Gross Pay Uk Calculator

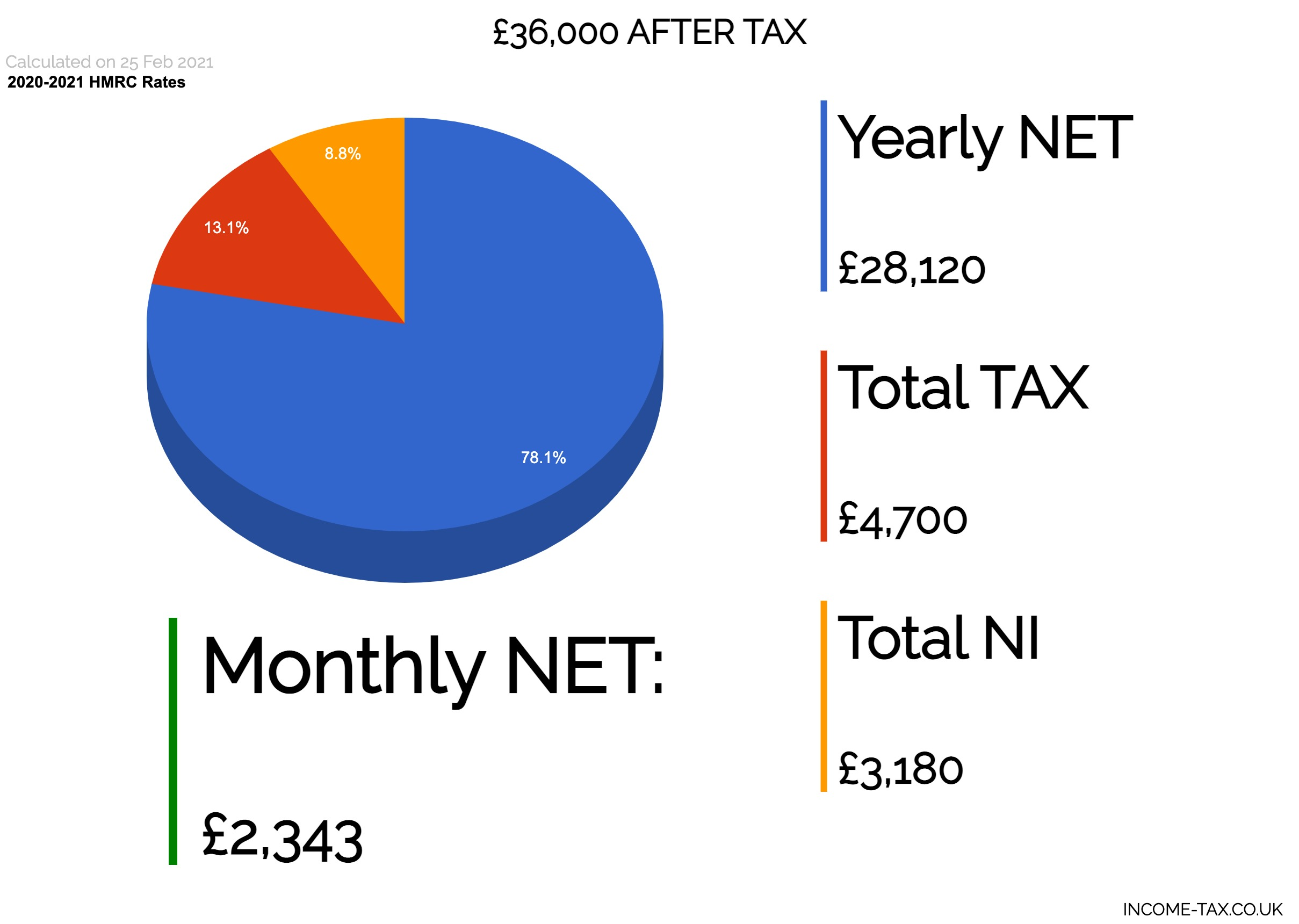

Calculate how much statutory redundancy you can get. Our online income tax calculator will help you work out your take home net pay based on your salary and tax code.

To Prepare An Income Statement Generate A Trial Balance Report Calculate Your Revenue Determine Income Statement Profit And Loss Statement Statement Template

We strongly recommend you agree to a gross salary.

Gross pay uk calculator. UK Take Home Pay Calculator. Find out how much money you will actually receive based on your weekly monthly or annual wages. You will see the costs to you as an employer including tax NI and pension contributions.

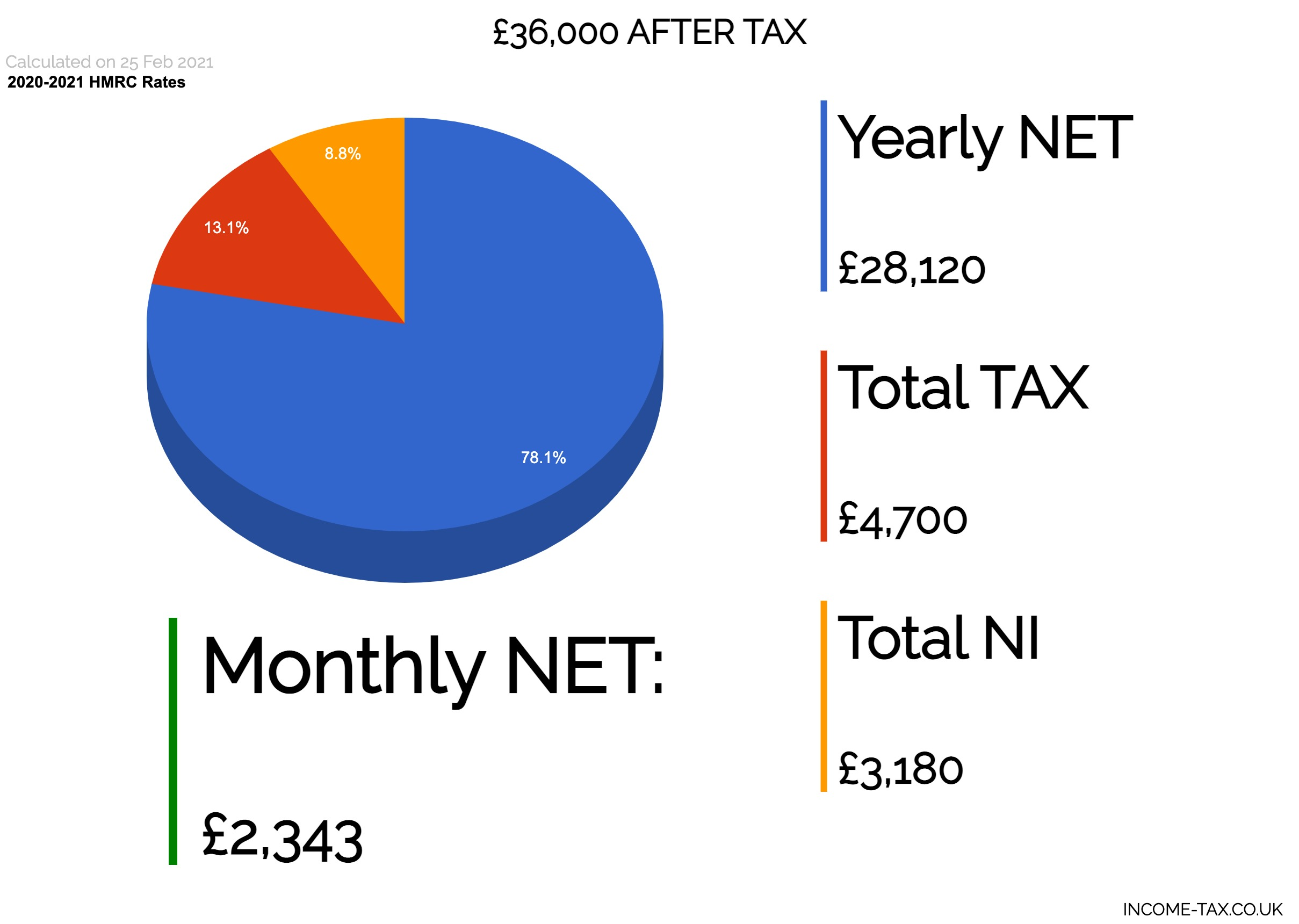

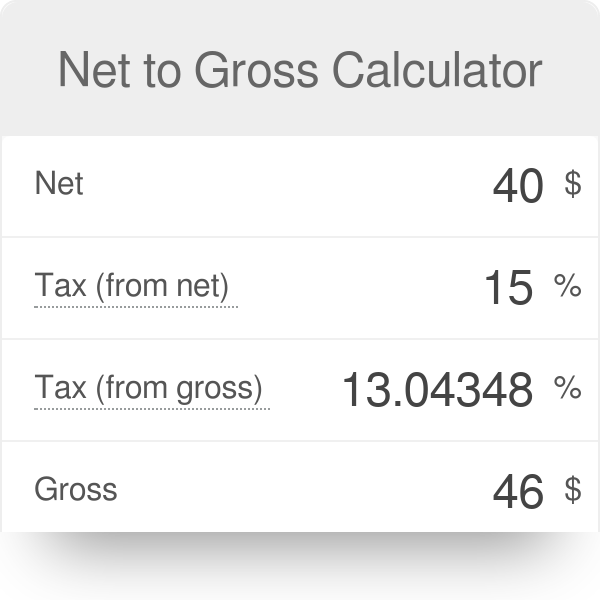

We offer you the chance to provide a gross or net salary for your calculations. The UKs income tax and National Insurance rates for the current year are set out in the tables below. Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240.

Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate.

Find out the benefit of that overtime. This is the NET amount after Tax the actual amount that you get paid after all deductions have been madeIf you select month and enter 3000 we will calculate based upon you taking home 3000 per month. How to use the Take-Home Calculator.

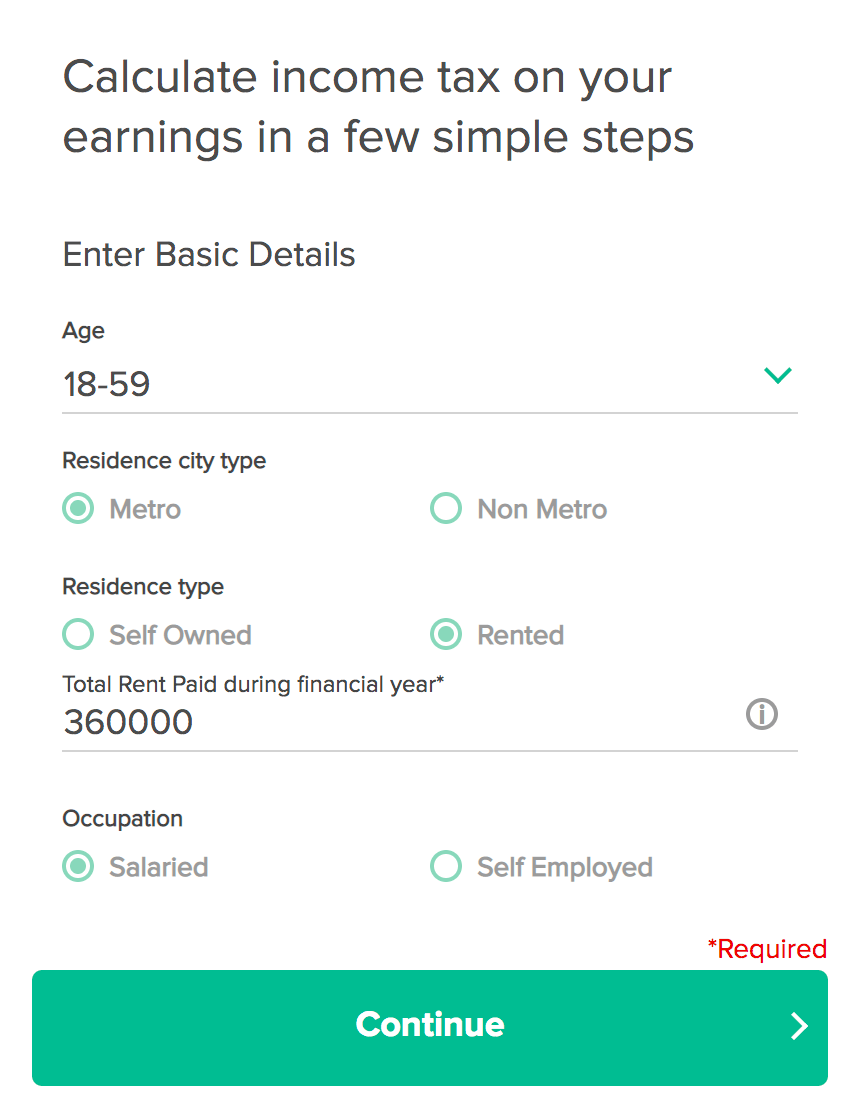

Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Use the calculator to work out an approximate gross wage from what your employee wants to take home. We have redesigned this tool to be as easy to use as possible whilst maintaining the level of accuracy you expect from our selection of tax tools.

Use the online salary tool to see how a change of. The 20202021 Net Salary Calculator below outlines the net salary amount for each possible gross salary level within the UK. Check your payroll calculations manually - GOVUK.

Why not find your dream salary too. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to. Net Income - Please enter the amount of Take Home Pay you require.

The results are broken down into yearly monthly weekly daily and hourly wages. This calculator assumes that you are younger than 65 unmarried and does not take childcare vouchers pension deductions or student loan. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

The latest budget information from April 2021 is used to show you exactly what you need to know. Our Registered Nurse is on a flat salary and earns 37k per year. Our salary calculator will provide you with an illustration of the costs associated with each employee.

To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Your gross hourly rate will be 2163 if youre working 40 hours per week. Please see the table below for a more detailed break-down.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown. SalaryBot will automatically check to see if youre being paid the minimum wage for your age group.

There are many other possible variables for a definitive source check your tax code and speak to the tax office. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. Calculate your statutory redundancy pay.

Hourly rates weekly pay and bonuses are also catered for. Use the calculator to work out what your employee will take home from a gross wage agreement. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

If your salary is 45000 a year youll take home 2853 every month. The Net Salary amounts are calculated to reflect what you will take home after your tax and national contribution amounts have been deducted. Use our net pay calculator to work out your monthly take-home pay as a contractor or permanent employee.

These include income tax as well as National Insurance payments. 37k equates to circa 308333 per calendar month therefore the Registered Nurses Gross Pay or Gross Salary is 308333 per month. Enter the gross wage per week or per month and you will see.

Its based on age weekly pay and number of years in the job. Enter your annual monthly or weekly income to work out your estimated gross to net earnings after tax and pension contributions and more easily decide which working arrangement might be better for you and your family. Enter the number of hours and the rate at which you will.

Our simple salary calculator gives an estimate of your take-home pay after your employer has made deductions from your gross salary. Use this calculator to find exactly what you take home from any salary you provide. Our Registered Nurse then pays 60000 per month in taxes and other deductions a made up number.

Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April.

Child Dependent Care Tax Credit Calculator Tax Credits After School Program School Programs

50 000 After Tax 2021 Income Tax Uk

Salary To Hourly Salary Converter Salary Finance Hour

How To Calculate And Increase Gross Margin Gross Margin Drop Shipping Business Calculator

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Annuity Vs Drawdown Calculator How Large Will Your Pension Pot Be After Retirement Annuity Life Annuity Pensions

Calculate Gross Margin On A Product Cost And Selling Price Including Profit Margin And Mark Up Percentag Price Calculator Pricing Formula Financial Calculators

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Nannyplus Tax Table 2017 18 Nanny Nanny Agencies North West

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Salary Calculator

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

72 000 After Tax Salary Uk Is 49 086 Tax Income Tax Salary

Working Capital Needs Calculator Plan Projections Business Planner Business Planning Finance Planner

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Template Federal Income Tax

How To Sell Online Payslips To Your Employees Payroll Things To Sell Payslip Template

Tax Flowchart Do You Have To File A Return Flow Chart Law School Humor Flow Chart Template

Post a Comment for "Gross Pay Uk Calculator"