Annual Income Calculator Colorado

Next determine any additional. The assumption is the sole provider is working full-time 2080 hours per year.

New Tax Law Take Home Pay Calculator For 75 000 Salary

After a few seconds you will be provided with a full breakdown of the tax you are paying.

Annual income calculator colorado. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Colorados income tax is also fairly average when compared to the top rate of those states with a. Income Tax Calculator USA Find out how much your salary is after tax.

The annual net income calculator will display the result in the last field. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator. The annual income calculator from Covert Units allows you to compare how much you would make annually if you took vacation time versus if you did not take vacation time.

How to find annual income - examples. The statute provides judges in a divorce or legal separation proceeding with an advisory-only calculation to consider under the following conditions. Living Wage Calculation for Montrose County Colorado.

Get exclusive health insurance savings through Connect for Health Colorado. Use this free tool to calculate 2020 Colorado Poverty Levels including monthly totals annual income amounts and percentages of Colorado Poverty Levels like 133 138 150 200 and more. For example if you are a filing your taxes as single have no children are below the age of 65 and you are not blind with the consideration of the standard tax deduction your calculation would look like this.

How to calculate annual income from hourly. Aside from state and federal taxes Centennial State residents who live in Aurora Denver Glendale Greenwood Village or Sheridan must also pay local taxes. Back to calculators Income annualisation calculator Work out your annual income from the money youve received so far this year.

Taxable Income in Colorado is calculated by subtracting your tax deductions from your gross income. There are eight other states with a flat income tax. If you have vacation pay for these days enter your weeks as the full 52 weeks.

The Income Tax calculation for Colorado includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Colorado State Tax Tables in 2021 Federal Tax Calculation for 10500000 Salary 10500000 Federal Tax Calculation. You will still report the premium tax credits you received with the IRS when you file your 2021 federal income tax return. To determine her annual income multiply all the values.

All you need to do to calculate annual income with this yearly income calculator is to enter your. The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level. The assumption is the sole provider is working full-time 2080 hours per year.

The table below details how Colorado State Income Tax is calculated in 2021. Living Wage Calculation for Denver County Colorado. Your working time will include days per week hours per day and weeks per year.

Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. See what youll need to earn to keep your current standard of living wherever you choose to work and live. Phone us on 1300 130 987Our team are happy to help put you in touch with a broker local to your areaOnline enquiryComplete our online enquiry form and well give you a call to connect you with one of our brokers.

Social Security - 3410. On average the number of weeks worked per year is around 50 weeks. 15 40 52 31200.

Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 463. The 2018 Colorado maintenance guidelines do not specify a maintenance normalization percentage when. The other 2 weeks are vacation.

The tool provides information for individuals and households with one or. Need help finding the right home loan. Unemployment benefits should be reported as income in your Connect for Health Colorado application.

In that situation the Colorado Maintenance Calculator. The tool provides information for individuals and households with one. Overview of Colorado Taxes.

Among these states Colorados rate ranks in about the middle of the pack. FLI Family Leave Insurance. Use this poverty level calculator to get 2021 annual and monthly federal poverty income levels and percentages for your household size in Colorado.

To use our Colorado Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. 23 lignes Living Wage calculator.

Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inColorado the net effect for those individuals is a higher state income tax bill in Colorado and a higher Federal tax bill. The calculator takes your gross income along with the other information you provided it with and uses it to calculate the final amount that you take home. First determine your hourly pay rate and working time.

Where do you work. Federal Income Tax - 5088. If youre still curious about how our yearly salary calculator works here are two examples showing it in practice.

Craig from Grand Junction CO got a plan for 59 per month. Compare the Cost of Living in Colorado Springs Colorado against another US Cities and States. Medicare - 798.

SDI State Disability Insurance - 3120. The Colorado alimony calculator applies the advisory maintenance formula found in Colorados maintenance statute CRS. State Income Tax - 2606.

1 the maintenance award is deductible for federal income tax purposes by the maintenance payor and taxable income to the maintenance recipient and 2 the spouses combined annual adjusted gross income is greater than 240000. Enter your gross income. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

It also gives you a breakdown of daily pay weekly pay and monthly pay.

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Appstore For Android

Colorado Paycheck Calculator Smartasset

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

Irs Announces 2016 Income Tax Brackets And Tax Rates Tax Deductions Tax Preparation Filing Taxes

Health Insurance Marketplace Calculator Kff

2021 Salary Paycheck Calculator 2021 Hourly Wage To Yearly Salary Conversion Calculator

Salary To Hourly Salary Converter Salary Finance Hour

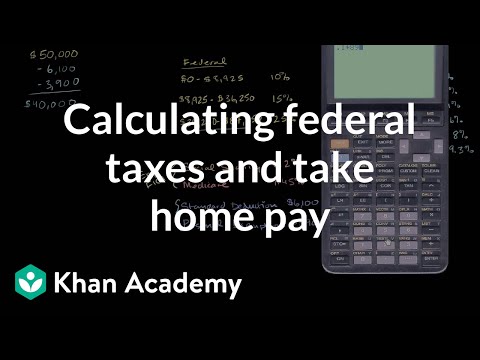

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Tax Return Income

Affordability Calculator Home Realestate Mortgage Payment Calculator How Much House Can I Afford Mortgage

What S The Average Annual Income After Taxes In Every State Income Tax Income Tax

New Tax Law Take Home Pay Calculator For 75 000 Salary

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

Post a Comment for "Annual Income Calculator Colorado"