Annual Income Calculator Florida

Social Security - 3410. Gross vs net income.

The Easiest Florida Child Support Calculator Instant Live

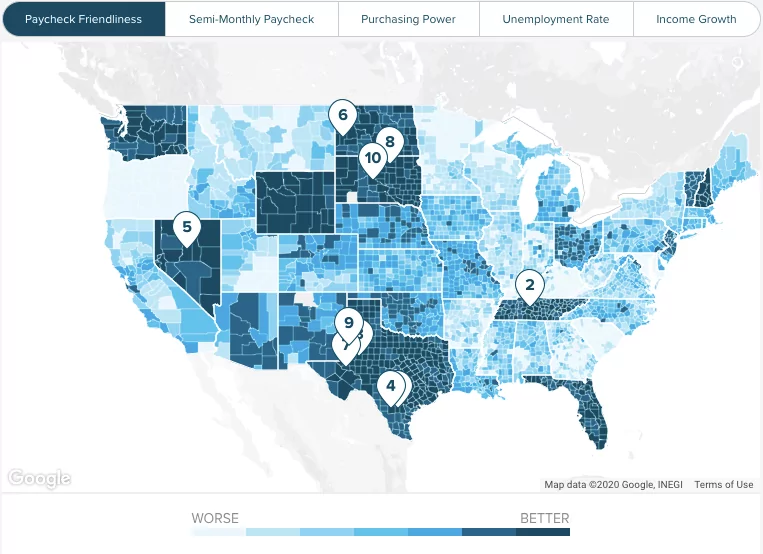

Additionally no Florida cities charge a local income tax.

Annual income calculator florida. That means the only. Income Tax Calculator USA Find out how much your salary is after tax. It can be used for the 2013 14 to 2019 20.

Where do you work. How annual income is calculated under the Federal Guidelines. On average the number of weeks worked per year is around 50 weeks.

How to find annual income - examples. Medicare - 798. State Income Tax - 2606.

Calculate your take home pay from hourly wage or salary. If you have vacation pay for these days enter your weeks as the full 52 weeks. Florida Hourly Paycheck Calculator.

To use our Florida Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. To keep things simple and help with Florida Tax Return Calculations and comparisons we have split the calculations into separate. Income Tax Calculator Florida Find out how much your salary is after tax.

Expenses like childcare medical expenses and housing costs are subtracted from the gross. Why not find your dream salary too. If youre moving to Florida from a state that levies an income tax youll get a pleasant surprise when you see your first paycheck.

Florida Food Stamps Income Limit Chart. Living Wage Calculation for Florida. The adjusted annual salary can be calculated as.

A deduction is a specific amount you can. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. Federal Income Tax - 5088.

15 40 52 31200. How to calculate annual income from hourly. Starting with your gross income of 40000 62 of that is taken for Social Security costs taking 2480 from you.

Medicare - 798. For example FICA taxes are calculated as such. Your working time will include days per week hours per day and weeks per year.

The tool provides information for individuals and households with one or two working. The ato publish tables and formulas to calculate weekly fortnightly and monthly payg income tax instalments that can vary from the annual tax amounts. Net pay 45705.

Next determine any additional. Gross annual income calculator. Your household income location filing status and number of personal exemptions.

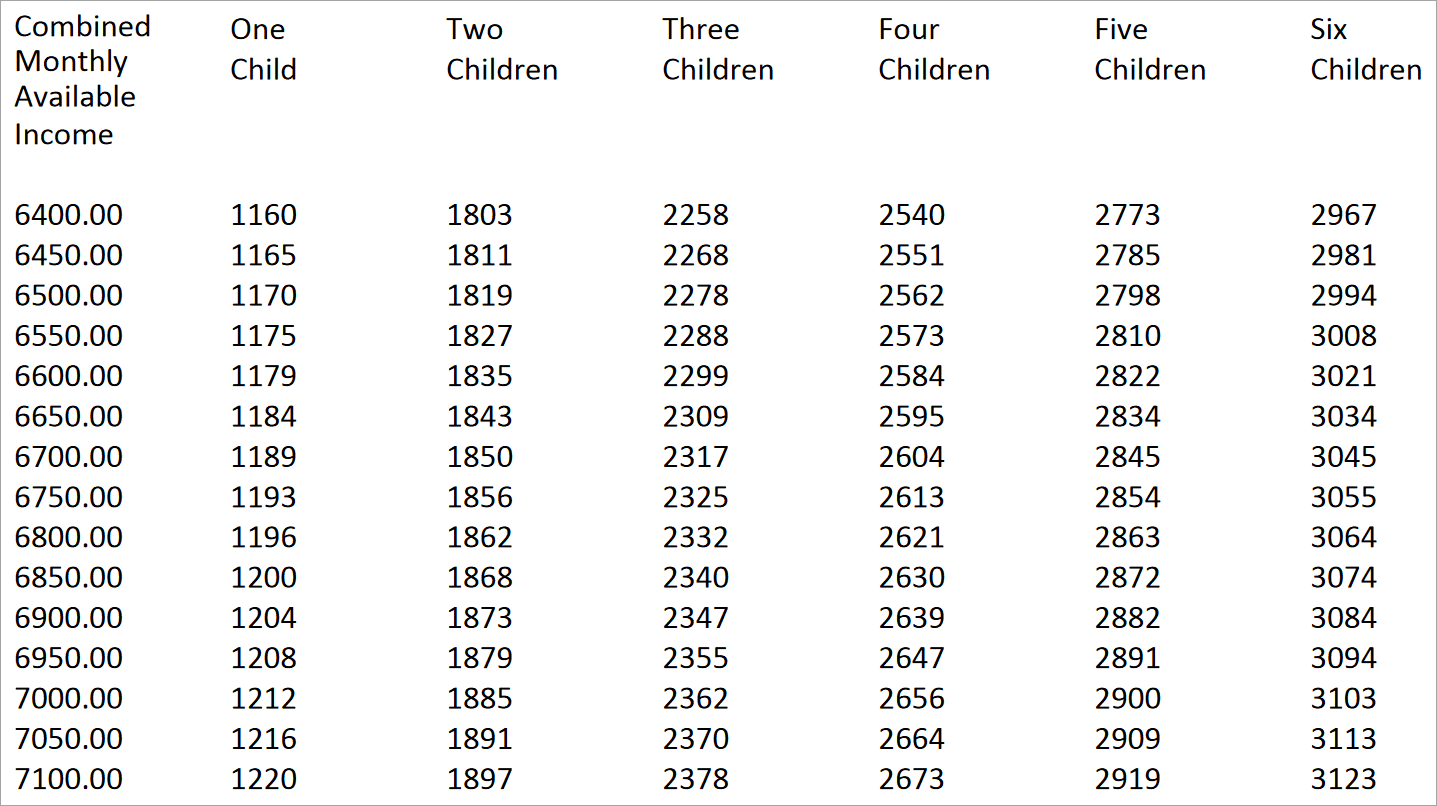

As a general rule to calculate income for child support you must identify the updated amounts related to the sources of income used to calculate your Total income on line 15000 150 for 2018 and prior years of the T1 General Form issued by the Canada Revenue Agency. Also we separately calculate the federal income taxes you will owe in the 2019 -. If youre still curious about how our yearly salary calculator works here are two examples showing it in practice.

The assumption is the sole provider is working full-time 2080 hours per year. The first thing you need to know is that your total monthly gross income for your household will be compared to a percentage of the federal poverty level to determine if you qualify and for what amount based on the number of people living in your household. Total tax - 9295.

Social Security - 3410. The law states that whichever is the. This Florida hourly paycheck calculator is perfect for those who are.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. How to Calculate Federal Tax and State Tax in Florida in. 30 8 260 62400 As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

Enter your gross income. The federal minimum wage is 725 per hour and the Florida state minimum wage is 1000 per hour. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Calculate your Florida net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Florida paycheck calculator. SDI State Disability Insurance - 3120. Overview of Florida Taxes.

There are legal minimum wages set by the federal government and the state government of Florida. Use our calculator to discover the Florida Minimum Wage. This salary calculation is based on an annual salary of 7000000 when filing an annual income tax return in Florida lets take a look at how we calculated the various payroll and incme tax deductions.

The Florida Minimum Wage is the lowermost hourly rate that any employee in Florida can expect by law. 145 of your gross income is taken for your Medicare costs taking 580 from you. Federal Income Tax - 5088.

Where do you work. After a few seconds you will be provided with a full breakdown of the tax you are paying. The annual net income calculator will display the result in the last field.

Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. Enter your gross income. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The Florida Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2021 and Florida State Income Tax Rates and Thresholds in 2021. To determine her annual income multiply all the values.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. 30 8 260 - 25 56400. To enter your time card times for a payroll related calculation use this time card calculator.

FLI Family Leave Insurance. The other 2 weeks are vacation. First determine your hourly pay rate and working time.

10 8 260 25 18 800 using 10 holidays and 15 paid vacation days a year subtract these days from the total number of working days a year.

Average Salary In Florida 2021 The Complete Guide

Paycheck Calculator Take Home Pay Calculator

My Florida Child Support Calculator New For 2020 Law Office Of A James Mullaney

Paycheck Calculator Take Home Pay Calculator

Florida Income Tax Calculator Smartasset Com Property Tax Income Tax Tax

Https Higherlogicdownload S3 Amazonaws Com Nasn 1ef908c5 8b24 4d12 8d36 42df9b9562c8 Uploadedimages Florida Kidcare Overview Presentation Fasn 2021 Pdf

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Salary Calculator

2021 Usda Household Income Limits Usda Mortgage Source

Gross Pay And Net Pay What S The Difference Paycheckcity

Florida Wage Calculator Minimum Wage Org

2021 Calculator For Alimony In Florida Lafrance Family Law

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Health Insurance Marketplace Calculator Kff

Texas Paycheck Calculator Smartasset

Florida Salary Calculator 2021 Icalculator

Florida Income Tax Calculator Smartasset

Gross Pay And Net Pay What S The Difference Paycheckcity

Post a Comment for "Annual Income Calculator Florida"