Gross Pay Results From Deducting Various Deductions From Your Earnings

Not sure whether it should be from gross or net pay. Gross pay is the amount of money an employee earns for time they worked.

Mathematics For Work And Everyday Life

Gross pay results from deducting various deductions from your earnings.

Gross pay results from deducting various deductions from your earnings. Your moneys in safe hands with us. I think not as it was to do with his employment. The deduction is for a lawful purpose is reasonable and the employee has agreed to or asked for the deduction in writing.

Quiz 2-5 choices decisions making money multiple choice 6. The deduction is worked out using your net wage. She is considering going back to school to change career fields.

If you pay an employee on an hourly basis the gross pay is the amount of hours she worked multiplied by the hourly rate. What topics of study do or did you enjoy most in school. Gross pay includes any overtime bonuses or reimbursements from an employer on top of regular hourly or salary pay.

If you pay your employee a salary the gross pay per period is the annual salary divided by the number of times you pay her in the year. Your moneys in safe hands with us. Employers can make a deduction from pay if.

De très nombreux exemples de phrases traduites contenant your gross earnings Dictionnaire français-anglais et moteur de recherche de traductions françaises. Look at your pay stub to see what other amounts are deducted. She is considering going back to school to change career fields.

Will deductions be made if I am on sick pay. For example if the employee earns an annual salary of 45000 and you. Traductions de expression GROSS PAY du anglais vers français et exemples dutilisation de GROSS PAY dans une phrase avec leurs traductions.

If your earnings reduce the amount deducted will also reduce. Annonce Safe and secure. Gross pay results from deducting various deductions from your earnings.

Your employer should be able to explain these deductions to you. It includes the full amount of pay before any taxes or deductions. De très nombreux exemples de phrases traduites contenant from your earnings Dictionnaire français-anglais et moteur de recherche de traductions françaises.

Case application Navine Nesrallah has worked for nine years in retail sales. Youll be sent a deduction from earnings order DEO if one of your employees is a paying parent who. What do you feel to be your most distinguishing skill or area of specialty.

When workers earn more than a certain amount called the tax threshold they have to pay income tax. What are your interests away from school or work. The deduction is specifically required by law for example PAYE tax student loan repayment child support.

Agreed in writing includes a general deductions clause in the employment agreement but an employer must consult with the employee before they make a specific deduction under a general deductions. Your employer can take 10 of your gross earnings which is 25. Gross pay is simply your employees wages before any deductions.

What factors should be considered before making this decision. They must only take 25 one week and then make another deduction from your next pay cheque for 25. Case application Sue Smith has worked for nine years in retail sales.

He is now leaving and I have been instructed to make a deduction. Assess your personal interests abilities and career goals. Based on your personal situation answer the following questions.

Does not pay child maintenance owed. Gross pay results from deducting various deductions from your earnings. If you work extra hours and your pay increases the amount deducted will also increase.

If you know that your earnings are too low to make deductions you must contact us as. Employee was sent on a course a few months ago and signed a note to say that if he left cost of course would be deducted from his pay. Chooses to pay child maintenance direct from their earnings.

What skills do you do well. Should the deduction include VAT. For example if an employer offers you a sales position with a base salary of 50000 plus a bonus of 2500 for every 25000 in sales the total you earn would be your gross pay.

What factors should be considered before making this decision. Annonce Safe and secure. Gross Pay 1000 - Federal Income Tax 14950 - Social Security 6200 - Medicare 1450 - voluntary deductions 150 Take home pay is 624 Materials Resources.

Deductions from wages or salaries Income tax. The deduction is worked out using your net earning. Gross pay results from deducting various deductions.

There may be other amounts such as pension plan contributions or union dues that your employer deducts from your pay.

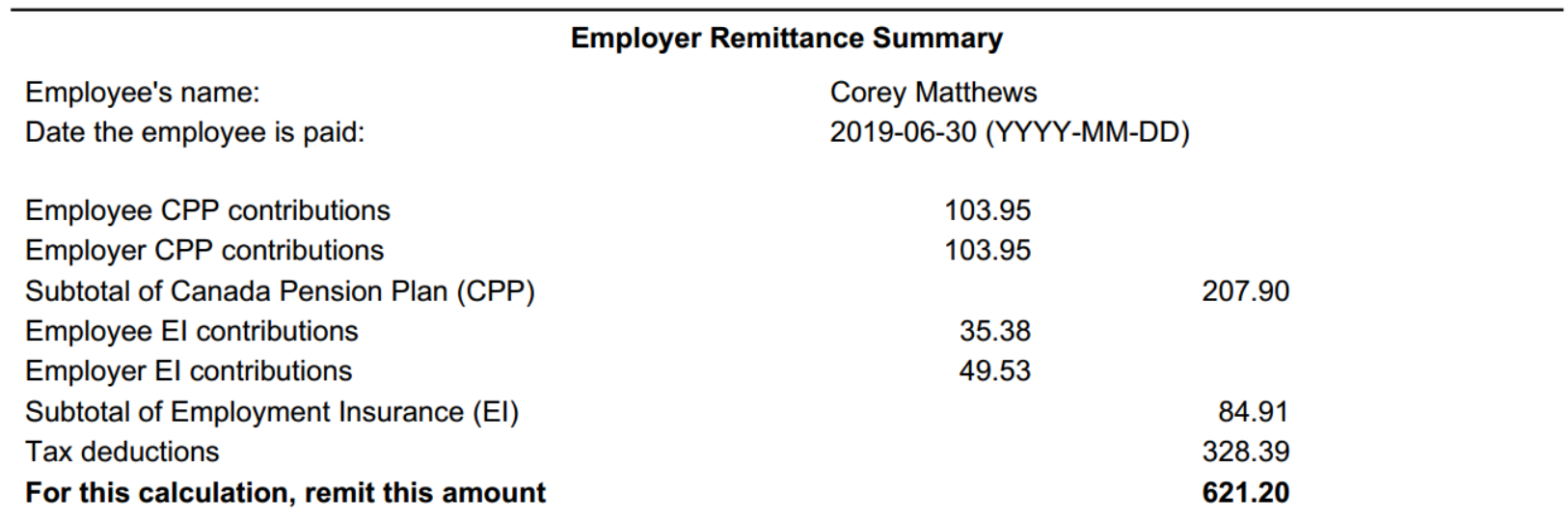

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

7 Microsoft Pay Stub Template Free Simple Salary Slip Payroll Checks Payroll Payroll Template

Free Paycheck Stub Template Check On Top Format Payroll Check Printed By Ezpaycheck Payroll Payroll Checks Payroll Software Payroll Checks Template

29 Free Payroll Templates Payroll Template Payroll Checks Free Checking

7 Free Payroll Checks Templates Simple Salary Slip Payroll Checks Payroll Checks Template Payroll Template

Download Pdf Deduct It Lower Your Small Business Taxes Free Epub Mobi Ebooks Small Business Tax Business Tax Small Business Tax Deductions

Real Paycheck Stubs Home Payroll Checks Check Stubs Payroll

Businessmen Check Stub Template Workers And Normal People Who Use Checks For Daily Purposes Need To Maintain Proper Pay Stubs Template Pay Stub Pay Stubs

Business Income Statement Template Fresh 95 Daycare In E Statement Template P L Statement Statement Template Income Statement Profit And Loss Statement

Understanding Your Paycheck Credit Com

25 Great Pay Stub Paycheck Stub Templates Pay Stub Paycheck Payroll Template

The Fine Print Reading Your Pay Stub Pay Stubs Template Paystub Template Pay Stub

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Post a Comment for "Gross Pay Results From Deducting Various Deductions From Your Earnings"