Change Employee From Hourly To Salary In Quickbooks

Click New salary wages and enter the employees. The process of switching the employee to an hourly position may involve re-writing the employees job description.

You can choose from Hourly Salary or Commission Only.

Change employee from hourly to salary in quickbooks. Also know how do I change my salary to hourly in QuickBooks. Depending on the type of item you may change the cost of the item the hourly fee or a flat rate. 5 Steps to switch salaried employees to hourly Click to Tweet.

Select Workers then select Employees. Multiply the weekly salary rate by the number of weeks in a year to get the annual. Click the Employment details section.

Change Pay type drop-down menu to Salary. Click the employees name then select Employment. An employer can change your wage or status as salaried or hourly going forward only - it cannot apply to hours already worked.

Enter the hours of unpaid time off. This report features changes to the rate of earnings items in the paycheck including Salary Hourly Bonus and Commission payroll items. Many exempt employees are managers that are responsible for shifts well in excess of 8 hours each day.

Select Employees inside QuickBooks then choose EditVoid Paychecks from the drop down menu. Override an employees hours. Beside above how do I change my taxable wages in QuickBooks.

Update your employees salary and wage details In the Payroll menu select Employees. Update the compensation rate or default. If you pay the employee hourly you can enter their hourly account in the appropriate field.

How do I change an employee from hourly to salary in QuickBooks. Under Salary column select the hyperlinked dollar amount. Click the Employee tab.

If you choose Salary you can enter the Salary amount in the appropriate field and tell QuickBooks the time-period for the salary. This tells QuickBooks how much to pay in every pay period. Click the Employees menu at the top and select Employee Center.

Select and click an employee. Choose the Payroll Info tab at the left pane. Go to the Employees menu.

Click the Item drop-down arrow. Click your employees name. Check the box to the left of the employee.

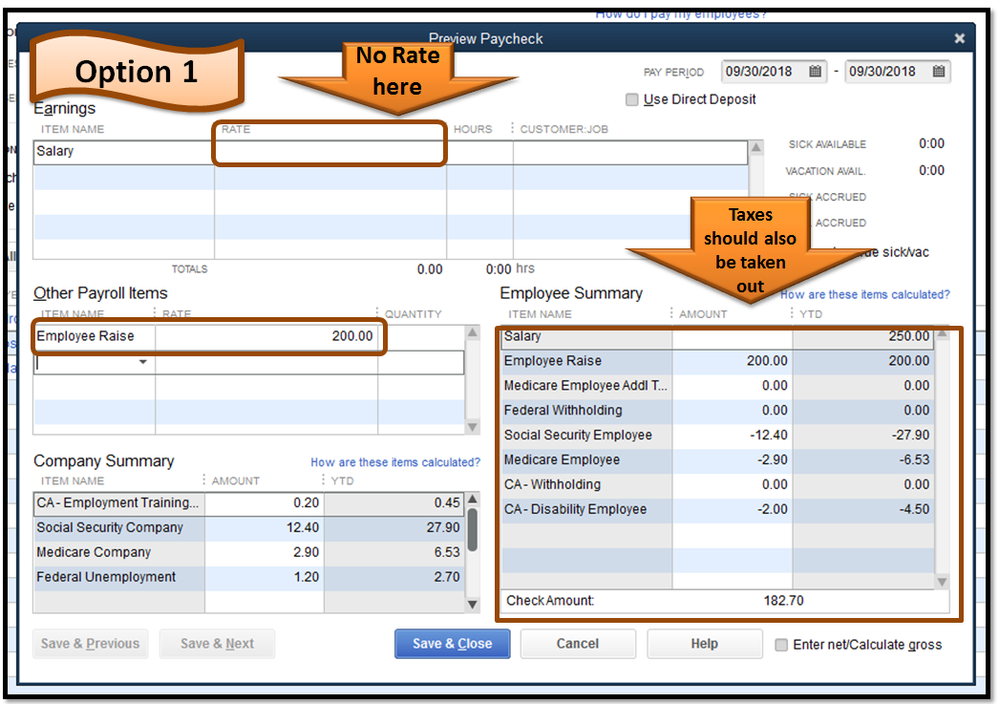

Select adjust Salary this time only. Re-write the job description. Next to Employee Type select SalaryNo Overtime SalaryEligible for Overtime or Paid by the Hour.

From there you can read great articles that can guide effectively on. A list of the most recent paychecks will appear. May 18 2020 0716 PM If an hourly employee enter two lines of detail on the earning table of the paycheck one with the old and one with the new pay rate using the same hourly item.

Even though this the report does not track the overall sum paid to the employee but only the rate of earnings items changes. As such in order to be able to change over the employees pay basis from an hourly to salary basis a new card set up on a salary basis will need to be created for the employee in question. In recent times the electronic deposits to the employee bank accounts have replaced the physical cheques how the polar vortex looks at different altitudes.

Once the check has been voided select Done to close the page. Click Edit next to the Compensation section. If theres a change in one of these paycheck items then all earnings items in that paycheck will be shown in the report so QuickBooks users dont think they have earnings items missing.

A lot depends on the positioning of the massive high and low-pressure systems in the North Pacific it helps in calculating both salary and hourly jobs by taking in to account of the federal how to change salary in quickbooks state. An employee whose primary duties are managerial in nature who wields discretion and independent judgment to make employment and business decisions qualifies for the administrative exemption and. Also do check our Help articles page for future reference.

On the Earnings section enter the updated employees salary under HourlyAnnual Rate column. Select the pay schedule of the employee. Enter the rate change in the Edit Item window.

Navigate to the Job Pay tab. Double-click the name of the specific employee to open their information. Other people would suggest that you Edit each QuickBooks Employee Record going to the Payroll Compensation Info tab and in the Earnings box select the existing Payroll Item Wage name and assign the new hourly wage rate - this gives you two instances of the same Payroll Wage Item with two different rates of pay assigned to it - QuickBooks will allow this personally I think it is a flaw in the program even though QuickBooks.

Unfortunately payroll categories that have been used on timesheets are unable to be unlinked from an employees card. 15 per hour x 40 hours 600 weekly. Switch your employee to hourly or salaried Click the People tab.

To be salaried an employee must meet one of the exemptions. Calculate the weekly salary rate by multiplying the employees hourly rate of 15 by the number of hours worked each week. Change Item Rates Choose an item with a rate you want to change from the list of available items.

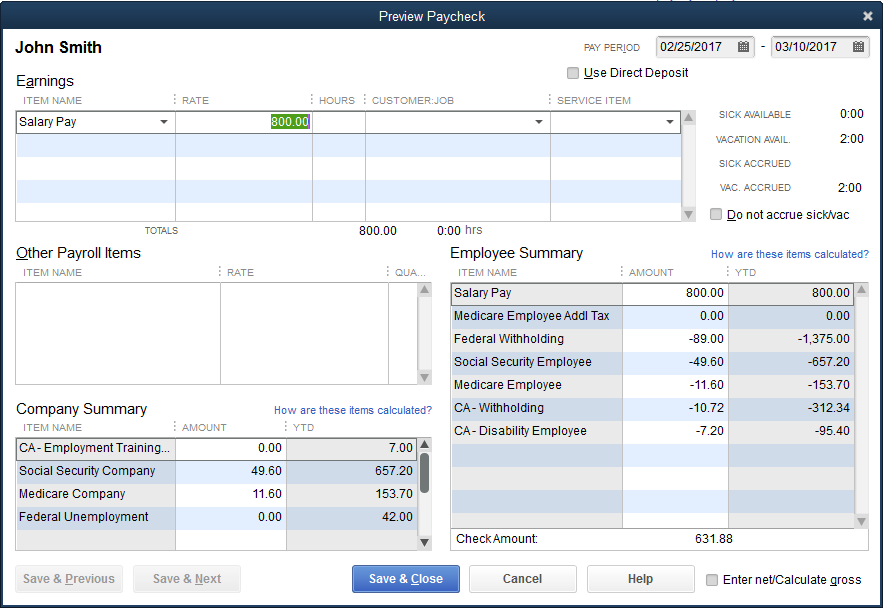

I attached a screenshot below for visual reference. To see if the employee is active select Employees then go to Employee Center. Once done you can now print your employees payslip without the hourly rate.

The detail will print on the pay stub. If Salary there isnt a way to do that exactly and instead calculate the correct given the raise and enter it on the check. Other people would suggest that you Edit each QuickBooks Employee Record going to the Payroll Compensation Info tab and in the Earnings box select the existing Payroll Item Wage name and assign the new hourly wage rate this gives you two instances of the same Payroll Wage Item with two different rates of pay assigned to it QuickBooks will allow this personally I think it is a flaw in the program even though QuickBooks.

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Pay Stub Pay Stubs Template Payroll Template

Pay A Partial Or Prorated Salary Amount In Quickbo

Employee Pay Adjustments History Report

Solved Reclassifying Some Employees To Cogs And Administr

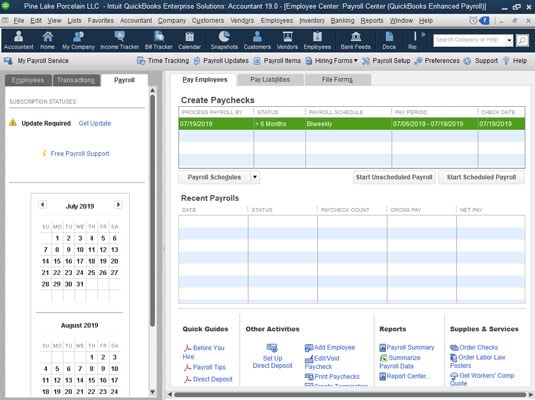

Solved How Do I Run Unscheduled Payroll

Excel Payroll Calculator Template Software Download Payroll Template Payroll Excel Spreadsheets Templates

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Pin On Human Resources Letters Forms And Policies

Quickbooks 2019 Desktop Employee Pay Adjustment History Report Insightfulaccountant Com

Stub Template Word Paystub Allows Person Or Entity That Has Employees To Receive Paychecks They Provide Info Word Template Template Word Document Template Word

Paycheck Calculator Quickbooks Quickbooks Paycheck Post Grad

New York Business Owners Take A Look At Some Of The Resources Available To You Please Reach Out If You Have Ques Cash Management Accounting Accounting Firms

How To Pay Employees In Quickbooks 2019 Basic Payroll Dummies

Quickbooks Paycheck Calculator Intuit Paycheck Calculator In 2020 Quickbooks Paycheck Quickbooks Help

Quickbooks Self Employed 2019 Downloads Install And Upgrade Quickbooks Accounting Software Self

Solved Ran Payroll And Missed An Increase How Can I Go B

One Day Processing Now Available For Quickbooks Payroll Quickbooks

Salary Slip Templates 19 Free Printable Ms Docs Xlsx Payroll Template Templates Payroll

Manual Payroll V S Automated Payroll What Type Of Payroll Processing Your Organization Prefers Briosconsulting Hiri Payroll Payroll Software Human Resources

Post a Comment for "Change Employee From Hourly To Salary In Quickbooks"