholding Certificate The IRS has changed the withholding. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis. If you dont qualify for this tax credit you can turn this off under the.

Georgia Hourly Paycheck Calculator Gusto

Georgia Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2021

How To Calculate Child Support In Georgia 2018 How Much Payments

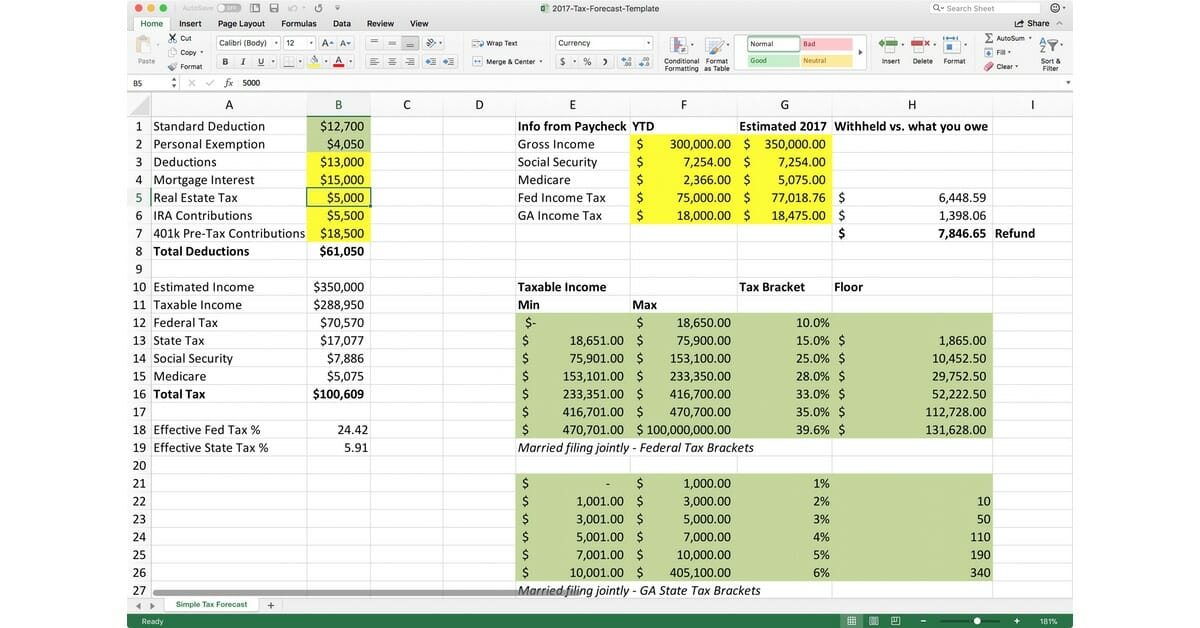

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Georgia Child Support Calculator 2020 Georgia Food Stamps Help

Paycheck Calculator Take Home Pay Calculator

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Georgia Child Support Calculator 2020 Georgia Food Stamps Help

Georgia Salary Paycheck Calculator Paycheckcity

Paycheck Calculator Take Home Pay Calculator

Georgia Child Support Laws Recording Law

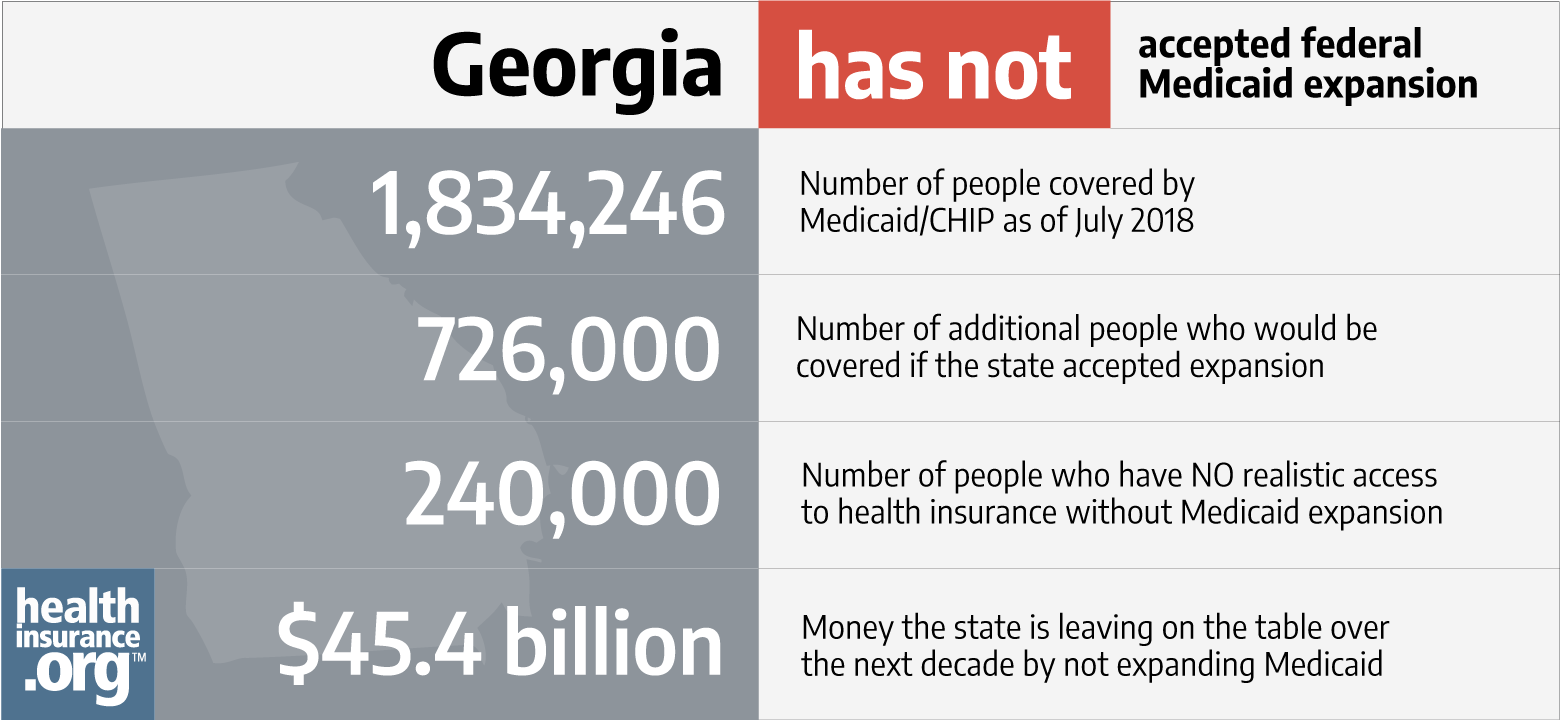

Georgia And The Aca S Medicaid Expansion Healthinsurance Org

Georgia Child Support Calculator 2020 Georgia Food Stamps Help

Georgia Paycheck Calculator Smartasset

This Is The Ideal Salary You Need To Take Home 100k In Your State

Georgia Paycheck Calculator Smartasset

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Post a Comment for "Gross Pay Calculator Georgia"